Region:Europe

Author(s):Geetanshi

Product Code:KRAA3670

Pages:93

Published On:September 2025

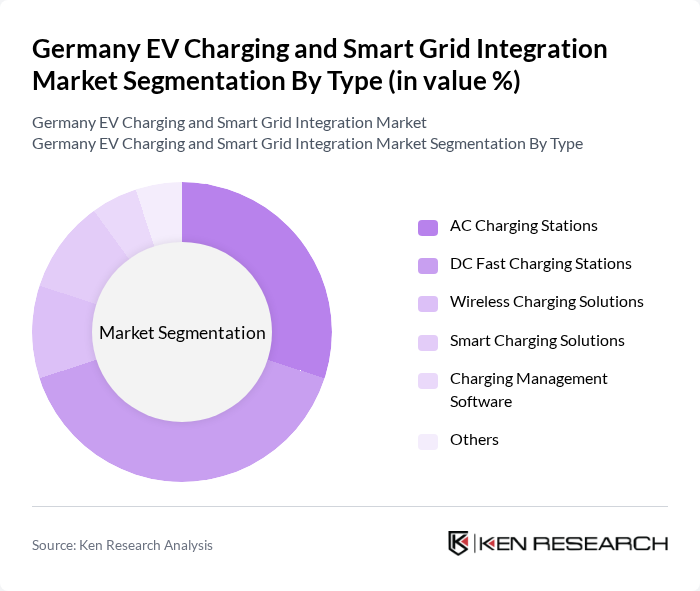

By Type:The market can be segmented into various types of charging solutions, including AC Charging Stations (covering Mode 1, Mode 2, and Mode 3 with power ranges from 2.3 kW to 22 kW), DC Fast Charging Stations, Wireless Charging Solutions, Smart Charging Solutions with advanced features including smart meters and cellular connectivity, Charging Management Software, and Others. Each of these sub-segments plays a crucial role in meeting the diverse needs of electric vehicle users.

The DC Fast Charging Stations segment is currently dominating the market due to the increasing demand for rapid charging solutions that minimize downtime for electric vehicle users. Fast chargers represent the largest revenue generating segment and are experiencing the fastest growth during the current period. As electric vehicles become more mainstream, consumers are seeking efficient charging options that can quickly replenish battery life. This trend is further supported by the expansion of charging networks in urban areas and along major highways through national fast-charging network initiatives, making DC fast charging a preferred choice for both individual users and fleet operators.

By End-User:The market can also be segmented by end-user categories, including Residential, Commercial (including retail locations with partnerships such as IKEA's collaboration with Mer to install over 1,000 charging points), Industrial, and Government & Utilities. Each segment has unique requirements and contributes differently to the overall market dynamics, with public charging stations strategically located along highways, urban centers, and other high-demand areas.

The Commercial segment is leading the market, driven by businesses investing in charging infrastructure to support their electric vehicle fleets and provide charging solutions for customers. This trend is particularly evident in urban areas where businesses are looking to enhance their sustainability profiles and attract eco-conscious consumers. The penetration of EV charging is notably high in commercial spaces compared to residential ones, with long-distance trips benefiting from ultra-fast charging capabilities made possible by public charging infrastructure. Additionally, government incentives for commercial installations further bolster this segment's growth.

The Germany EV Charging and Smart Grid Integration Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, ABB Ltd., Schneider Electric SE, Ionity GmbH, EnBW Energie Baden-Württemberg AG, E.ON SE, ChargePoint, Inc., Tesla, Inc., Volkswagen AG, BMW AG, RWE AG, Greenway Infrastructure, Allego N.V., EVBox Group, Fastned B.V. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Germany EV charging and smart grid integration market appears promising, driven by technological advancements and increasing consumer demand for sustainable solutions. As the government continues to invest in infrastructure and incentives, the market is expected to witness significant growth. Innovations in fast charging technologies and the integration of renewable energy sources will further enhance the efficiency and sustainability of the charging network, positioning Germany as a leader in the EV sector.

| Segment | Sub-Segments |

|---|---|

| By Type | AC Charging Stations DC Fast Charging Stations Wireless Charging Solutions Smart Charging Solutions Charging Management Software Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Public Charging Private Charging Fleet Charging Workplace Charging |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) |

| By Charging Speed | Level 1 Charging Level 2 Charging Level 3 Charging |

| By Distribution Mode | Direct Sales Online Sales Distributors Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| EV Charging Infrastructure Providers | 80 | Business Development Managers, Technical Directors |

| Utility Companies Involved in Smart Grid Projects | 60 | Project Managers, Energy Analysts |

| EV Users and Owners | 120 | Individual Consumers, Fleet Managers |

| Government and Regulatory Bodies | 40 | Policy Makers, Regulatory Affairs Specialists |

| Technology Providers for Smart Grid Solutions | 50 | Product Managers, R&D Engineers |

The Germany EV Charging and Smart Grid Integration Market is valued at approximately USD 1.3 billion, driven by the increasing adoption of electric vehicles, government incentives, and advancements in charging technology.