Region:Asia

Author(s):Shubham

Product Code:KRAB0571

Pages:81

Published On:August 2025

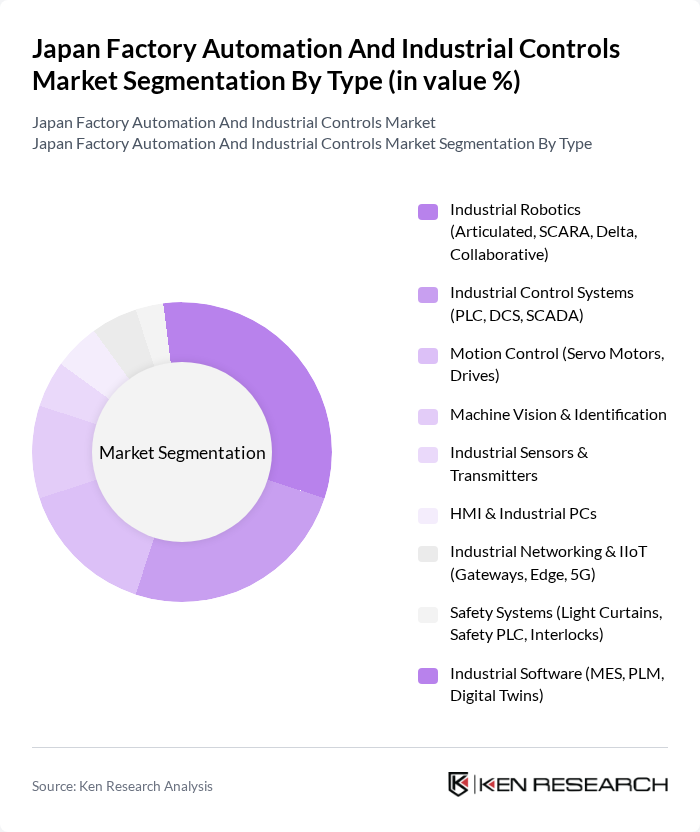

By Type:The market is segmented into various types, including Industrial Robotics, Industrial Control Systems, Motion Control, Machine Vision & Identification, Industrial Sensors & Transmitters, HMI & Industrial PCs, Industrial Networking & IIoT, Safety Systems, and Industrial Software. Each of these sub-segments plays a crucial role in enhancing operational efficiency and productivity in manufacturing processes.

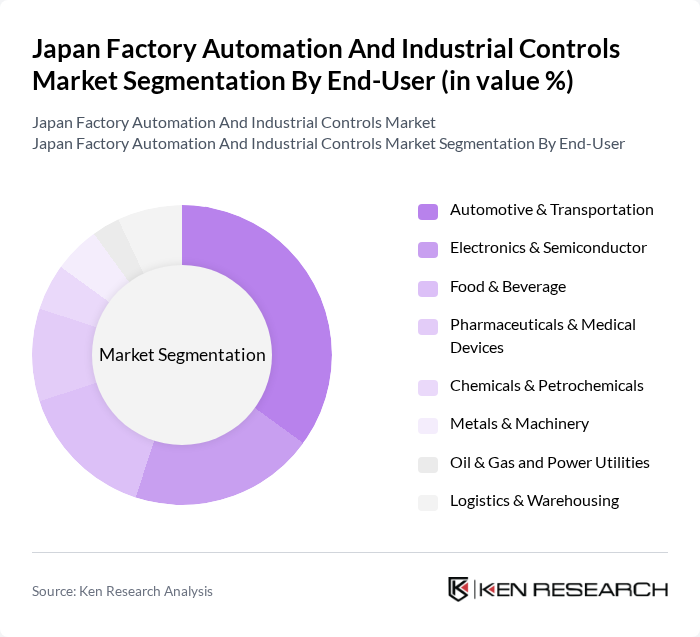

By End-User:The end-user segmentation includes Automotive & Transportation, Electronics & Semiconductor, Food & Beverage, Pharmaceuticals & Medical Devices, Chemicals & Petrochemicals, Metals & Machinery, Oil & Gas and Power Utilities, and Logistics & Warehousing. Each sector has unique automation needs, driving the demand for tailored solutions. Automotive and electronics remain the largest adopters in Japan given robot density and precision requirements, followed by F&B and pharmaceuticals where quality and traceability standards drive controls, sensors, vision, and MES uptake.

The Japan Factory Automation And Industrial Controls Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mitsubishi Electric Corporation, Fanuc Corporation, Yaskawa Electric Corporation, Omron Corporation, Keyence Corporation, Yokogawa Electric Corporation, Panasonic Industry Co., Ltd., SMC Corporation, ABB Ltd., Siemens AG, Schneider Electric SE, Rockwell Automation, Inc., Beckhoff Automation GmbH & Co. KG, Emerson Electric Co., Delta Electronics, Inc., KUKA AG, Honeywell International Inc., Fuji Electric Co., Ltd., Denso Wave Incorporated, Nachi-Fujikoshi Corp. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan factory automation and industrial controls market appears promising, driven by ongoing technological advancements and a strong governmental push towards Industry 4.0. As companies increasingly adopt smart factory concepts, the integration of AI and IoT technologies will enhance operational efficiencies. Furthermore, the focus on sustainability will drive innovations in energy-efficient automation solutions, positioning Japan as a leader in the global automation landscape. The market is expected to evolve rapidly, adapting to emerging trends and consumer demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Industrial Robotics (Articulated, SCARA, Delta, Collaborative) Industrial Control Systems (PLC, DCS, SCADA) Motion Control (Servo Motors, Drives) Machine Vision & Identification Industrial Sensors & Transmitters HMI & Industrial PCs Industrial Networking & IIoT (Gateways, Edge, 5G) Safety Systems (Light Curtains, Safety PLC, Interlocks) Industrial Software (MES, PLM, Digital Twins) |

| By End-User | Automotive & Transportation Electronics & Semiconductor Food & Beverage Pharmaceuticals & Medical Devices Chemicals & Petrochemicals Metals & Machinery Oil & Gas and Power Utilities Logistics & Warehousing |

| By Component | Hardware Software Services (Integration, Maintenance, Training) |

| By Application | Discrete Manufacturing (Assembly, Welding, Painting) Process Automation (Batch, Continuous) Packaging & Palletizing Quality Inspection & Testing Material Handling & Intralogistics |

| By Distribution Channel | Direct Sales Distributor/Systems Integrator Channel Online & e-Procurement |

| By Industry Vertical | Automotive OEMs & Tier Suppliers Electronics/EMS & Semiconductor Fabs Food & Beverage Processing Pharmaceuticals & Biotechnology Chemicals & Materials Heavy Industry & Shipbuilding Utilities (Power, Water) & Energy |

| By Price Range | Entry-Level Systems Mid-Range Systems High-Performance Systems |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturing Automation | 120 | Production Managers, Automation Engineers |

| Electronics Assembly Line Controls | 95 | Operations Supervisors, Quality Assurance Managers |

| Pharmaceutical Process Automation | 75 | Regulatory Affairs Specialists, Process Engineers |

| Food and Beverage Industry Controls | 60 | Plant Managers, Safety Compliance Officers |

| Logistics and Supply Chain Automation | 90 | Logistics Coordinators, Supply Chain Analysts |

The Japan Factory Automation and Industrial Controls Market is valued at approximately USD 15 billion, reflecting a robust growth trajectory driven by advancements in robotics, controls, and digitalization in manufacturing processes.