Region:Middle East

Author(s):Shubham

Product Code:KRAA0761

Pages:99

Published On:August 2025

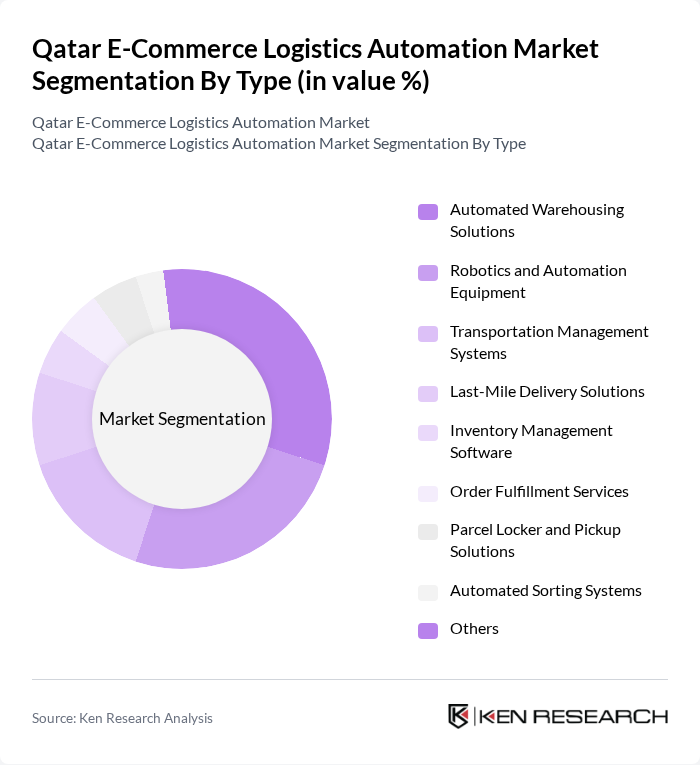

By Type:The market is segmented into various types of logistics automation solutions, including Automated Warehousing Solutions, Robotics and Automation Equipment, Transportation Management Systems, Last-Mile Delivery Solutions, Inventory Management Software, Order Fulfillment Services, Parcel Locker and Pickup Solutions, Automated Sorting Systems, and Others. Among these, Automated Warehousing Solutions are leading due to the increasing need for efficient storage and retrieval systems in e-commerce operations. The demand for Robotics and Automation Equipment is also rising as businesses seek to enhance operational efficiency and reduce labor costs. The adoption of predictive analytics and mobile-first logistics is also accelerating, reflecting broader digital transformation trends in Qatar's logistics sector .

By End-User:The end-user segmentation includes Retail (Apparel, Electronics, Grocery, etc.), Wholesale & Distribution, Manufacturing & Industrial, E-commerce Marketplaces, Third-Party Logistics (3PL) Providers, Food & Beverage Delivery, Healthcare & Pharmaceuticals, and Others. The Retail segment is currently the dominant end-user, driven by the surge in online shopping and the need for efficient logistics solutions to meet consumer expectations. E-commerce Marketplaces are also significant contributors, as they require advanced logistics automation to handle high volumes of orders efficiently. The adoption of omnichannel retail strategies and mobile-first solutions is further boosting demand for logistics automation in these segments .

The Qatar E-Commerce Logistics Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Post, Aramex, DHL Express, FedEx, UPS, Mena Logistics, Q-Express, Al-Futtaim Logistics, Agility Logistics, Gulf Warehousing Company (GWC), Kuehne + Nagel, DB Schenker, CEVA Logistics, Amazon Logistics, Lulu Group International, Jarir Bookstore, Qatar Logistics, Zajel contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar e-commerce logistics automation market appears promising, driven by technological advancements and increasing consumer expectations. As more businesses adopt automation technologies, the logistics landscape will evolve, enhancing efficiency and reducing operational costs. Additionally, the integration of sustainable practices will likely become a focal point, aligning with global trends. The market is expected to witness significant growth as companies leverage innovative solutions to meet the demands of a rapidly changing retail environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Automated Warehousing Solutions Robotics and Automation Equipment Transportation Management Systems Last-Mile Delivery Solutions Inventory Management Software Order Fulfillment Services Parcel Locker and Pickup Solutions Automated Sorting Systems Others |

| By End-User | Retail (Apparel, Electronics, Grocery, etc.) Wholesale & Distribution Manufacturing & Industrial E-commerce Marketplaces Third-Party Logistics (3PL) Providers Food & Beverage Delivery Healthcare & Pharmaceuticals Others |

| By Sales Channel | Direct Sales Online Sales Distributors/Resellers System Integrators Retail Partnerships Others |

| By Distribution Mode | Road Transport Air Freight Sea Freight Rail Transport Courier/Express/Parcel (CEP) Others |

| By Application | B2B Logistics B2C Logistics C2C Logistics Reverse Logistics & Returns Automation Cross-Border E-Commerce Logistics Others |

| By Technology | AI and Machine Learning Internet of Things (IoT) Blockchain Technology Cloud Computing Robotics Process Automation (RPA) Automated Guided Vehicles (AGVs) Others |

| By Price Range | Low-End Solutions Mid-Range Solutions High-End Solutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| E-commerce Fulfillment Centers | 100 | Operations Managers, Logistics Coordinators |

| Last-Mile Delivery Services | 80 | Delivery Managers, Fleet Supervisors |

| Warehouse Automation Solutions | 70 | Warehouse Managers, Automation Engineers |

| Supply Chain Technology Providers | 50 | Product Managers, Business Development Executives |

| Consumer Behavior in E-commerce Returns | 90 | Customer Experience Managers, Marketing Analysts |

The Qatar E-Commerce Logistics Automation Market is valued at approximately USD 1.0 billion, reflecting significant growth driven by the expansion of the e-commerce sector and the adoption of advanced technologies in logistics operations.