Region:Asia

Author(s):Rebecca

Product Code:KRAA1382

Pages:89

Published On:August 2025

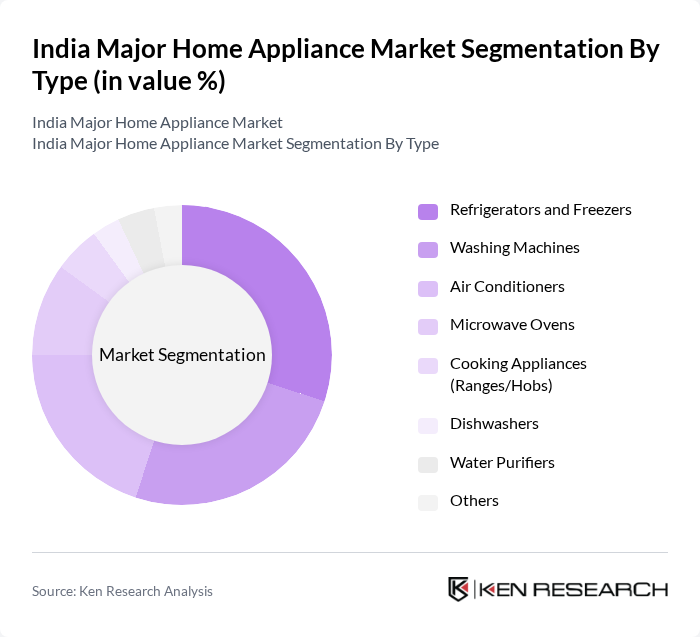

By Type:The major segments under this category include Refrigerators and Freezers, Washing Machines, Air Conditioners, Microwave Ovens, Cooking Appliances (Ranges/Hobs), Dishwashers, Water Purifiers, and Others. Among these, Refrigerators and Freezers are leading the market due to their essential role in food preservation and the growing trend of nuclear families that require efficient storage solutions. The demand for energy-efficient and smart models is increasing, driven by heightened consumer awareness regarding sustainability, government incentives for energy savings, and technological advancements such as inverter compressors and IoT-enabled features .

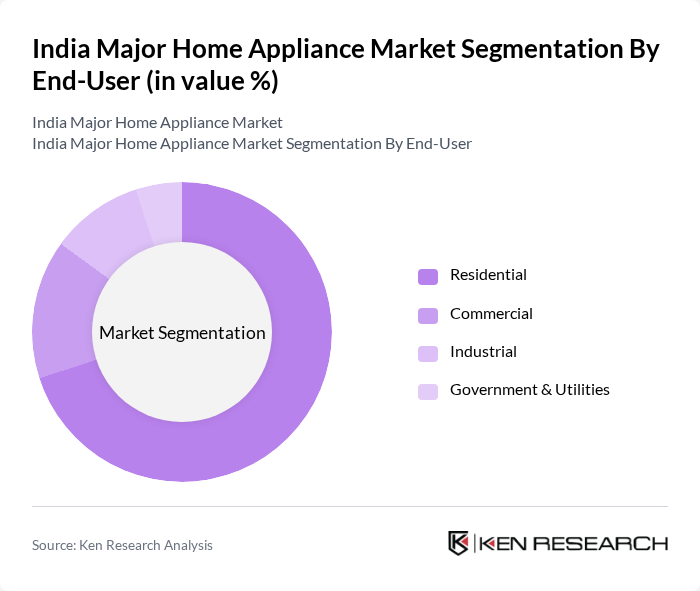

By End-User:The end-user segments include Residential, Commercial, Industrial, and Government & Utilities. The Residential segment dominates the market, driven by the increasing number of households, rising disposable incomes, and the growing trend of home automation. Consumers are investing in modern appliances that enhance convenience, improve quality of life, and enable smart home integration. The commercial segment is also expanding, supported by the hospitality and healthcare sectors' demand for specialized appliances .

The India Major Home Appliance Market is characterized by a dynamic mix of regional and international players. Leading participants such as LG Electronics India Pvt. Ltd., Samsung India Electronics Pvt. Ltd., Whirlpool of India Ltd., Godrej Appliances Ltd., Bosch Home Appliances (BSH Household Appliances Manufacturing Pvt. Ltd.), Panasonic Life Solutions India Pvt. Ltd., Haier Appliances India Pvt. Ltd., Voltas Ltd. (Tata Group), Electrolux India Pvt. Ltd., Midea India Pvt. Ltd., IFB Industries Ltd., Blue Star Ltd., Bajaj Electricals Ltd., Havells India Ltd. (including Lloyd), Crompton Greaves Consumer Electricals Ltd., Morphy Richards (Bajaj Electricals Ltd.), Sharp Business Systems (India) Pvt. Ltd., Philips India Ltd., Hawkins Cookers Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indian major home appliance market appears promising, driven by technological innovations and evolving consumer preferences. As urbanization continues, the demand for energy-efficient and smart appliances is expected to rise significantly. Additionally, the increasing penetration of e-commerce platforms will facilitate easier access to a wider range of products, enhancing consumer choice. Companies that adapt to these trends and invest in sustainable practices are likely to thrive in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerators and Freezers Washing Machines Air Conditioners Microwave Ovens Cooking Appliances (Ranges/Hobs) Dishwashers Water Purifiers Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Region | North India South India East India West India |

| By Application | Kitchen Appliances Laundry Appliances Climate Control Appliances Water Treatment Appliances |

| By Sales Channel | Offline Retail Online Retail Direct Sales |

| By Price Range | Budget Appliances Mid-Range Appliances Premium Appliances |

| By Brand Loyalty | Brand-Conscious Consumers Price-Sensitive Consumers Quality-Focused Consumers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Refrigerator Market Insights | 100 | Product Managers, Retail Buyers |

| Washing Machine Consumer Preferences | 90 | Household Decision Makers, Appliance Retailers |

| Air Conditioner Usage Trends | 80 | HVAC Technicians, Homeowners |

| Smart Appliance Adoption Rates | 60 | Tech-Savvy Consumers, Early Adopters |

| Energy Efficiency Awareness | 50 | Environmental Advocates, Utility Company Representatives |

The India Major Home Appliance Market is valued at approximately USD 77.7 billion, driven by factors such as rising disposable incomes, urbanization, and increasing demand for energy-efficient appliances.