Region:Europe

Author(s):Shubham

Product Code:KRAC0717

Pages:81

Published On:August 2025

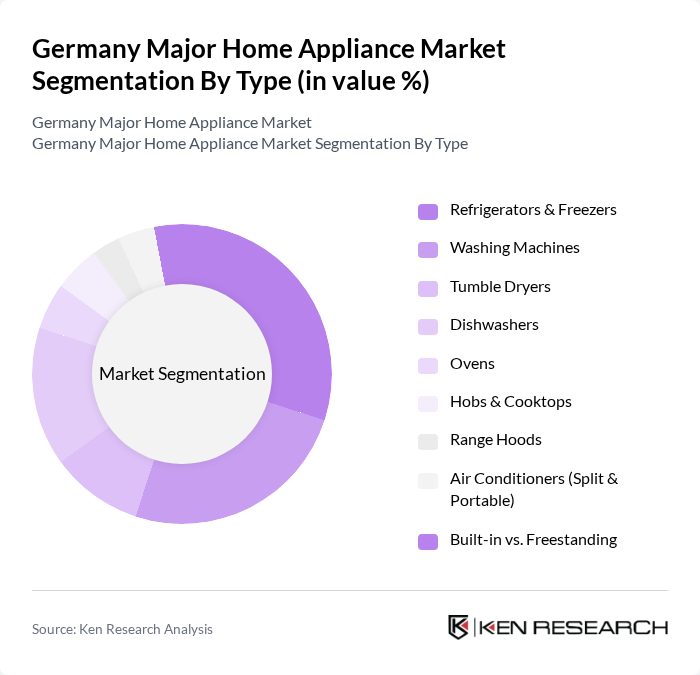

By Type:The major segments in this category include Refrigerators & Freezers, Washing Machines, Tumble Dryers, Dishwashers, Ovens, Hobs & Cooktops, Range Hoods, Air Conditioners (Split & Portable), and Built-in vs. Freestanding appliances. Among these, Refrigerators & Freezers are the leading subsegment, driven by consumer preferences for energy-efficient models and smart technology integration; replacement demand is supported by energy?efficiency regulations and the growing popularity of connected features.

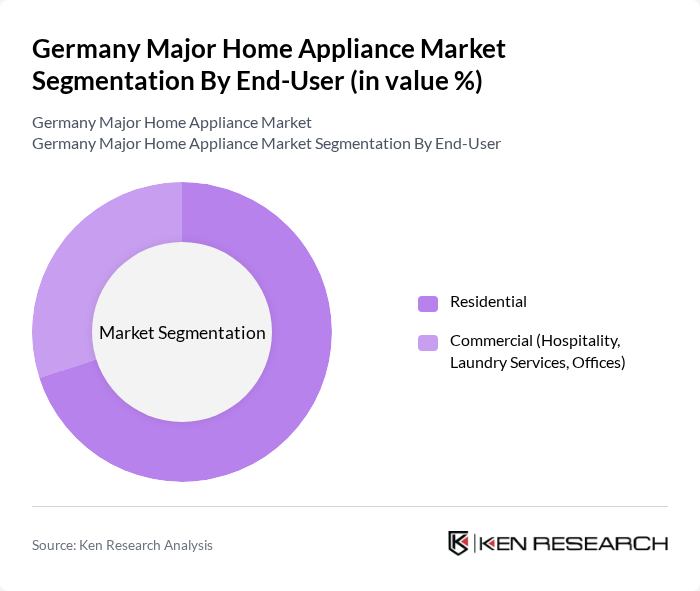

By End-User:The end-user segmentation includes Residential and Commercial sectors. The Residential segment dominates the market, driven by increasing household incomes and a growing trend towards home improvement, built?in kitchen adoption, and e?commerce availability of large appliances. The Commercial segment, while smaller, is also growing due to the rising demand for appliances in hospitality and laundry services.

The Germany Major Home Appliance Market is characterized by a dynamic mix of regional and international players. Leading participants such as BSH Hausgeräte GmbH (Bosch, Siemens, Neff, Gaggenau), Miele & Cie. KG, Electrolux AB (incl. AEG), Whirlpool Corporation (Bauknecht Hausgeräte GmbH), Haier Europe (incl. Candy, Hoover), Samsung Electronics GmbH, LG Electronics Deutschland GmbH, Hisense Germany GmbH (incl. Gorenje), Panasonic Marketing Europe GmbH, Sharp Consumer Electronics (Europe) GmbH, Vestel Elektronik Sanayi ve Ticaret A.?., Arçelik A.?. (Beko Grundig Deutschland GmbH), Liebherr-Hausgeräte GmbH, Grundig Intermedia GmbH, Bosch Thermotechnik GmbH (for HVAC/AC overlap) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the German major home appliance market appears promising, driven by technological advancements and a growing emphasis on sustainability. As consumers increasingly seek energy-efficient and smart appliances, manufacturers are likely to invest in innovative solutions that cater to these preferences. Additionally, the expansion of e-commerce platforms will facilitate easier access to a wider range of products, enhancing consumer choice and convenience. Overall, the market is poised for growth, adapting to evolving consumer needs and regulatory frameworks.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerators & Freezers Washing Machines Tumble Dryers Dishwashers Ovens Hobs & Cooktops Range Hoods Air Conditioners (Split & Portable) Built-in vs. Freestanding (cut-across view) |

| By End-User | Residential Commercial (Hospitality, Laundry Services, Offices) |

| By Sales Channel | E-commerce (Amazon, OTTO, Brand D2C) Electronics Chains (MediaMarkt, Saturn, expert) DIY & Furniture Retail (IKEA, Bauhaus, Hornbach) Specialty/Independent Dealers |

| By Price Range | Budget Mid-Range Premium/Luxury |

| By Energy Label | A to B Rated C to D Rated E and Below |

| By Connectivity | Connected/Smart (Wi?Fi, Matter-enabled) Non-connected |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Major Appliance Retailers | 150 | Store Managers, Sales Directors |

| Consumer Electronics Stores | 100 | Product Specialists, Customer Service Representatives |

| Home Appliance Manufacturers | 80 | Product Development Managers, Marketing Executives |

| Consumer Households | 150 | Homeowners, Renters |

| Industry Experts and Analysts | 50 | Market Analysts, Industry Consultants |

The Germany Major Home Appliance Market is valued at approximately EUR 14.0 billion. This figure reflects a significant share within the broader appliances market, driven by consumer demand for energy-efficient and technologically advanced products.