Vietnam Engineering Plastics Market Overview

- The Vietnam Engineering Plastics Market is valued at USD 1.1 billion, based on a five-year historical analysis. Growth is primarily driven by robust demand from automotive, electronics, and industrial manufacturing sectors, as well as the increasing adoption of lightweight materials in manufacturing processes. The market is further supported by the expansion of export-oriented production, foreign direct investment inflows, and the shift toward higher-value plastics, particularly under the China+1 manufacturing strategy. Advancements in manufacturing technology and heightened awareness of engineering plastics’ superior performance over traditional materials also contribute to market expansion .

- Key cities such asHo Chi Minh CityandHanoicontinue to dominate the Vietnam Engineering Plastics Market due to their established industrial bases and significant infrastructure investments. These urban centers attract multinational corporations and house numerous manufacturing facilities, which drive high demand for engineering plastics in automotive, electronics, and consumer goods applications .

- In 2023, the Vietnamese government enactedDecree No. 08/2022/ND-CP(amending and supplementing several articles of the Law on Environmental Protection 2020), issued by the Ministry of Natural Resources and Environment. This regulation mandates extended producer responsibility (EPR) for plastic packaging and provides incentives for manufacturers utilizing recyclable or biodegradable engineering plastics. Companies are required to meet recycling targets and report compliance, thereby encouraging sustainable practices and alignment with global environmental standards .

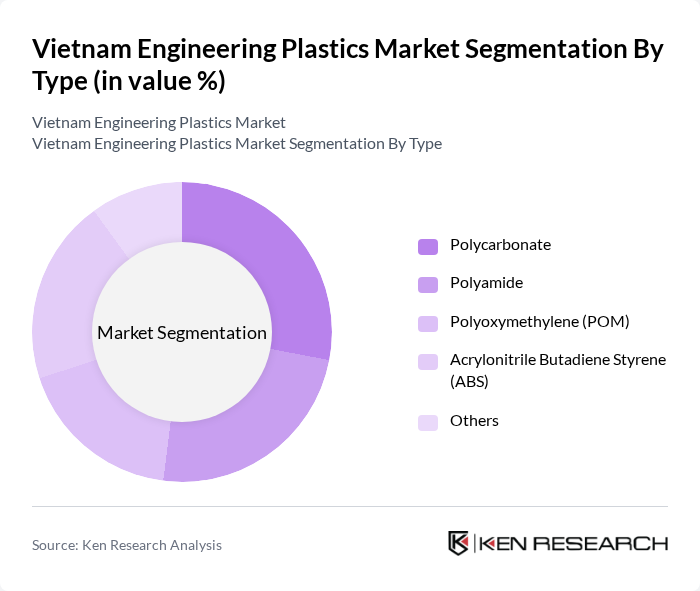

Vietnam Engineering Plastics Market Segmentation

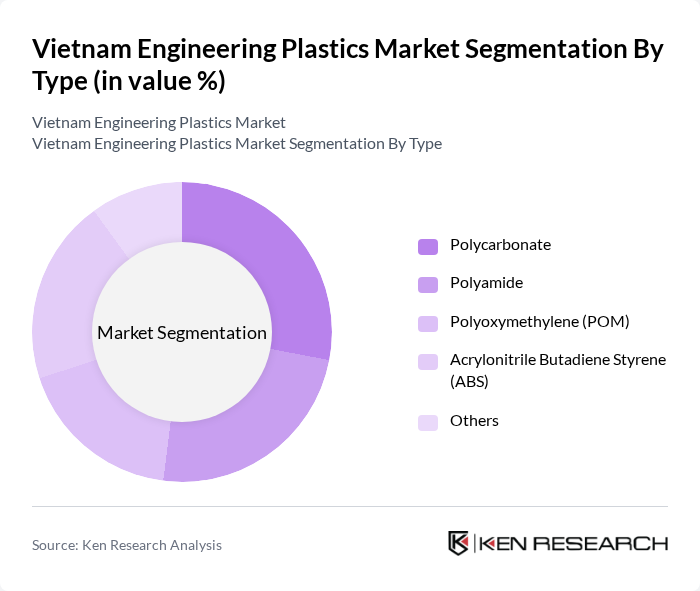

By Type:The engineering plastics market is segmented intoPolycarbonate,Polyamide,Polyoxymethylene (POM),Acrylonitrile Butadiene Styrene (ABS), andOthers. Each type serves distinct applications: Polycarbonate offers high impact resistance and optical clarity, making it suitable for automotive and electronics; Polyamide is valued for strength and thermal stability, especially in automotive components; POM is chosen for low friction and wear resistance; ABS stands out for its cost-performance balance, toughness, and ease of processing, and is widely used in electronics, appliances, and automotive parts .

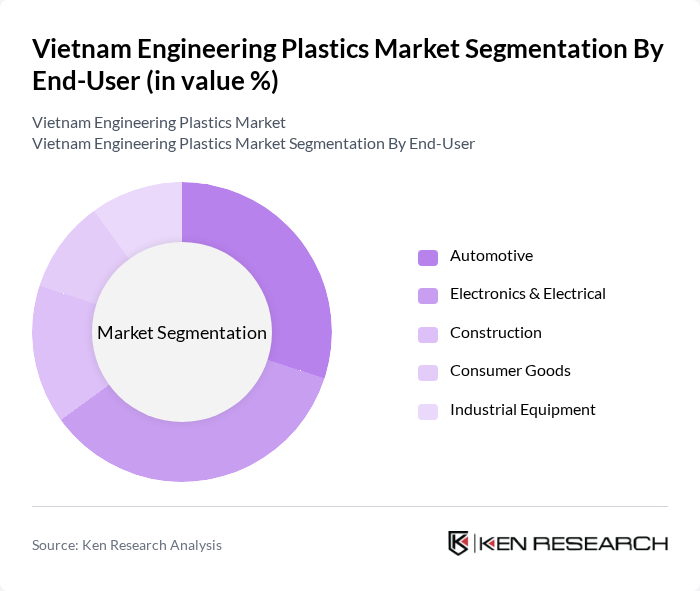

By End-User:The engineering plastics market is segmented by end-user industries:Automotive,Electronics & Electrical,Construction,Consumer Goods, andIndustrial Equipment. The electronics and electrical sector currently holds the largest share, driven by Vietnam’s expanding electronics manufacturing base and rising exports of consumer devices and electrical components. The automotive sector is also a major consumer, supported by the country’s growing vehicle production and demand for lightweight, fuel-efficient materials. Construction, consumer goods, and industrial equipment sectors are increasingly adopting engineering plastics for their durability, cost-effectiveness, and performance .

Vietnam Engineering Plastics Market Competitive Landscape

The Vietnam Engineering Plastics Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF Vietnam, Dow Vietnam, LG Chem Vietnam, SABIC Vietnam, DuPont Vietnam, Mitsubishi Engineering-Plastics Corporation Vietnam, Covestro Vietnam, Solvay Vietnam, Evonik Industries Vietnam, Toray Industries Vietnam, Teijin Limited Vietnam, Asahi Kasei Corporation Vietnam, Eastman Chemical Company Vietnam, Arkema Group Vietnam, and Celanese Corporation Vietnam contribute to innovation, geographic expansion, and service delivery in this space.

Vietnam Engineering Plastics Market Industry Analysis

Growth Drivers

- Increasing Demand from Automotive Industry:The automotive sector in Vietnam is projected to grow significantly, with production expected to reach 500,000 vehicles in the future, up from 400,000 in the previous period. This surge is driven by rising consumer incomes and urbanization, leading to increased demand for lightweight and durable materials. Engineering plastics, known for their strength and weight reduction capabilities, are becoming essential in manufacturing components such as dashboards and bumpers, thus propelling market growth.

- Expansion of Electronics Manufacturing:Vietnam's electronics manufacturing output is anticipated to exceed $100 billion in the future, driven by major global companies relocating production to the region. This growth is fostering demand for engineering plastics, which are crucial in producing lightweight, high-performance components for consumer electronics. The shift towards smart devices and IoT products further enhances the need for advanced materials, positioning engineering plastics as a key player in this expanding market.

- Rising Construction Activities:The construction sector in Vietnam is expected to grow at a rate of 7.5% annually, with investments projected to reach $20 billion in the future. This growth is fueled by urbanization and infrastructure development, increasing the demand for engineering plastics in applications such as piping, insulation, and structural components. The durability and versatility of these materials make them ideal for modern construction projects, thereby driving market expansion.

Market Challenges

- Fluctuating Raw Material Prices:The engineering plastics market faces significant challenges due to volatile raw material prices, which can fluctuate by as much as 30% annually. Factors such as geopolitical tensions and supply chain disruptions contribute to this instability, impacting production costs and profit margins for manufacturers. This unpredictability can hinder investment in new technologies and limit market growth potential.

- Environmental Regulations Compliance:Stricter environmental regulations in Vietnam are posing challenges for engineering plastics manufacturers. Compliance costs can reach up to $1 million for mid-sized companies, affecting their operational budgets. These regulations aim to reduce plastic waste and promote sustainable practices, compelling companies to invest in eco-friendly alternatives, which may not yet be commercially viable, thus impacting market dynamics.

Vietnam Engineering Plastics Market Future Outlook

The Vietnam engineering plastics market is poised for significant transformation, driven by technological advancements and a shift towards sustainability. As manufacturers increasingly adopt smart manufacturing technologies, efficiency and production capabilities will improve. Additionally, the growing consumer preference for eco-friendly products will likely accelerate the development of bio-based engineering plastics, aligning with global sustainability trends. This evolution presents a unique opportunity for companies to innovate and capture emerging market segments, ensuring long-term growth and competitiveness.

Market Opportunities

- Development of Bio-Based Engineering Plastics:The increasing focus on sustainability is driving the development of bio-based engineering plastics, which are projected to capture a market share of 15% in the future. This shift not only meets consumer demand for eco-friendly products but also aligns with government initiatives promoting green materials, creating a lucrative opportunity for manufacturers to innovate and differentiate their offerings.

- Technological Advancements in Production:Innovations in production technologies, such as 3D printing and advanced polymerization techniques, are expected to enhance the efficiency and quality of engineering plastics. These advancements can reduce production costs by up to 20%, allowing companies to offer competitive pricing while improving product performance. This opportunity is crucial for capturing market share in the rapidly evolving manufacturing landscape.