Region:Europe

Author(s):Rebecca

Product Code:KRAB0233

Pages:90

Published On:August 2025

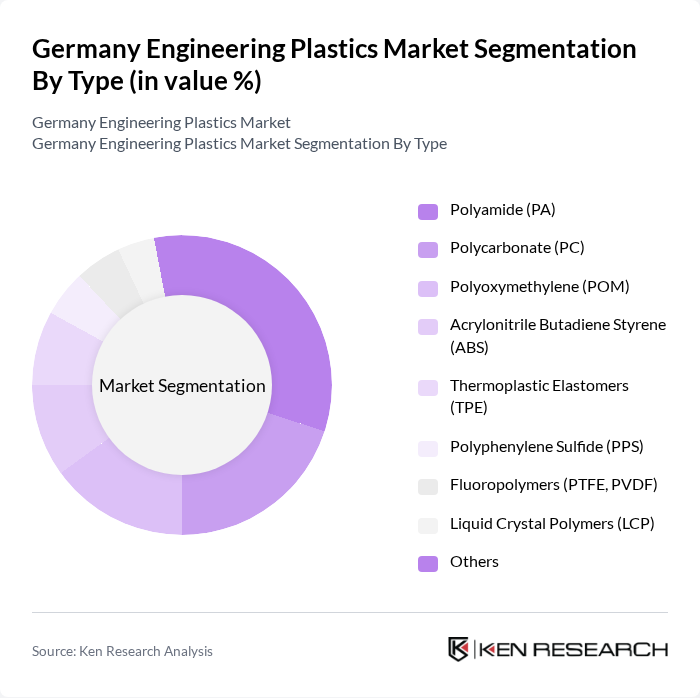

By Type:The engineering plastics market is segmented into various types, including Polyamide (PA), Polycarbonate (PC), Polyoxymethylene (POM), Acrylonitrile Butadiene Styrene (ABS), Thermoplastic Elastomers (TPE), Polyphenylene Sulfide (PPS), Fluoropolymers (PTFE, PVDF), Liquid Crystal Polymers (LCP), and Others. Among these, Polyamide (PA) is the leading subsegment due to its excellent mechanical properties, chemical resistance, and versatility, making it suitable for a wide range of applications in automotive, electrical, and industrial sectors. Polycarbonate and fluoropolymers are also notable for their high-performance characteristics in demanding environments.

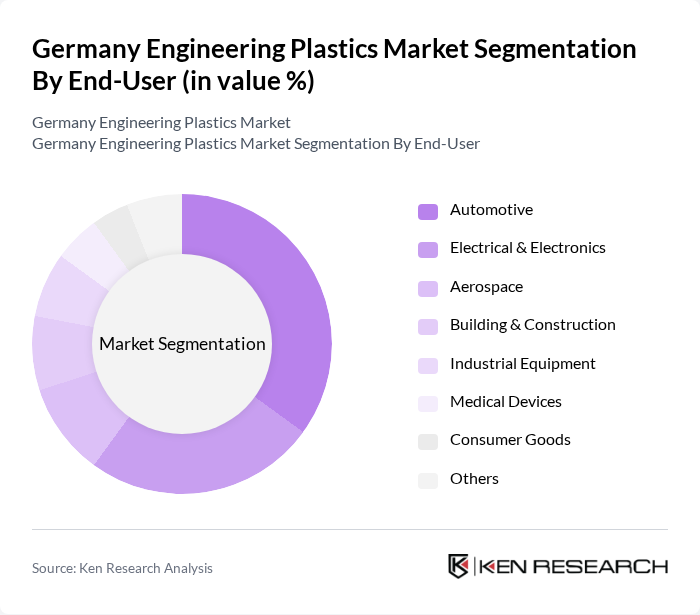

By End-User:The end-user segmentation includes Automotive, Electrical & Electronics, Aerospace, Building & Construction, Industrial Equipment, Medical Devices, Consumer Goods, and Others. The automotive sector is the dominant end-user, driven by the increasing demand for lightweight and fuel-efficient vehicles, which require high-performance engineering plastics for various components. The electrical and electronics sector follows, benefiting from the adoption of advanced materials for insulation and miniaturization. The packaging segment is also significant, particularly for PET-based engineering plastics, while aerospace is the fastest-growing segment due to investments in lightweight and high-impact resistant materials.

The Germany Engineering Plastics Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Covestro AG, Evonik Industries AG, LANXESS AG, DuBay Polymer GmbH, Röchling Engineering Plastics SE & Co. KG, BARLOG Plastics GmbH, Celanese Corporation, Solvay S.A., DSM Engineering Plastics (now part of DSM-Firmenich), Mitsubishi Engineering-Plastics Corporation, Teijin Limited, Asahi Kasei Corporation, KRAIBURG TPE GmbH & Co. KG, RTP Company, Grupa Azoty S.A., Equipolymers GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the engineering plastics market in Germany appears promising, driven by technological advancements and a strong focus on sustainability. As industries increasingly prioritize lightweight and eco-friendly materials, the demand for engineering plastics is expected to rise. Innovations in manufacturing processes, coupled with regulatory support for sustainable practices, will likely create a conducive environment for growth. Companies that adapt to these trends and invest in research and development will be well-positioned to capitalize on emerging opportunities in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Polyamide (PA) Polycarbonate (PC) Polyoxymethylene (POM) Acrylonitrile Butadiene Styrene (ABS) Thermoplastic Elastomers (TPE) Polyphenylene Sulfide (PPS) Fluoropolymers (PTFE, PVDF) Liquid Crystal Polymers (LCP) Others |

| By End-User | Automotive Electrical & Electronics Aerospace Building & Construction Industrial Equipment Medical Devices Consumer Goods Others |

| By Application | Structural Components Electrical Insulation Fluid Handling Packaging Automotive Interiors Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Price Range | Economy Mid-Range Premium Others |

| By Component | Additives Fillers Reinforcements Others |

| By Regulatory Compliance | REACH Compliance RoHS Compliance ISO Certifications Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Engineering Plastics | 100 | Product Engineers, Supply Chain Managers |

| Aerospace Material Applications | 60 | Materials Scientists, Procurement Managers |

| Consumer Electronics Plastics | 50 | Design Engineers, Quality Assurance Managers |

| Medical Device Plastics | 40 | Regulatory Affairs Specialists, R&D Managers |

| Industrial Applications of Engineering Plastics | 70 | Operations Managers, Product Development Leads |

The Germany Engineering Plastics Market is valued at approximately USD 4.8 billion, reflecting a robust growth trajectory driven by demand in automotive, aerospace, and electrical sectors, alongside advancements in polymer technology and sustainability initiatives.