Region:Europe

Author(s):Shubham

Product Code:KRAB5017

Pages:88

Published On:October 2025

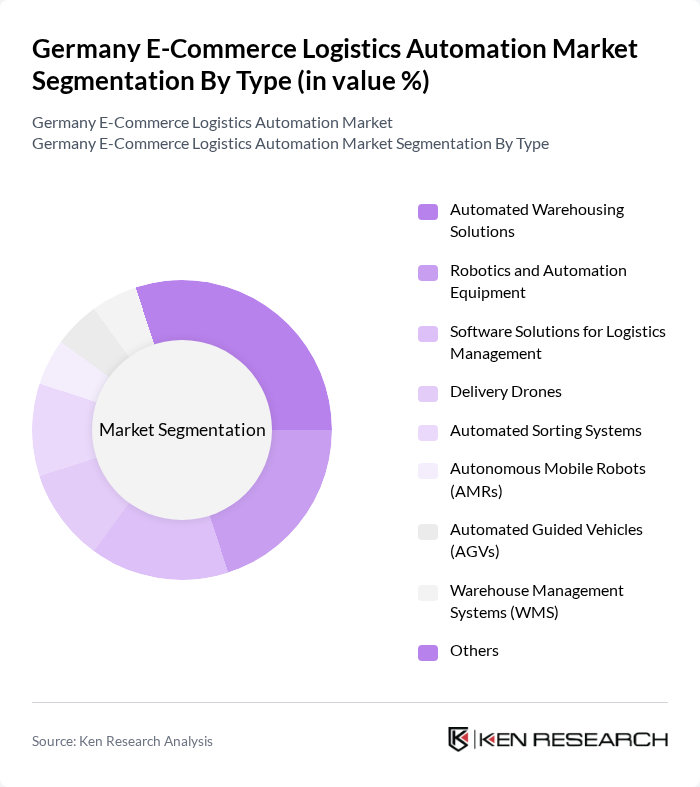

By Type:The market can be segmented into various types of automation solutions that enhance logistics efficiency. Key subsegments include Automated Warehousing Solutions, Robotics and Automation Equipment, Software Solutions for Logistics Management, Delivery Drones, Automated Sorting Systems, Autonomous Mobile Robots (AMRs), Automated Guided Vehicles (AGVs), Warehouse Management Systems (WMS), and Others. Each of these subsegments plays a crucial role in optimizing logistics operations, reducing costs, and improving service delivery. Automated warehousing and robotics are now standard in leading fulfillment centers, while software solutions enable real-time tracking, demand forecasting, and returns management. Emerging technologies such as delivery drones and blockchain for product authentication are in pilot phases, reflecting the market’s innovative trajectory.

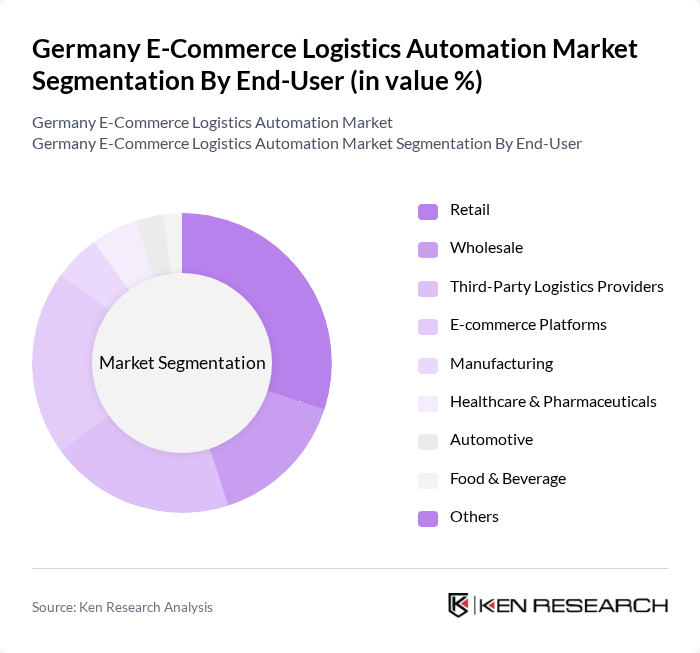

By End-User:The end-user segmentation includes various industries that utilize logistics automation solutions. Key subsegments are Retail, Wholesale, Third-Party Logistics Providers, E-commerce Platforms, Manufacturing, Healthcare & Pharmaceuticals, Automotive, Food & Beverage, and Others. Each sector has unique requirements and benefits from automation, leading to increased efficiency and customer satisfaction. Retail and e-commerce platforms are particularly aggressive adopters, driven by the need to manage high order volumes, reduce returns, and meet consumer expectations for fast, reliable delivery. Third-party logistics providers are also significant users, leveraging automation to offer scalable, cost-effective services to a broad client base.

The Germany E-Commerce Logistics Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, Geodis, XPO Logistics, DPDgroup, Hermes Germany GmbH, Amazon Logistics, Aramex, SEKO Logistics, CEVA Logistics, Rhenus Logistics, GXO Logistics, GLS Germany, Zalando Logistics, FedEx Germany, UPS Germany, Alaiko, Zenfulfillment, Flink contribute to innovation, geographic expansion, and service delivery in this space.

The future of the German e-commerce logistics automation market appears promising, driven by ongoing technological advancements and evolving consumer expectations. As companies increasingly adopt AI and machine learning, operational efficiencies are expected to improve significantly. Additionally, the focus on sustainable logistics solutions will likely shape investment strategies, encouraging companies to innovate while meeting environmental standards. The integration of IoT technologies will further enhance real-time tracking and inventory management, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Automated Warehousing Solutions Robotics and Automation Equipment Software Solutions for Logistics Management Delivery Drones Automated Sorting Systems Autonomous Mobile Robots (AMRs) Automated Guided Vehicles (AGVs) Warehouse Management Systems (WMS) Others |

| By End-User | Retail Wholesale Third-Party Logistics Providers E-commerce Platforms Manufacturing Healthcare & Pharmaceuticals Automotive Food & Beverage Others |

| By Sales Channel | Direct Sales Online Sales Distributors Resellers Retail Sales Others |

| By Distribution Mode | Road Transport Rail Transport Air Transport Sea Transport Others |

| By Application | Order Fulfillment Inventory Management Shipping and Delivery Returns Management Supply Chain Visibility Last-Mile Delivery Predictive Maintenance Others |

| By Industry Vertical | Consumer Electronics Fashion and Apparel Food and Beverage Health and Beauty Automotive Home & Furniture Books, Games & Music Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| E-commerce Fulfillment Centers | 100 | Operations Managers, Logistics Coordinators |

| Last-Mile Delivery Solutions | 80 | Delivery Managers, Supply Chain Analysts |

| Warehouse Automation Technologies | 70 | Warehouse Managers, IT Managers |

| Returns Management Systems | 60 | Customer Experience Managers, Returns Analysts |

| Logistics Software Providers | 50 | Product Managers, Business Development Executives |

The Germany E-Commerce Logistics Automation Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by the demand for efficient supply chain solutions and advancements in automation technologies.