Region:Middle East

Author(s):Dev

Product Code:KRAC4835

Pages:100

Published On:October 2025

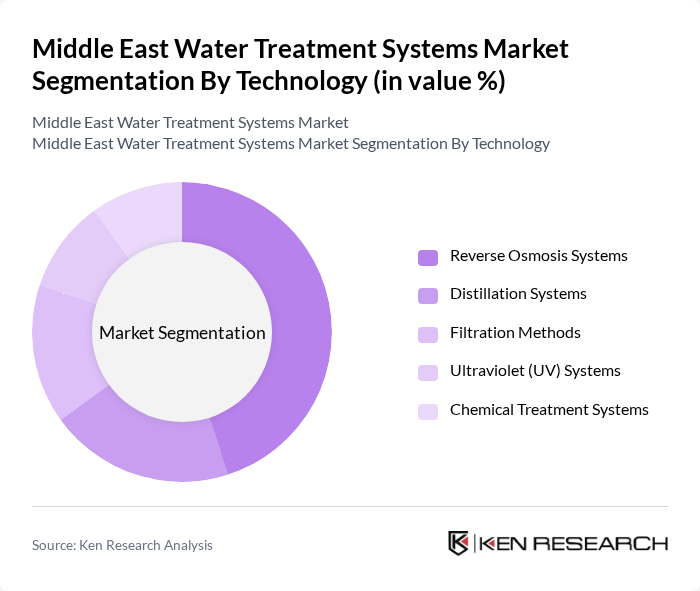

By Technology:The technology segment includes various methods used in water treatment systems. The subsegments are Reverse Osmosis Systems, Distillation Systems, Filtration Methods, Ultraviolet (UV) Systems, and Chemical Treatment Systems. Reverse Osmosis Systems hold the largest share due to their high efficiency in removing a broad spectrum of contaminants and their widespread application in both industrial and residential settings. The growing emphasis on water purification, public health, and compliance with stringent water quality standards continues to drive demand for these technologies .

By Installation:The installation segment is categorized into Point-of-Use (PoU) and Point-of-Entry (PoE) systems. Point-of-Use systems are gaining traction due to their convenience and effectiveness in providing clean drinking water directly at the consumption point. This trend is driven by increasing consumer awareness regarding water quality, rising incidences of waterborne diseases, and the need for immediate access to purified water in both residential and commercial settings .

The Middle East Water Treatment Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as 3M Company, Koninklijke Philips N.V., Pentair plc, Panasonic Corporation, Veolia Environnement S.A., SUEZ S.A., Xylem Inc., IDE Technologies Ltd., Ecolab Inc., Danaher Corporation, Alfa Laval AB, and GEA Group AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East water treatment systems market appears promising, driven by increasing investments in sustainable technologies and infrastructure. As governments prioritize water security, the integration of smart water management systems and energy-efficient technologies will likely gain traction. Additionally, the expansion of desalination projects and wastewater treatment initiatives will play a crucial role in addressing water scarcity challenges, ensuring a resilient water supply for the region's growing population.

| Segment | Sub-Segments |

|---|---|

| By Technology | Reverse Osmosis Systems Distillation Systems Filtration Methods Ultraviolet (UV) Systems Chemical Treatment Systems |

| By Installation | Point-of-Use (PoU) Point-of-Entry (PoE) |

| By Application | Industrial Commercial Residential Municipal |

| By Device Type (Point-of-Use) | Tabletop Pitchers Faucet-Mounted Filters Under-Sink Filters Counter-Top Filters |

| By Country | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | Wholesale Retail Direct-to-Consumer |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Water Treatment Facilities | 100 | Water Treatment Plant Managers, Environmental Engineers |

| Industrial Water Users | 60 | Facility Managers, Operations Directors |

| Water Treatment Equipment Suppliers | 50 | Sales Managers, Product Development Engineers |

| Regulatory Bodies and Environmental Agencies | 40 | Policy Makers, Compliance Officers |

| Research Institutions and Academia | 40 | Researchers, Professors in Environmental Science |

The Middle East Water Treatment Systems Market is valued at approximately USD 3.8 billion, driven by factors such as water scarcity, urbanization, industrial demand, and government initiatives aimed at improving water quality and accessibility.