Region:Europe

Author(s):Geetanshi

Product Code:KRAB5211

Pages:95

Published On:October 2025

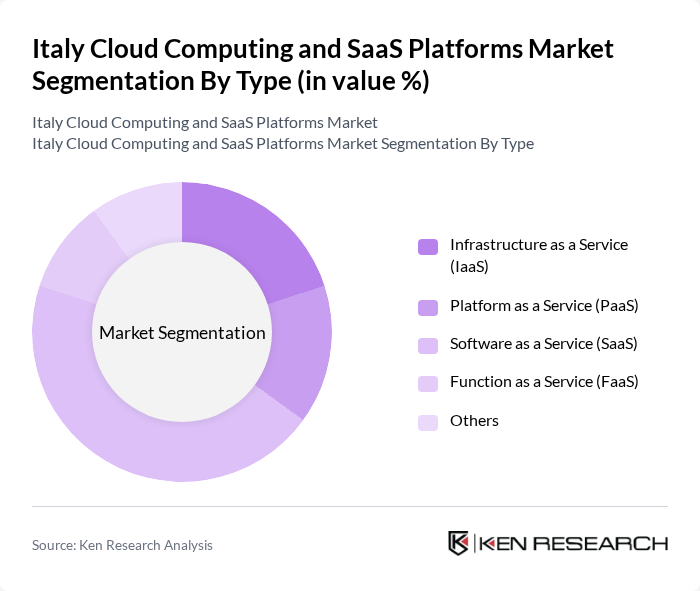

By Type:The market is segmented into various types, including Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS), Function as a Service (FaaS), and others. Among these, Software as a Service (SaaS) is the leading segment, driven by its flexibility, ease of use, and the growing trend of subscription-based models. Businesses are increasingly opting for SaaS solutions to streamline operations and enhance collaboration.

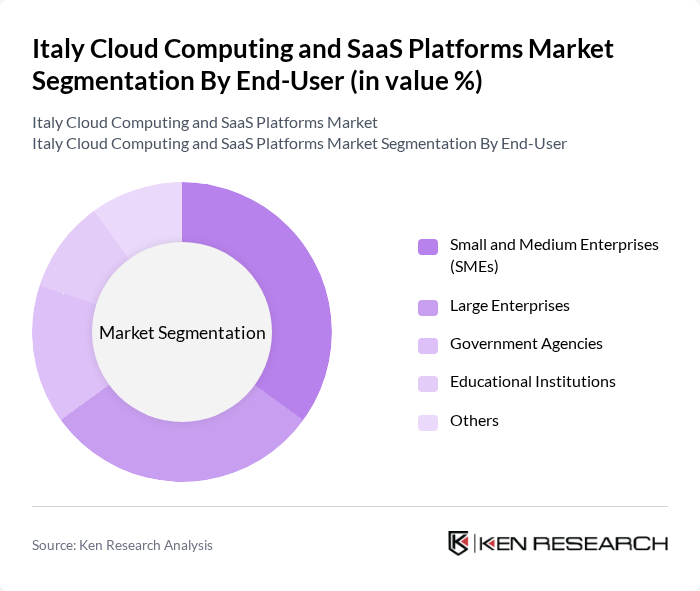

By End-User:The end-user segmentation includes Small and Medium Enterprises (SMEs), Large Enterprises, Government Agencies, Educational Institutions, and others. The Small and Medium Enterprises (SMEs) segment is particularly prominent, as these businesses increasingly adopt cloud solutions to enhance their operational capabilities without significant upfront investments. The flexibility and scalability offered by cloud services are crucial for SMEs looking to compete in a digital economy.

The Italy Cloud Computing and SaaS Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform, IBM Cloud, Oracle Cloud, Salesforce, SAP, Aruba Cloud, OVHcloud, Fastly, DigitalOcean, Rackspace Technology, Zoho Corporation, ServiceNow, and Alibaba Cloud contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Italy cloud computing and SaaS platforms market appears promising, driven by ongoing digital transformation efforts and increasing reliance on remote work solutions. As businesses continue to prioritize data security and compliance, the demand for innovative cloud services is expected to rise. Additionally, the integration of advanced technologies such as AI and machine learning will further enhance the capabilities of SaaS platforms, making them more attractive to a broader range of industries and fostering sustainable growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Infrastructure as a Service (IaaS) Platform as a Service (PaaS) Software as a Service (SaaS) Function as a Service (FaaS) Others |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies Educational Institutions Others |

| By Industry Vertical | Healthcare Retail Financial Services Manufacturing Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Multi-Cloud |

| By Pricing Model | Subscription-Based Pay-As-You-Go Freemium Others |

| By Geographic Focus | Northern Italy Central Italy Southern Italy Islands |

| By Customer Size | Small Businesses Medium Businesses Large Corporations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise SaaS Adoption | 120 | IT Managers, CTOs, Digital Transformation Leads |

| Cloud Infrastructure Services | 90 | Cloud Architects, System Administrators, Network Engineers |

| SME SaaS Utilization | 60 | Business Owners, Operations Managers, Financial Officers |

| Sector-Specific SaaS Solutions | 50 | Healthcare IT Directors, Retail Operations Managers |

| Cloud Security and Compliance | 40 | Compliance Officers, Security Analysts, Risk Management Professionals |

The Italy Cloud Computing and SaaS Platforms Market is valued at approximately USD 10 billion, reflecting significant growth driven by digital transformation initiatives, remote work trends, and the demand for scalable IT solutions across various sectors.