Region:Europe

Author(s):Dev

Product Code:KRAA1647

Pages:99

Published On:August 2025

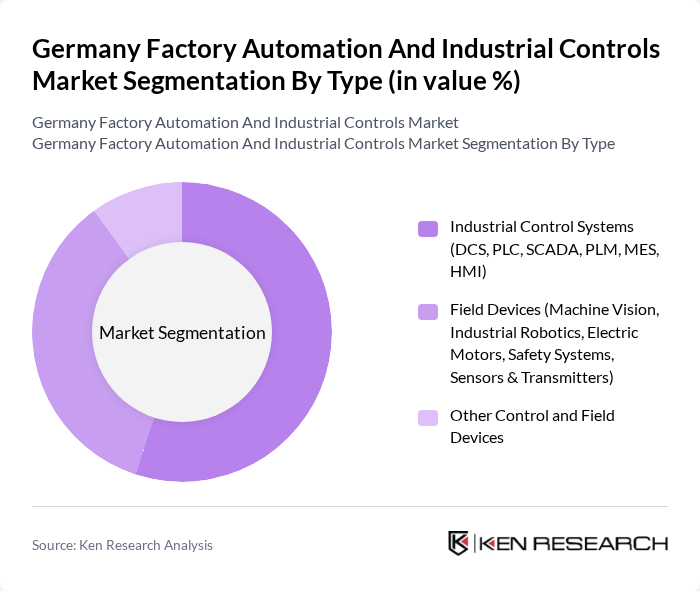

By Type:The market is segmented into Industrial Control Systems, Field Devices, and Other Control and Field Devices. Industrial Control Systems include DCS, PLC, SCADA, PLM, MES, and HMI, which are essential for managing and automating industrial processes. Field Devices encompass Machine Vision, Industrial Robotics, Electric Motors, Safety Systems, and Sensors & Transmitters, which are critical for operational efficiency and safety. Other Control and Field Devices include various ancillary devices that support automation processes.

By End-User:The end-user segmentation includes Automotive and Transportation, Food and Beverage, Pharmaceuticals and Biotechnology, Chemicals and Petrochemicals, Oil and Gas, Power and Utilities, Electronics and Semiconductors, and Other End-user Industries. The automotive sector is a significant contributor, driven by the need for precision, robotics integration, and flexible production. The food and beverage industry also plays a crucial role, emphasizing hygienic design, traceability, and regulatory compliance, while pharmaceuticals increasingly adopt MES and validated control systems to meet GxP and serialization requirements.

The Germany Factory Automation And Industrial Controls Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Bosch Rexroth AG, Schneider Electric SE, Rockwell Automation, Inc., Mitsubishi Electric Corporation, ABB Ltd., Honeywell International Inc., Yokogawa Electric Corporation, Emerson Electric Co., Omron Corporation, FANUC Corporation, KUKA AG, NI (National Instruments) Corporation, B&R Industrial Automation GmbH (ABB Group), Festo SE & Co. KG, Beckhoff Automation GmbH & Co. KG, Phoenix Contact GmbH & Co. KG, WAGO Kontakttechnik GmbH & Co. KG, Sick AG, ifm electronic gmbh, Lenze SE, Pilz GmbH & Co. KG, SEW?EURODRIVE GmbH & Co KG, Pepperl+Fuchs SE, HARTING Technology Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the factory automation and industrial controls market in Germany appears promising, driven by ongoing technological advancements and a strong push towards digital transformation. As industries increasingly adopt AI, IoT, and cloud-based solutions, operational efficiency is expected to improve significantly. Furthermore, the focus on sustainability and smart manufacturing will likely create new avenues for growth, enabling companies to enhance productivity while minimizing environmental impact, thus shaping a more resilient industrial landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Industrial Control Systems (DCS, PLC, SCADA, PLM, MES, HMI) Field Devices (Machine Vision, Industrial Robotics, Electric Motors, Safety Systems, Sensors & Transmitters) Other Control and Field Devices |

| By End-User | Automotive and Transportation Food and Beverage Pharmaceuticals and Biotechnology Chemicals and Petrochemicals Oil and Gas Power and Utilities Electronics and Semiconductors Other End-user Industries |

| By Component | Hardware Software (On-premise, Cloud, Edge) Services (Integration, Maintenance, Consulting) |

| By Application | Process Automation Discrete Automation Hybrid Industries |

| By Sales Channel | Direct Sales (OEMs and System Integrators) Authorized Distributors and Partners Online and E-procurement |

| By Distribution Mode | Project-Based and System Integration MRO/Aftermarket Supply |

| By Price Range | Entry-Level Mid-Range Premium/Enterprise |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturing Automation | 120 | Production Managers, Automation Engineers |

| Pharmaceuticals Industrial Controls | 80 | Quality Assurance Managers, Process Engineers |

| Consumer Goods Production Systems | 90 | Operations Directors, Supply Chain Managers |

| Food and Beverage Automation | 70 | Plant Managers, Safety Compliance Officers |

| Logistics and Warehouse Automation | 85 | Logistics Coordinators, IT Managers |

The Germany Factory Automation and Industrial Controls Market is valued at approximately USD 7.7 billion, reflecting strong demand across various sectors, including automotive, pharmaceuticals, and food and beverage, as companies seek efficiency and cost reduction.