Region:North America

Author(s):Geetanshi

Product Code:KRAC0112

Pages:80

Published On:August 2025

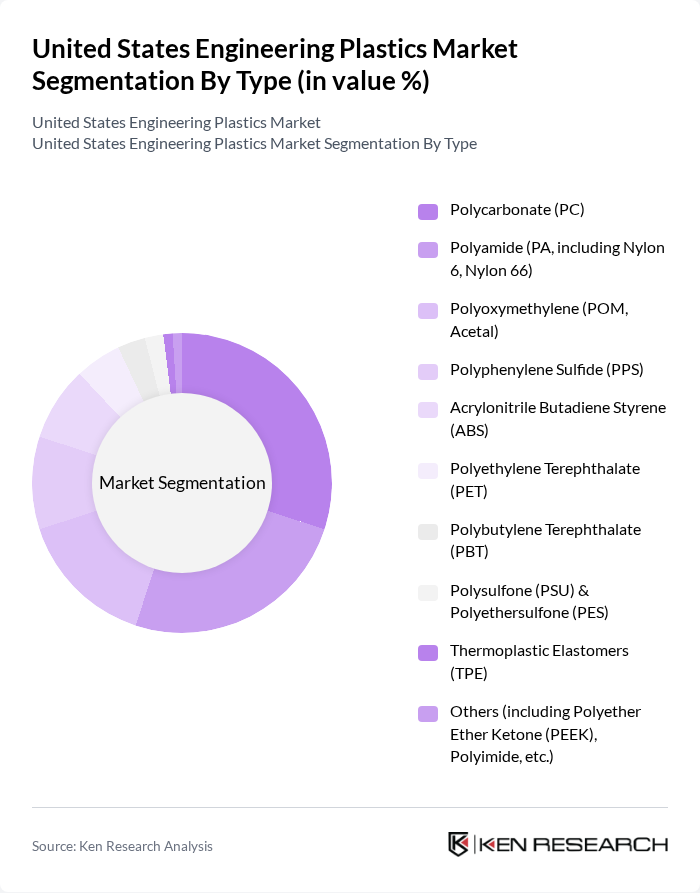

By Type:The engineering plastics market is segmented into Polycarbonate (PC), Polyamide (PA, including Nylon 6, Nylon 66), Polyoxymethylene (POM, Acetal), Polyphenylene Sulfide (PPS), Acrylonitrile Butadiene Styrene (ABS), Polyethylene Terephthalate (PET), Polybutylene Terephthalate (PBT), Polysulfone (PSU) & Polyethersulfone (PES), Thermoplastic Elastomers (TPE), and Others (including Polyether Ether Ketone (PEEK), Polyimide, etc.). Among these, Polycarbonate and Polyamide remain the leading subsegments, driven by their extensive use in automotive, electrical, and electronics applications due to their superior mechanical strength, thermal stability, and design flexibility.

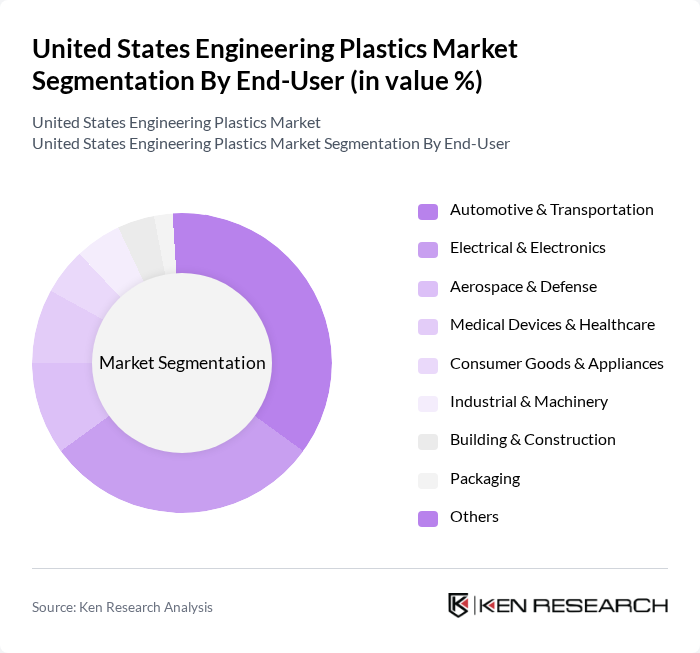

By End-User:The engineering plastics market is segmented by end-user industries, including Automotive & Transportation, Electrical & Electronics, Aerospace & Defense, Medical Devices & Healthcare, Consumer Goods & Appliances, Industrial & Machinery, Building & Construction, Packaging, and Others. The automotive and electronics sectors are the largest consumers, driven by the need for lightweight, durable, and high-performance materials in vehicle components, electric mobility, and miniaturized electronic devices. The medical and healthcare segment is also expanding, fueled by demand for biocompatible and sterilizable plastics in diagnostic and surgical equipment.

The United States Engineering Plastics Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF Corporation, DuPont de Nemours, Inc., SABIC Innovative Plastics, Covestro LLC, Solvay S.A., Eastman Chemical Company, LANXESS Corporation, Mitsubishi Engineering-Plastics Corporation, Celanese Corporation, RTP Company, Ensinger Inc., Teijin Limited, Arkema Inc., Kraton Corporation, and Victrex USA, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the United States engineering plastics market appears promising, driven by technological advancements and a growing emphasis on sustainability. As industries increasingly adopt lightweight materials and innovative polymer technologies, the market is expected to witness significant transformations. Furthermore, the shift towards a circular economy will encourage the development of recyclable and biodegradable plastics, aligning with consumer preferences for environmentally friendly products. This evolving landscape presents opportunities for companies to innovate and expand their market presence in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Polycarbonate (PC) Polyamide (PA, including Nylon 6, Nylon 66) Polyoxymethylene (POM, Acetal) Polyphenylene Sulfide (PPS) Acrylonitrile Butadiene Styrene (ABS) Polyethylene Terephthalate (PET) Polybutylene Terephthalate (PBT) Polysulfone (PSU) & Polyethersulfone (PES) Thermoplastic Elastomers (TPE) Others (including Polyether Ether Ketone (PEEK), Polyimide, etc.) |

| By End-User | Automotive & Transportation Electrical & Electronics Aerospace & Defense Medical Devices & Healthcare Consumer Goods & Appliances Industrial & Machinery Building & Construction Packaging Others |

| By Application | Structural Components Electrical Insulation & Connectors Fluid Handling Systems Packaging & Containers Automotive Interiors & Exteriors Medical Components Others |

| By Distribution Channel | Direct Sales (Manufacturers to OEMs) Distributors & Dealers Online Retail Wholesalers Others |

| By Region | Northeast Midwest South West Far West Others |

| By Price Range | Economy Mid-Range Premium |

| By Product Form | Sheets Rods Films Molding Compounds Granules & Pellets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Engineering Plastics | 100 | Product Engineers, Procurement Managers |

| Aerospace Material Applications | 70 | Material Scientists, Aerospace Engineers |

| Consumer Goods Manufacturing | 80 | Design Engineers, Supply Chain Analysts |

| Electronics Housing Solutions | 60 | Product Development Managers, Quality Assurance Leads |

| Construction Material Innovations | 50 | Construction Project Managers, Material Suppliers |

The United States Engineering Plastics Market is valued at approximately USD 15 billion, reflecting a robust growth trajectory driven by demand for lightweight and durable materials across various industries, including automotive, aerospace, and healthcare.