Region:Central and South America

Author(s):Geetanshi

Product Code:KRAB2764

Pages:97

Published On:October 2025

By Type:The market is segmented into various types of services, including Hard Services, Soft Services, Integrated Facility Management Services, Specialized Services, and Support Services. Each of these segments plays a crucial role in the overall facility management landscape, catering to different operational needs and client requirements .

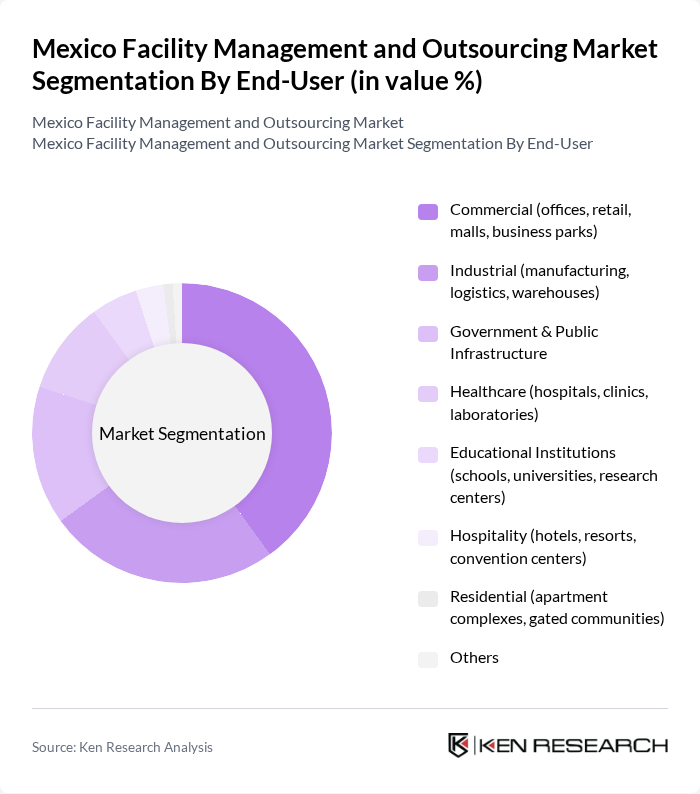

By End-User:The facility management market is further segmented by end-users, including Commercial, Industrial, Government & Public Infrastructure, Healthcare, Educational Institutions, Hospitality, Residential, and Others. Each end-user segment has unique requirements and contributes differently to the market dynamics .

The Mexico Facility Management and Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as ISS Facility Services México, Sodexo México, CBRE Group, Inc. (México), JLL (Jones Lang LaSalle México), Aramark México, Cushman & Wakefield México, Grupo Eulen México, GSI Servicios, Grupo Multisistemas de Seguridad Industrial, Corporativo UNNE, OCS Group México, Compass Group México, ABM Industries (México), Sertec Facility Services, Johnson Controls México contribute to innovation, geographic expansion, and service delivery in this space .

The future of the facility management and outsourcing market in Mexico appears promising, driven by technological innovations and a growing emphasis on sustainability. As urbanization continues, the demand for integrated facility services is expected to rise, with companies increasingly adopting smart building technologies. Additionally, the focus on health and safety standards will likely shape service offerings, ensuring that facilities meet evolving regulatory requirements and consumer expectations in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services (e.g., HVAC, electrical, plumbing, building maintenance) Soft Services (e.g., cleaning, security, landscaping, waste management) Integrated Facility Management Services Specialized Services (e.g., energy management, pest control, catering) Support Services (e.g., mailroom, reception, document management) |

| By End-User | Commercial (offices, retail, malls, business parks) Industrial (manufacturing, logistics, warehouses) Government & Public Infrastructure Healthcare (hospitals, clinics, laboratories) Educational Institutions (schools, universities, research centers) Hospitality (hotels, resorts, convention centers) Residential (apartment complexes, gated communities) Others |

| By Service Model | Outsourced Facility Management In-House Facility Management Hybrid Model |

| By Sector | Real Estate & Commercial Properties Industrial & Manufacturing Retail Hospitality & Leisure Healthcare Education Public Sector & Infrastructure |

| By Geographic Coverage | Mexico City Metropolitan Area Monterrey Metropolitan Area Guadalajara Metropolitan Area Other Urban Areas Suburban Areas Rural Areas |

| By Contract Type | Fixed-Price Contracts Time and Materials Contracts Performance-Based Contracts |

| By Investment Source | Private Investment Public Funding Foreign Direct Investment Joint Ventures |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Office Facility Management | 100 | Facility Managers, Real Estate Directors |

| Healthcare Facility Outsourcing | 70 | Healthcare Administrators, Operations Managers |

| Educational Institution Services | 60 | Campus Facility Directors, Procurement Officers |

| Retail Space Management | 80 | Store Managers, Regional Operations Managers |

| Industrial Facility Services | 50 | Plant Managers, Supply Chain Managers |

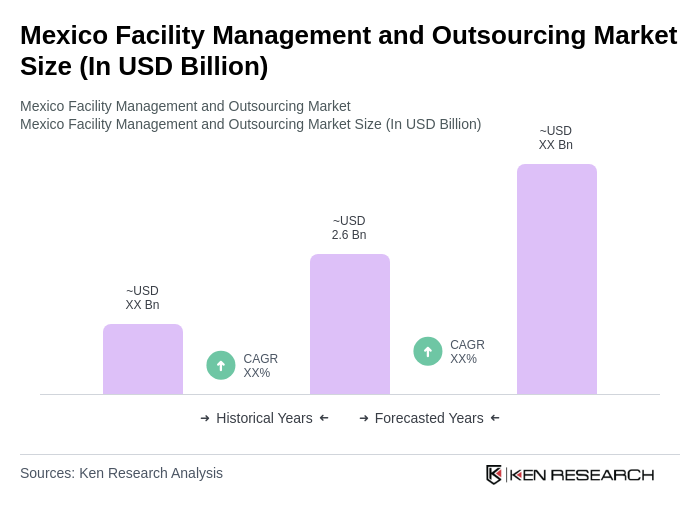

The Mexico Facility Management and Outsourcing Market is valued at approximately USD 2.6 billion, reflecting a significant growth driven by the demand for efficient facility management, commercial real estate expansion, and increasing outsourcing trends among businesses.