Region:Europe

Author(s):Rebecca

Product Code:KRAB4101

Pages:86

Published On:October 2025

By Type:The mattress and bedding market can be segmented into Innerspring Mattresses, Memory Foam Mattresses, Latex Mattresses, Hybrid Mattresses, Adjustable Beds, Organic Mattresses, Airbed Mattresses, and Others. Innerspring Mattresses currently hold the largest market share, favored for their support and durability, especially in the residential segment. However, Memory Foam Mattresses are experiencing the fastest growth due to their comfort, pressure relief, and increasing consumer preference for personalized sleep solutions. The trend toward health and wellness, as well as demand for eco-friendly and ergonomic products, continues to drive innovation in this segment .

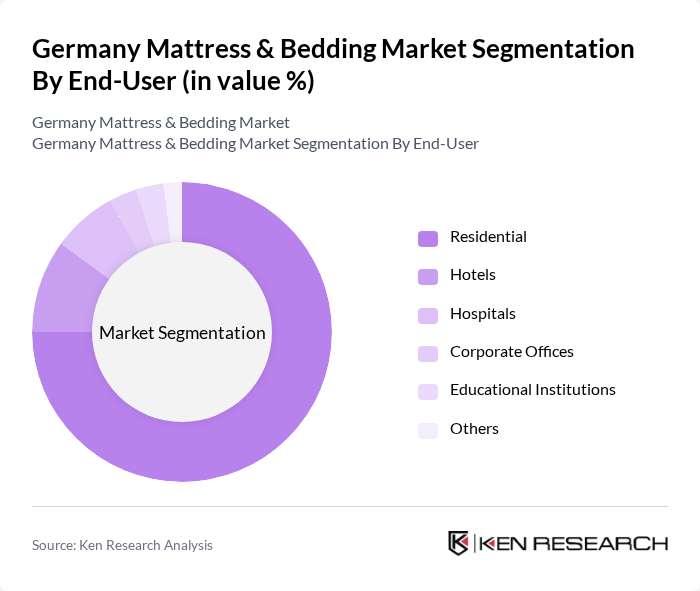

By End-User:The market can also be segmented based on end-users, including Residential, Hotels, Hospitals, Corporate Offices, Educational Institutions, and Others. The Residential segment is the largest, accounting for over three-quarters of the market, driven by the increasing focus on home comfort, home improvement, and frequent replacement cycles. Commercial demand is also growing, particularly in hotels and healthcare, as ergonomic and specialty mattresses become more prevalent in these settings .

The Germany Mattress & Bedding Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tempur Sealy International, Inc., Emma Matratze GmbH, IKEA Deutschland GmbH, Ravensberger Matratzen GmbH, Hilding Anders International AB, Breckle Matratzenwerk Weida GmbH, Müller Möbelwerkstätten GmbH, Bett1.de GmbH, Schlaraffia GmbH & Co. KG, Dunlopillo GmbH, Sembella GmbH, Matratzen Concord GmbH, FMP Matratzenmanufaktur GmbH, Billerbeck Betten-Union GmbH & Co. KG, RUF-Betten GmbH & Co. KG, Recticel Schlafkomfort GmbH, Bodyguard Matratzen GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Germany mattress and bedding market appears promising, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, demand for innovative sleep solutions, including smart mattresses, is expected to increase. Additionally, the luxury bedding segment is likely to expand, catering to affluent consumers seeking premium products. Companies that adapt to these trends and invest in sustainable practices will likely gain a competitive edge in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Innerspring Mattresses Memory Foam Mattresses Latex Mattresses Hybrid Mattresses Adjustable Beds Organic Mattresses Airbed Mattresses Others |

| By End-User | Residential Hotels Hospitals Corporate Offices Educational Institutions Others |

| By Sales Channel | Online Retail Offline Retail Direct Sales Wholesale Distributors Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Material | Foam Fabric Metal Wood Others |

| By Brand Positioning | Luxury Brands Value Brands Eco-Friendly Brands Innovative Brands Others |

| By Distribution Mode | Direct Distribution Indirect Distribution E-commerce Platforms Retail Chains Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Mattress Sales | 100 | Store Managers, Sales Representatives |

| Bedding Product Manufacturers | 80 | Product Development Managers, Quality Assurance Leads |

| Consumer Insights on Mattress Purchases | 150 | Homeowners, Recent Mattress Buyers |

| Online Bedding Retailers | 60 | E-commerce Managers, Digital Marketing Specialists |

| Industry Experts and Analysts | 40 | Market Analysts, Industry Consultants |

The Germany Mattress & Bedding Market is valued at approximately USD 2.1 billion, reflecting a growing consumer focus on sleep health, increased disposable income, and a trend towards premium and customized mattresses.