Region:Middle East

Author(s):Dev

Product Code:KRAA8172

Pages:93

Published On:November 2025

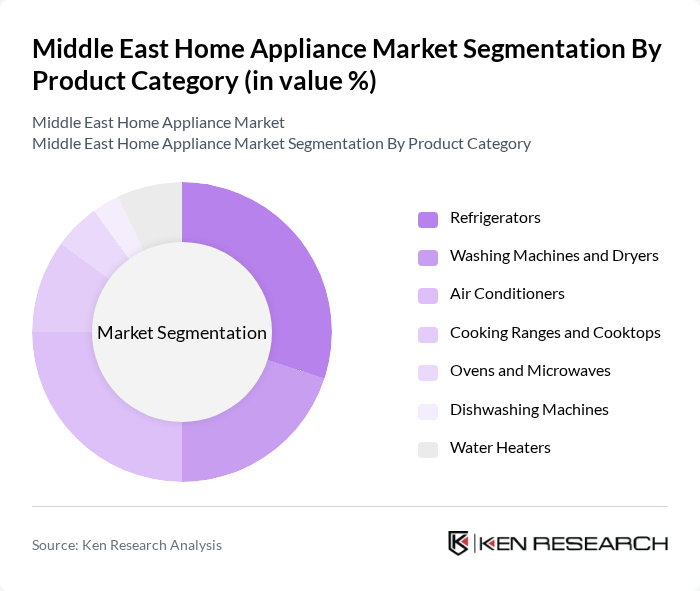

By Product Category:The product category segmentation includes major appliances and small appliances. Major appliances encompass essential household items such as refrigerators, washing machines, air conditioners, and cooking ranges, while small appliances cater to specific tasks and convenience, including coffee makers, food processors, and air fryers. The major appliances segment is currently leading the market due to the essential nature of these products in daily life, with refrigerators and air conditioners representing the largest shares .

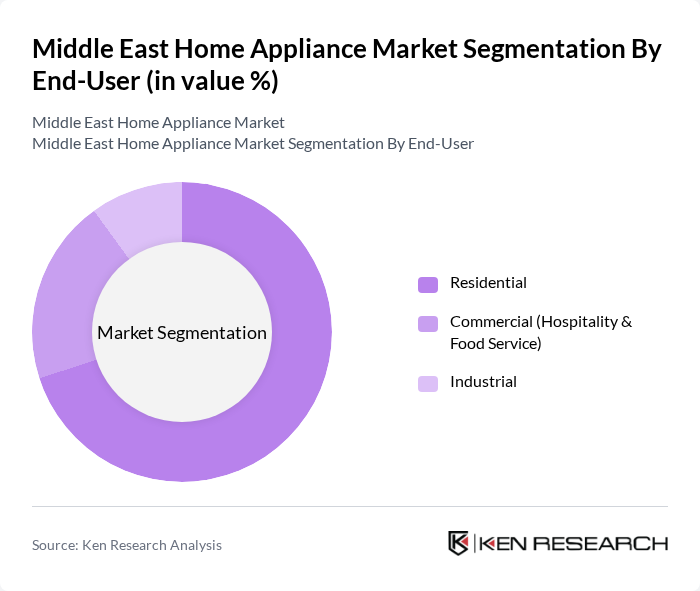

By End-User:The end-user segmentation includes residential, commercial, and industrial users. The residential segment dominates the market, driven by increasing household incomes, a growing trend towards modern living standards, and the expansion of urban housing. Consumers are increasingly investing in home appliances to enhance their quality of life and convenience .

The Middle East Home Appliance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics Co., Ltd., LG Electronics Inc., Whirlpool Corporation, Robert Bosch GmbH (Bosch Home Appliances), Electrolux AB, Panasonic Holdings Corporation, Haier Smart Home Co., Ltd., Midea Group Co., Ltd., Hisense Group Co., Ltd., Arçelik A.?., Koninklijke Philips N.V., Dreametech (Dreame Technology Co., Ltd.), Tuya Smart Inc., Jumbo Electronics (Regional Distributor & Retailer), and Morphy Richards contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East home appliance market is poised for transformative growth driven by urbanization, rising incomes, and technological advancements. As consumers increasingly prioritize energy efficiency and smart technologies, manufacturers will need to adapt their offerings. The integration of IoT and sustainable practices will likely shape product development. Additionally, the expansion of e-commerce platforms will facilitate greater access to diverse appliance options, enhancing consumer choice and convenience in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Major Appliances Refrigerators Washing Machines and Dryers Air Conditioners Cooking Ranges and Cooktops Ovens and Microwaves Dishwashing Machines Water Heaters Small Appliances Coffee Makers and Tea Makers Toasters and Grills Blenders and Food Processors Juicers and Fryers Vacuum Cleaners Hair Dryers and Irons Air Purifiers and Humidifiers Rice Cookers and Steamers |

| By End-User | Residential Commercial (Hospitality & Food Service) Industrial |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Bahrain, Oman) Levant Region (Egypt, Jordan, Lebanon, Syria) North Africa (Morocco, Algeria, Tunisia, Libya) Sub-Saharan Africa (Ethiopia, Kenya, Nigeria) |

| By Technology | Smart Appliances (IoT-Enabled, Connected Devices) Energy-Efficient Appliances (Inverter Technology, High Energy Star Ratings) Traditional Appliances |

| By Distribution Channel | Multi-Brand Retailers and Specialty Stores Supermarkets and Hypermarkets E-Commerce Platforms Direct Sales and Brand Stores Others (Wholesalers, Distributors) |

| By Price Segment | Premium Segment Mid-Range Segment Budget Segment |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Home Appliances | 100 | Store Managers, Sales Representatives |

| Consumer Preferences in Home Appliances | 120 | Homeowners, Renters |

| Distribution Channels for Home Appliances | 80 | Logistics Coordinators, Supply Chain Managers |

| Market Trends in Smart Appliances | 60 | Product Managers, Technology Specialists |

| Impact of E-commerce on Home Appliance Sales | 60 | E-commerce Managers, Digital Marketing Specialists |

The Middle East Home Appliance Market is valued at approximately USD 22 billion, driven by rising disposable incomes, urbanization, and a growing preference for energy-efficient appliances among consumers.