Region:Africa

Author(s):Geetanshi

Product Code:KRAB2771

Pages:94

Published On:October 2025

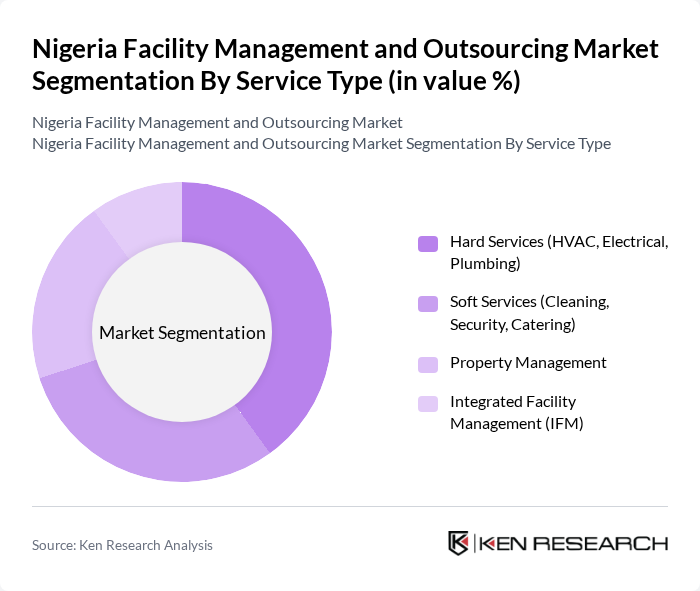

By Service Type:The service type segmentation includes various categories such as Hard Services, Soft Services, Property Management, and Integrated Facility Management (IFM). Among these,Hard Services, which encompass HVAC, electrical, and plumbing, are crucial for maintaining the operational efficiency and safety of facilities.Soft Services, including cleaning, security, and catering, are essential for enhancing the overall experience and well-being of occupants.Property Managementfocuses on the administration, leasing, and maintenance of real estate assets, whileIFMintegrates multiple services under a single contract for streamlined operations and cost efficiency. The adoption of technology-driven solutions, such as IoT-enabled monitoring and predictive maintenance, is increasingly prevalent across all service types to improve performance and sustainability.

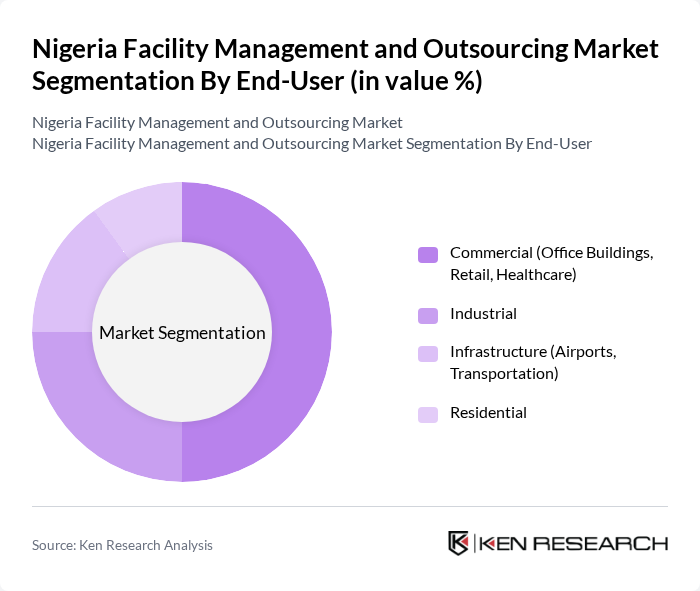

By End-User:The end-user segmentation includes Commercial, Industrial, Infrastructure, and Residential sectors. TheCommercial sector, which includes office buildings, retail spaces, and healthcare facilities, is the largest consumer of facility management services, driven by rapid real estate development and the need for compliance with international standards. TheIndustrial sectoris expanding due to increased manufacturing and logistics activities, requiring specialized facility management for operational efficiency and safety.Infrastructure, including airports and transportation hubs, demands advanced and integrated services for complex operations, while theResidential sectoris growing as urbanization and housing developments accelerate, especially in major cities.

The Nigeria Facility Management and Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Total Facilities Management Ltd, Alpha Mead Group, Grandeur Real-Estate Company, Cxall Facilities Management, Green Facilities Ltd, Eko Maintenance, Briscoe Properties Limited, FilmoRealty, Global PFI Group, Libra Reliance Properties, Provast, Trim Estate & Facility Management Services, Willco Property Management, UPDC Facility Management, Starsight Power Utility contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's facility management and outsourcing market appears promising, driven by urbanization and technological advancements. As the urban population continues to grow, the demand for efficient facility management services will increase. Additionally, the integration of smart technologies will enhance operational efficiency, allowing firms to offer innovative solutions. However, addressing the skills gap and regulatory challenges will be crucial for sustaining growth and attracting foreign investment in the sector.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Hard Services (HVAC, Electrical, Plumbing) Soft Services (Cleaning, Security, Catering) Property Management Integrated Facility Management (IFM) |

| By End-User | Commercial (Office Buildings, Retail, Healthcare) Industrial Infrastructure (Airports, Transportation) Residential |

| By Sector Organization | Organized Sector Unorganized Sector |

| By Service Model | Single Service Outsourcing Bundled Services Integrated FM Solutions In-House Management |

| By Geographic Coverage | Lagos Abuja Port Harcourt Other Major Cities |

| By Contract Type | Fixed-Price Contracts Time and Material Contracts Performance-Based Contracts |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Facility Management | 120 | Facility Managers, Operations Directors |

| Outsourcing Service Providers | 90 | Business Development Managers, Service Delivery Heads |

| Real Estate Management Firms | 70 | Property Managers, Asset Managers |

| Government Facility Management | 60 | Public Sector Facility Managers, Procurement Officers |

| Healthcare Facility Management | 50 | Healthcare Administrators, Facility Operations Managers |

The Nigeria Facility Management and Outsourcing Market is valued at approximately USD 2.5 billion, driven by the increasing demand for efficient management of facilities and services, particularly in urban areas experiencing rapid infrastructure development.