Region:Africa

Author(s):Shubham

Product Code:KRAA0832

Pages:86

Published On:August 2025

By Type:The market is segmented into various types, including Inventory Management Software, Inventory Analytics Platforms, RFID and Barcode Solutions, Cloud-Based Inventory Solutions, Consulting and Implementation Services, Managed Services, and Training and Support Services. Among these, Inventory Management Software is the leading sub-segment due to its essential role in automating inventory processes and enhancing operational efficiency. The increasing demand for real-time data and analytics, as well as integration with other enterprise systems, further drives the adoption of these solutions .

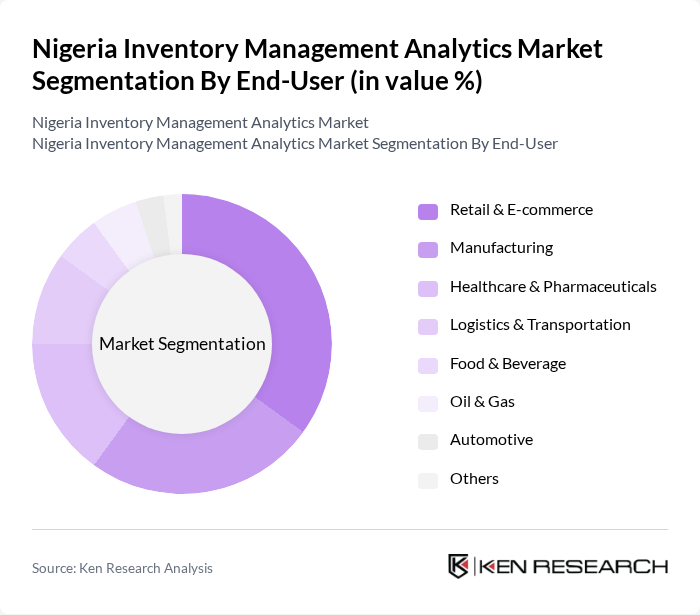

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Logistics & Transportation, Food & Beverage, Oil & Gas, Automotive, and Others. The Retail & E-commerce sector is the dominant segment, driven by the rapid growth of online shopping and the need for efficient inventory management to meet consumer demands. This sector's reliance on technology for inventory tracking and management, as well as the expansion of omnichannel retailing, further solidifies its leading position .

The Nigeria Inventory Management Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP Nigeria, Oracle Nigeria, IBM Nigeria, Infor Nigeria, Microsoft Nigeria (Dynamics 365), Zoho Nigeria, Odoo Nigeria, Tally Solutions Nigeria, Sage Nigeria, NetSuite Nigeria, Redline Logistics, ABC Transport, TradeDepot, Omnibiz, FieldInsight Africa contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Nigeria inventory management analytics market appears promising, driven by technological advancements and increasing digital adoption. As businesses continue to recognize the importance of data-driven decision-making, the integration of artificial intelligence and machine learning into inventory systems is expected to enhance predictive capabilities. Furthermore, the ongoing government initiatives aimed at promoting digital transformation will likely facilitate greater access to advanced analytics tools, enabling companies to optimize their inventory management processes effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Inventory Management Software Inventory Analytics Platforms RFID and Barcode Solutions Cloud-Based Inventory Solutions Consulting and Implementation Services Managed Services Training and Support Services |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Logistics & Transportation Food & Beverage Oil & Gas Automotive Others |

| By Application | Demand Forecasting & Planning Inventory Optimization Warehouse Management Order & Fulfillment Management Supply Chain Visibility & Analytics Others |

| By Sales Channel | Direct Sales Online Sales Distributors Value-Added Resellers (VARs) Others |

| By Deployment Mode | Cloud-Based On-Premise Hybrid |

| By Price Range | Entry-Level Solutions Mid-Tier Solutions Enterprise Solutions |

| By Customer Segment | Small Businesses Medium Enterprises Large Enterprises |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 60 | Inventory Managers, Supply Chain Coordinators |

| Manufacturing Supply Chain Analytics | 50 | Operations Managers, Production Planners |

| E-commerce Inventory Strategies | 45 | eCommerce Managers, Logistics Analysts |

| Warehouse Management Systems | 40 | Warehouse Managers, IT Systems Analysts |

| Logistics and Distribution Optimization | 40 | Logistics Managers, Distribution Center Supervisors |

The Nigeria Inventory Management Analytics Market is valued at approximately USD 680 million, reflecting significant growth driven by technology adoption in supply chain management and the rise of e-commerce.