Region:Asia

Author(s):Rebecca

Product Code:KRAE0970

Pages:95

Published On:December 2025

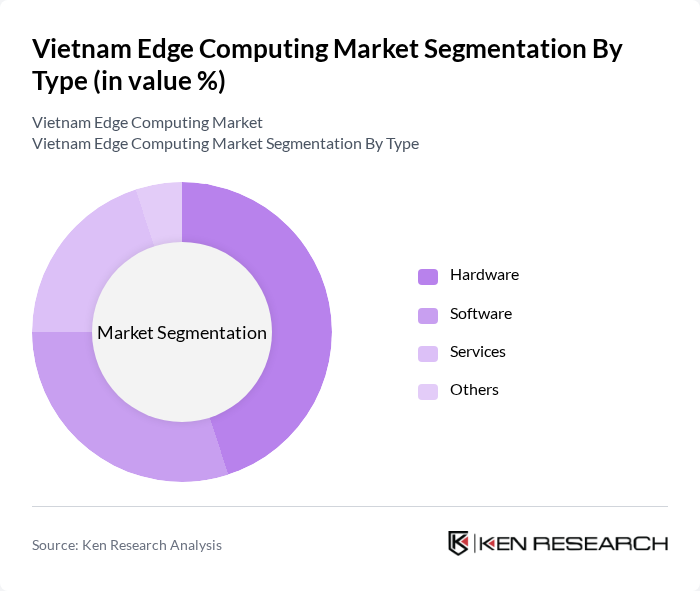

By Type:The edge computing market is segmented into hardware, software, services, and others. Among these, the hardware segment is currently leading the market due to the increasing demand for physical devices that support edge computing capabilities. This includes servers, routers, and IoT devices that facilitate data processing closer to the source, thereby reducing latency and improving performance. The software segment is also gaining traction as businesses seek advanced analytics and management tools to optimize their edge computing environments.

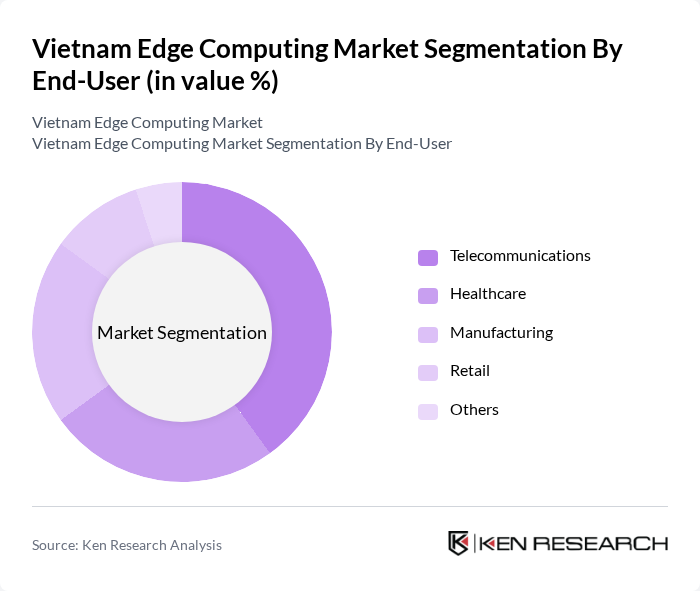

By End-User:The end-user segmentation includes telecommunications, healthcare, manufacturing, retail, and others. Telecommunications is the dominant segment, driven by the rapid rollout of 5G networks and the need for low-latency applications. The healthcare sector is also emerging as a significant user of edge computing, utilizing real-time data processing for telemedicine and patient monitoring systems. Manufacturing and retail are increasingly adopting edge solutions to enhance operational efficiency and customer experience.

The Vietnam Edge Computing Market is characterized by a dynamic mix of regional and international players. Leading participants such as FPT Corporation, Viettel Group, CMC Corporation, VNPT Technology, MobiFone, VNG Corporation, TMA Solutions, CMC Telecom, HPT Vietnam, VCCorp, VinaData, CMC Cloud, Viettel IDC, FPT Telecom, and MobiFone Technology contribute to innovation, geographic expansion, and service delivery in this space.

The future of the edge computing market in Vietnam appears promising, driven by technological advancements and increasing digitalization across sectors. As businesses continue to embrace digital transformation, the integration of edge computing with emerging technologies like AI and machine learning will become more prevalent. Additionally, the government's commitment to enhancing digital infrastructure and promoting smart city initiatives will further stimulate market growth, creating a conducive environment for innovation and investment in edge computing solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Hardware Software Services Others |

| By End-User | Telecommunications Healthcare Manufacturing Retail Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Industry Vertical | Automotive Energy and Utilities Smart Cities Others |

| By Region | Northern Vietnam Southern Vietnam Central Vietnam |

| By Application | Smart Manufacturing Smart Transportation Smart Healthcare Others |

| By Policy Support | Government Grants Tax Incentives Research and Development Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Edge Computing Adoption | 100 | IT Managers, Operations Directors |

| Healthcare Data Processing Solutions | 80 | Healthcare IT Specialists, Data Analysts |

| Telecommunications Infrastructure Upgrades | 70 | Network Engineers, Project Managers |

| Smart City Initiatives and Edge Computing | 60 | Urban Planners, Technology Consultants |

| IoT Device Management and Edge Solutions | 90 | Product Managers, IoT Solution Architects |

The Vietnam Edge Computing Market is valued at approximately USD 90 million, driven by the increasing demand for localized data processing and low-latency performance for applications such as streaming, AR, VR, and IoT.