Region:Europe

Author(s):Shubham

Product Code:KRAA0884

Pages:95

Published On:August 2025

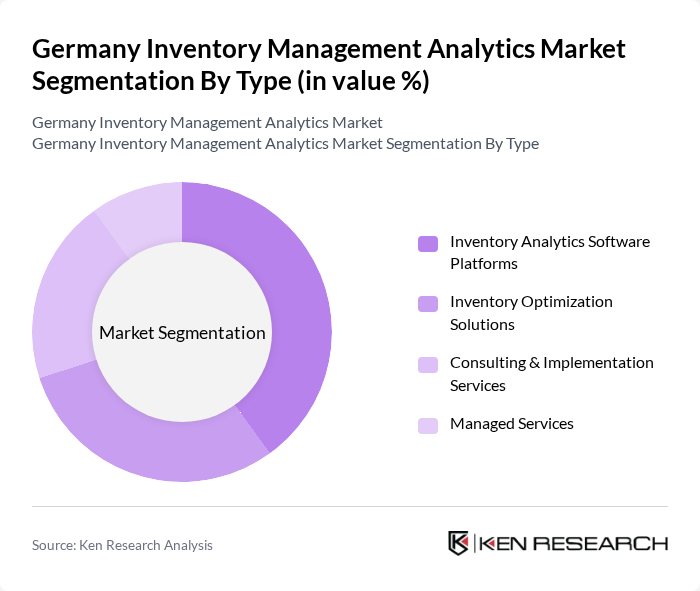

By Type:The market is segmented into four main types: Inventory Analytics Software Platforms, Inventory Optimization Solutions, Consulting & Implementation Services, and Managed Services. Each of these sub-segments plays a crucial role in enhancing inventory management practices across various industries.

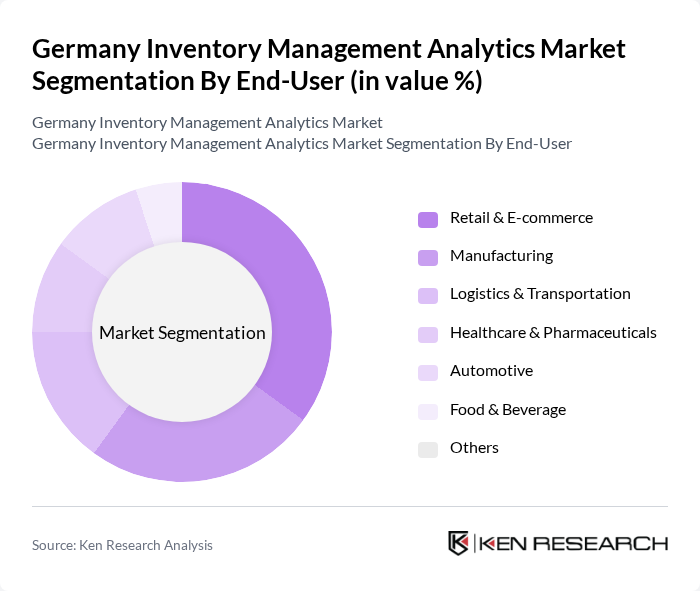

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing, Logistics & Transportation, Healthcare & Pharmaceuticals, Automotive, Food & Beverage, and Others. Each sector has unique requirements for inventory management analytics, driving demand for tailored solutions.

The Germany Inventory Management Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Blue Yonder GmbH (formerly JDA Software, Germany HQ), Oracle Corporation, IBM Corporation, Microsoft Corporation, Infor, Manhattan Associates, Körber Supply Chain (Körber AG), Epicor Software Corporation, NetSuite (Oracle NetSuite), Zebra Technologies, PSI Logistics GmbH, Inform GmbH, proALPHA Business Solutions GmbH, S&P Computersysteme GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the inventory management analytics market in Germany appears promising, driven by technological advancements and evolving consumer behaviors. As businesses increasingly prioritize efficiency and data-driven decision-making, the integration of automation and IoT devices will become more prevalent. Additionally, the focus on sustainability will encourage companies to adopt greener practices in inventory management, aligning with regulatory pressures and consumer expectations. This evolving landscape will create a fertile ground for innovation and growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Inventory Analytics Software Platforms Inventory Optimization Solutions Consulting & Implementation Services Managed Services |

| By End-User | Retail & E-commerce Manufacturing Logistics & Transportation Healthcare & Pharmaceuticals Automotive Food & Beverage Others |

| By Industry Vertical | Consumer Goods Automotive Electronics & Electricals Pharmaceuticals & Healthcare Industrial Machinery Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Sales Channel | Direct Sales Distributors/VARs Online Sales/Marketplaces |

| By Geographic Region | North Germany South Germany East Germany West Germany |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 90 | Inventory Managers, Supply Chain Executives |

| Manufacturing Supply Chain Analytics | 70 | Operations Managers, Production Planners |

| E-commerce Inventory Optimization | 60 | E-commerce Managers, Logistics Coordinators |

| Warehouse Management Systems | 50 | Warehouse Managers, IT Systems Analysts |

| Inventory Forecasting Techniques | 40 | Data Analysts, Business Intelligence Managers |

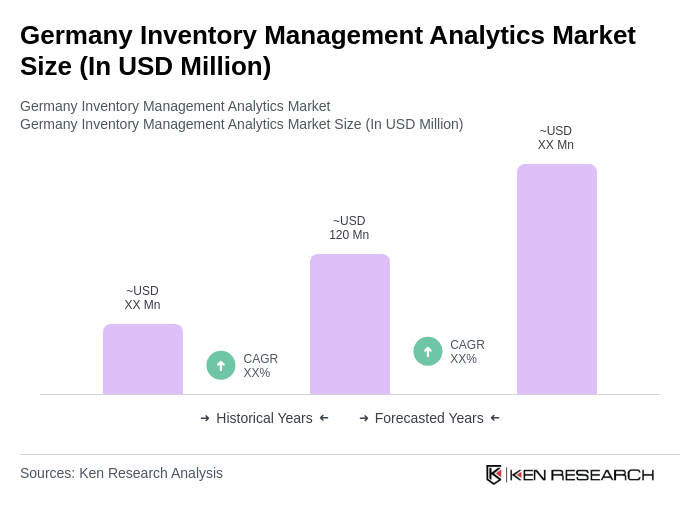

The Germany Inventory Management Analytics Market is valued at approximately USD 120 million, reflecting a five-year historical analysis. This growth is driven by the need for businesses to optimize inventory levels and enhance operational efficiency.