Region:Europe

Author(s):Geetanshi

Product Code:KRAB5171

Pages:98

Published On:October 2025

By Type:

The market is segmented into Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS), Function as a Service (FaaS), Backup and Disaster Recovery Services, Cloud Storage Services, Edge Computing Services, Serverless Computing, and Others. Among these, Software as a Service (SaaS) is the leading subsegment, driven by its widespread adoption across businesses of all sizes. Companies prefer SaaS solutions for their cost-effectiveness, ease of use, and ability to scale quickly without significant upfront investment. The demand for SaaS applications in sectors such as healthcare, finance, and education has surged, making it a dominant force in the market. Infrastructure as a Service (IaaS) is also registering rapid growth due to increased demand for flexible and scalable infrastructure, particularly among large enterprises and organizations deploying AI and big data workloads .

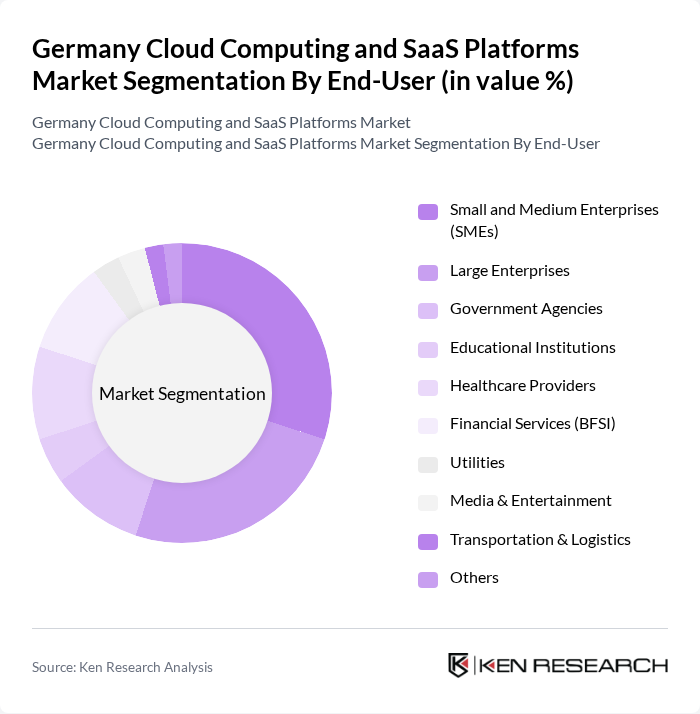

By End-User:

The end-user segmentation includes Small and Medium Enterprises (SMEs), Large Enterprises, Government Agencies, Educational Institutions, Healthcare Providers, Financial Services (BFSI), Utilities, Media & Entertainment, Transportation & Logistics, and Others. The Small and Medium Enterprises (SMEs) segment is currently the most significant contributor to the market, as these businesses increasingly adopt cloud solutions to enhance operational efficiency and reduce costs. The flexibility and scalability offered by cloud services allow SMEs to compete effectively with larger corporations, driving their growth in the cloud computing landscape. Large enterprises and government agencies are also accelerating cloud adoption to support digital transformation, compliance, and secure data management .

The Germany Cloud Computing and SaaS Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Deutsche Telekom AG (T-Systems), Software AG, Atos SE, TeamViewer AG, 1&1 IONOS SE, OVHcloud, Amazon Web Services, Inc. (AWS), Microsoft Corporation (Azure), Google Cloud Platform, IBM Corporation, Oracle Corporation, Salesforce.com, Inc., Fujitsu Technology Solutions GmbH, Claranet GmbH, Alibaba Cloud, Accenture GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Germany cloud computing and SaaS platforms market appears promising, driven by ongoing digital transformation and the increasing need for remote work solutions. As organizations continue to prioritize data security and compliance, investments in advanced cloud technologies are expected to rise. Furthermore, the integration of AI and machine learning into SaaS offerings will enhance operational efficiencies, while the demand for industry-specific solutions will create new avenues for growth, positioning the market for sustained expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Infrastructure as a Service (IaaS) Platform as a Service (PaaS) Software as a Service (SaaS) Function as a Service (FaaS) Backup and Disaster Recovery Services Cloud Storage Services Edge Computing Services Serverless Computing Others |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies Educational Institutions Healthcare Providers Financial Services (BFSI) Utilities Media & Entertainment Transportation & Logistics Others |

| By Industry Vertical | IT and Telecommunications Retail Manufacturing Media and Entertainment Transportation and Logistics Healthcare Banking, Financial Services & Insurance (BFSI) Utilities Government and Public Sector Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Multi-Cloud Sovereign Cloud Others |

| By Pricing Model | Subscription-Based Pay-As-You-Go Tiered Pricing Freemium Others |

| By Service Level Agreement (SLA) | Basic SLA Standard SLA Premium SLA Customized SLA Others |

| By Customer Size | Small Businesses Medium Enterprises Large Corporations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise SaaS Adoption | 120 | IT Managers, CTOs, Business Analysts |

| Cloud Infrastructure Services | 60 | Cloud Architects, System Administrators |

| Healthcare SaaS Solutions | 50 | Healthcare IT Directors, Compliance Officers |

| Financial Services Cloud Platforms | 40 | Finance Managers, Risk Analysts |

| SME Cloud Adoption Trends | 70 | Small Business Owners, IT Consultants |

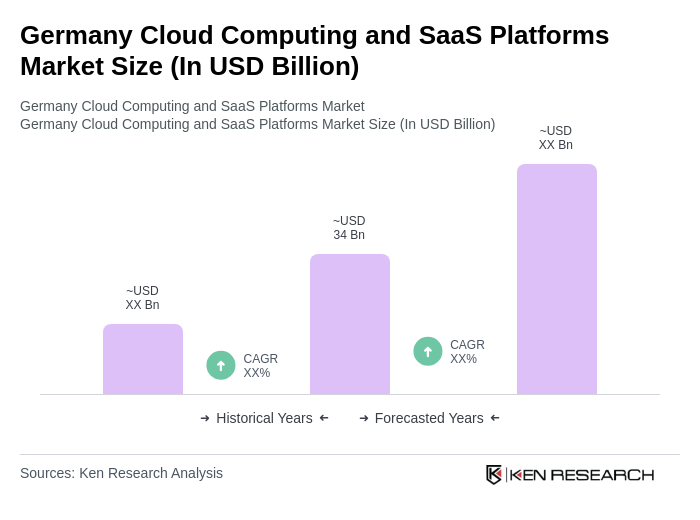

The Germany Cloud Computing and SaaS Platforms Market is valued at approximately USD 34 billion, reflecting significant growth driven by digital transformation initiatives across various sectors, including manufacturing, finance, healthcare, and retail.