Region:Europe

Author(s):Shubham

Product Code:KRAB3209

Pages:92

Published On:October 2025

By Type:The market is segmented into various types, including AC Charging Stations, DC Fast Charging Stations, Wireless Charging Solutions, Charging Management Software, and Others. Among these, AC Charging Stations are widely adopted due to their cost-effectiveness and compatibility with most electric vehicles. However, DC Fast Charging Stations are gaining traction as they significantly reduce charging time, catering to the growing demand for quick charging solutions. The Charging Management Software segment is also emerging as a critical component, enabling efficient management of charging networks and user experiences.

By End-User:The market is categorized into Residential, Commercial, Industrial, and Government & Utilities segments. The Residential segment is currently leading the market, driven by the increasing number of electric vehicle owners seeking convenient home charging solutions. The Commercial segment is also expanding rapidly as businesses recognize the importance of providing charging facilities to attract customers and employees. Government initiatives further support the growth of charging infrastructure in public spaces.

The Spain EV Charging and Smart Grid Integration Market is characterized by a dynamic mix of regional and international players. Leading participants such as Iberdrola, Endesa, Repsol, Ferrovial, Siemens, Schneider Electric, EDP Renewables, Circontrol, Wallbox, EVBox, Greenway Infrastructure, ChargePoint, Tesla, ABB, Alfen contribute to innovation, geographic expansion, and service delivery in this space.

The future of the EV charging and smart grid integration market in Spain appears promising, driven by ongoing technological advancements and increasing government support. As the country aims to achieve its climate goals, investments in renewable energy and smart grid technologies are expected to rise significantly. Furthermore, the integration of vehicle-to-grid (V2G) systems will enhance energy efficiency and grid stability, paving the way for a more sustainable transportation ecosystem. This evolving landscape will likely attract new players and foster innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | AC Charging Stations DC Fast Charging Stations Wireless Charging Solutions Charging Management Software Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Public Charging Stations Private Charging Solutions Fleet Charging Solutions Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Others |

| By Charging Speed | Level 1 Charging Level 2 Charging Level 3 Charging Others |

| By Distribution Mode | Direct Sales Online Sales Distributors Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| EV Charging Infrastructure Providers | 100 | CEOs, Business Development Managers |

| Utility Companies Involved in Smart Grid | 80 | Energy Analysts, Grid Operations Managers |

| Government Policy Makers on Energy | 60 | Energy Policy Advisors, Regulatory Affairs Specialists |

| Automotive Manufacturers with EV Offerings | 70 | Product Managers, Sustainability Officers |

| Research Institutions Focused on Energy | 50 | Research Directors, Energy Economists |

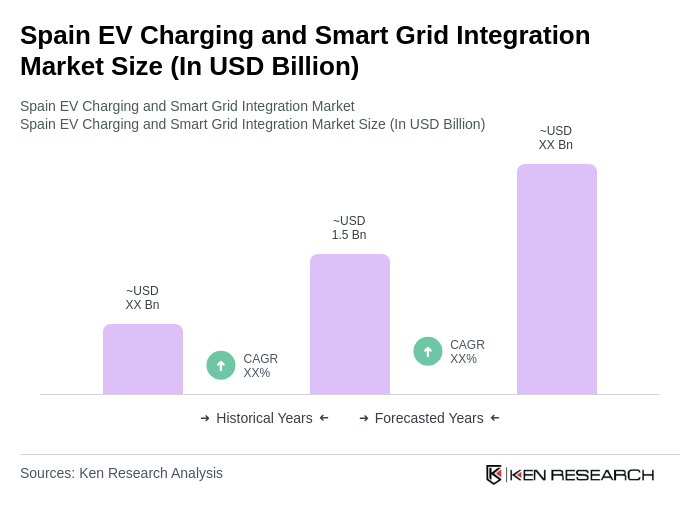

The Spain EV Charging and Smart Grid Integration Market is valued at approximately USD 1.5 billion, driven by the increasing adoption of electric vehicles, government incentives, and advancements in charging infrastructure technology.