Region:Europe

Author(s):Rebecca

Product Code:KRAB2866

Pages:85

Published On:October 2025

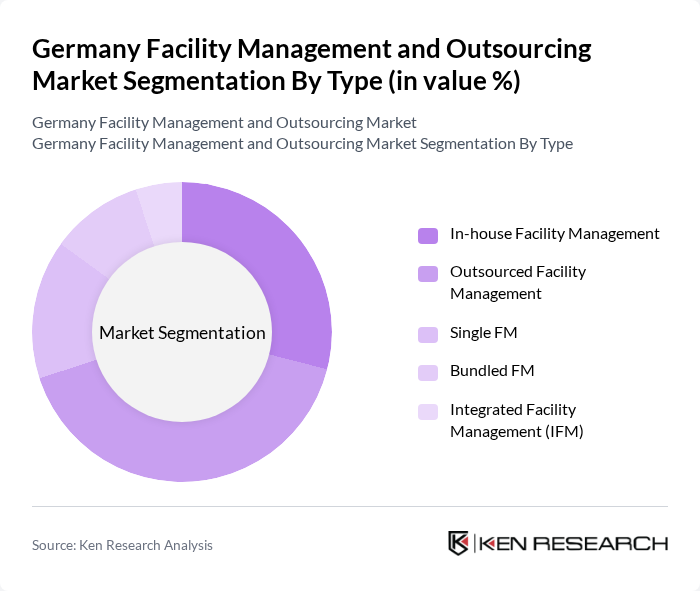

By Type:The market is segmented into various types, including In-house Facility Management, Outsourced Facility Management, Single FM, Bundled FM, and Integrated Facility Management (IFM). Each of these segments caters to different operational needs and preferences of organizations, with a notable trend towards outsourcing for cost efficiency, digitalization, and specialized expertise.

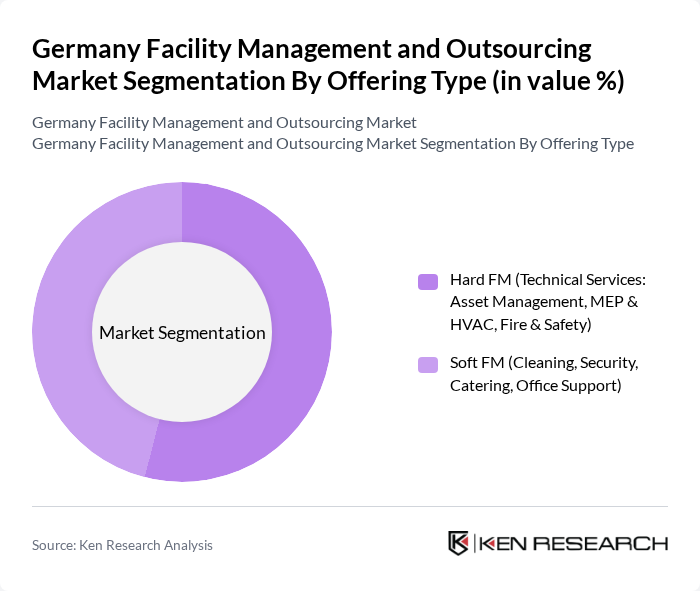

By Offering Type:The market is further divided into Hard FM and Soft FM. Hard FM includes technical services such as asset management, MEP & HVAC, and fire & safety, while Soft FM encompasses services like cleaning, security, catering, and office support. The increasing focus on operational efficiency, compliance, and workplace safety standards drives the demand for both types of offerings.

The Germany Facility Management and Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as ISS Facility Services GmbH, Sodexo Deutschland GmbH, CBRE Group, Inc., JLL (Jones Lang LaSalle SE), Dussmann Group, Bilfinger SE, Apleona GmbH, Strabag Property and Facility Services GmbH, ENGIE Deutschland GmbH, KÖTTER Services, WISAG Facility Service Holding GmbH, Vebego Deutschland GmbH, Caverion Deutschland GmbH, SPIE Deutschland & Zentraleuropa GmbH, and Vonovia SE contribute to innovation, geographic expansion, and service delivery in this space.

The future of the facility management market in Germany appears promising, driven by technological advancements and a growing emphasis on sustainability. As companies increasingly adopt smart technologies, operational efficiencies are expected to improve significantly. Additionally, the rising demand for customized facility solutions will likely create new avenues for service providers. However, firms must navigate competitive pressures and regulatory challenges to capitalize on these opportunities effectively, ensuring they remain agile and responsive to market dynamics.

| Segment | Sub-Segments |

|---|---|

| By Type | In-house Facility Management Outsourced Facility Management Single FM Bundled FM Integrated Facility Management (IFM) |

| By Offering Type | Hard FM (Technical Services: Asset Management, MEP & HVAC, Fire & Safety) Soft FM (Cleaning, Security, Catering, Office Support) |

| By End-User | Commercial Institutional Public/Infrastructure Healthcare Industrial & Process Sector Residential Others |

| By Region | Northern Germany Southern Germany Eastern Germany Western Germany |

| By Contract Type | Fixed-Price Contracts Time and Material Contracts Performance-Based Contracts |

| By Technology Adoption | Traditional Methods Digital Solutions Smart Technologies (IoT, Automation, Data Analytics) |

| By Pricing Model | Hourly Rates Monthly Retainers Project-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Facility Management | 100 | Facility Managers, Operations Directors |

| Healthcare Facility Outsourcing | 60 | Healthcare Administrators, Procurement Managers |

| Educational Institution Services | 50 | Campus Facility Managers, Administrative Heads |

| Retail Space Management | 40 | Store Managers, Regional Operations Managers |

| Industrial Facility Services | 50 | Plant Managers, Safety Officers |

The Germany Facility Management and Outsourcing Market is valued at approximately USD 56 billion, reflecting a significant growth trend driven by the demand for efficient building management solutions and the increasing emphasis on sustainability and digital transformation.