Region:Global

Author(s):Dev

Product Code:KRAA3887

Pages:99

Published On:January 2026

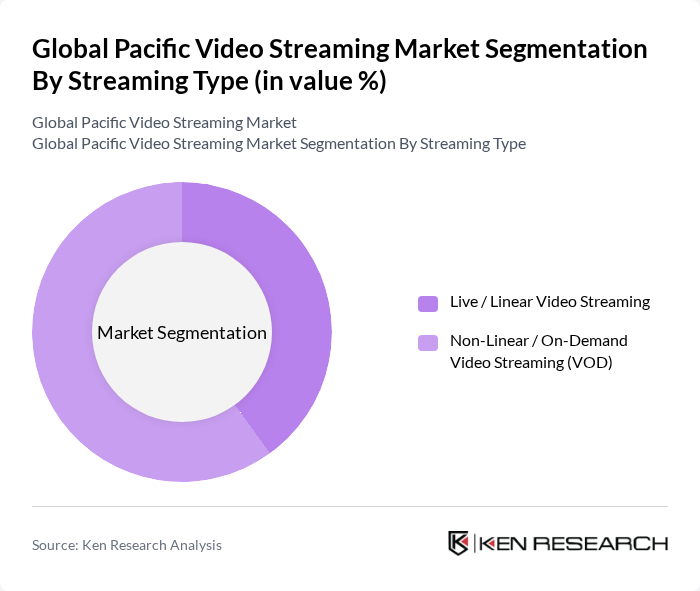

By Streaming Type:The streaming type segmentation includes Live / Linear Video Streaming and Non-Linear / On-Demand Video Streaming (VOD). Non-Linear / On-Demand Video Streaming has emerged as the dominant segment due to the increasing consumer preference for flexibility in viewing schedules and the ability to access content on multiple devices at any time. This trend is driven by the rise of binge-watching culture, deeper content libraries, recommendation algorithms, and the growth of original series and films on major OTT platforms. Live / Linear Video Streaming, while still popular for sports, news, concerts, and other real-time broadcasts, has seen comparatively slower growth than its on-demand counterpart but remains strategically important for premium live sports rights and appointment viewing.

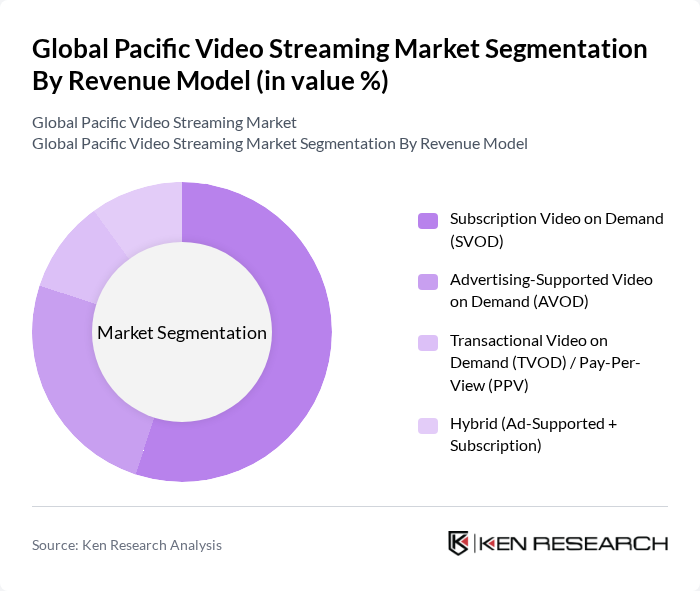

By Revenue Model:The revenue model segmentation includes Subscription Video on Demand (SVOD), Advertising-Supported Video on Demand (AVOD), Transactional Video on Demand (TVOD) / Pay-Per-View (PPV), and Hybrid (Ad-Supported + Subscription). Subscription Video on Demand (SVOD) is the leading revenue model, driven by the popularity of platforms like Netflix, Disney+, and regional subscription services, as well as consumer willingness to pay for premium, ad-free, and exclusive content. In mature markets, SVOD revenue remains dominant, but growth is increasingly supplemented by the expansion of lower-priced ad-supported tiers that help manage churn and reach more price-sensitive users. AVOD is also gaining strong traction, particularly in Asia Pacific and emerging markets, where users prefer free or low-cost access supported by targeted advertising, and where connected TV and mobile viewing are driving digital video ad spend. TVOD / PPV remains important for premium events and new releases, while hybrid models combining subscription and advertising are becoming more prevalent as platforms optimize monetization and user choice.

The Global Pacific Video Streaming Market is characterized by a dynamic mix of regional and international players. Leading participants such as Netflix, Amazon Prime Video, Disney+, Hulu, HBO Max, Apple TV+, YouTube (incl. YouTube Premium & YouTube TV), Paramount+, Peacock, The Roku Channel, Tubi, Vudu, Sling TV, FuboTV, Regional & Local OTT Platforms (e.g., iQIYI, Viu, Stan) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the video streaming market appears promising, driven by technological advancements and evolving consumer preferences. As internet penetration continues to rise, platforms will increasingly focus on enhancing user experiences through personalized content and interactive features. Additionally, the integration of artificial intelligence will play a crucial role in content recommendation systems, further engaging viewers. The market is expected to witness significant growth as companies adapt to changing regulations and explore innovative monetization strategies, ensuring sustainability and profitability.

| Segment | Sub-Segments |

|---|---|

| By Streaming Type | Live / Linear Video Streaming Non-Linear / On-Demand Video Streaming (VOD) |

| By Revenue Model | Subscription Video on Demand (SVOD) Advertising-Supported Video on Demand (AVOD) Transactional Video on Demand (TVOD) / Pay-Per-View (PPV) Hybrid (Ad-Supported + Subscription) |

| By End User | Consumer / Household Enterprises Broadcasters, Operators & Media Companies Education & EdTech Platforms Healthcare & Other Professional Segments |

| By Platform / Device | Smartphones & Tablets Smart TVs Laptops & Desktops Connected TV Devices & Streaming Media Players Other Connected Devices |

| By Deployment Mode | Cloud-Based Streaming On-Premise / Private Infrastructure Hybrid Deployment |

| By Content Genre | Movies & Series Sports News & Documentaries User-Generated & Social Video Other Niche Content (e.g., Gaming, e-Learning) |

| By Region (Global Pacific) | East Asia Southeast Asia Oceania Latin America (Pacific-Facing) North America (Pacific-Facing) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Streaming Preferences | 120 | Regular Users, Occasional Viewers |

| Content Creator Insights | 90 | Independent Filmmakers, YouTube Creators |

| Industry Expert Opinions | 60 | Media Analysts, Streaming Executives |

| Advertising Effectiveness | 75 | Marketing Managers, Brand Strategists |

| Technology Adoption Trends | 65 | IT Managers, Product Development Leads |

The Global Pacific Video Streaming Market is valued at approximately USD 120 billion, reflecting significant growth driven by high-speed internet penetration, smart device proliferation, and a consumer shift towards on-demand content.