Region:Middle East

Author(s):Shubham

Product Code:KRAB5660

Pages:99

Published On:October 2025

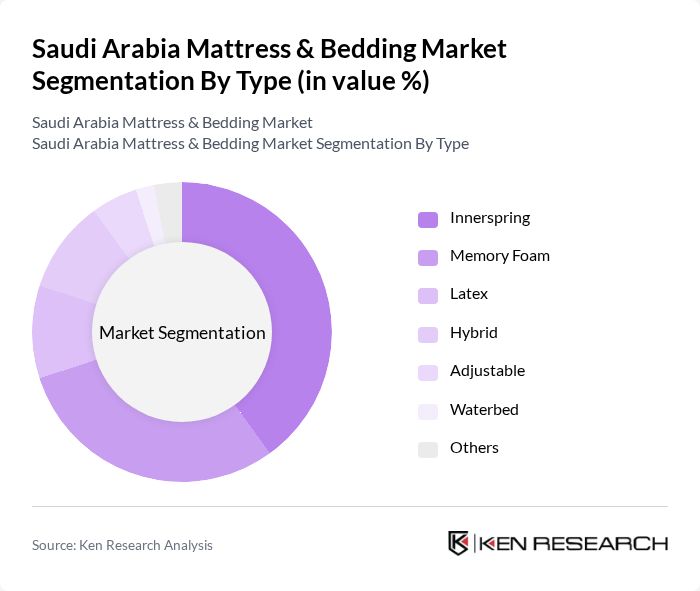

By Type:The mattress and bedding market can be segmented into various types, including Innerspring, Memory Foam, Latex, Hybrid, Adjustable, Waterbed, and Others. Among these, the Innerspring segment has traditionally dominated the market due to its widespread acceptance and affordability. However, the Memory Foam segment is gaining traction as consumers increasingly seek comfort and support, particularly for those with specific health needs. The Hybrid segment is also emerging as a popular choice, combining the benefits of both innerspring and foam technologies.

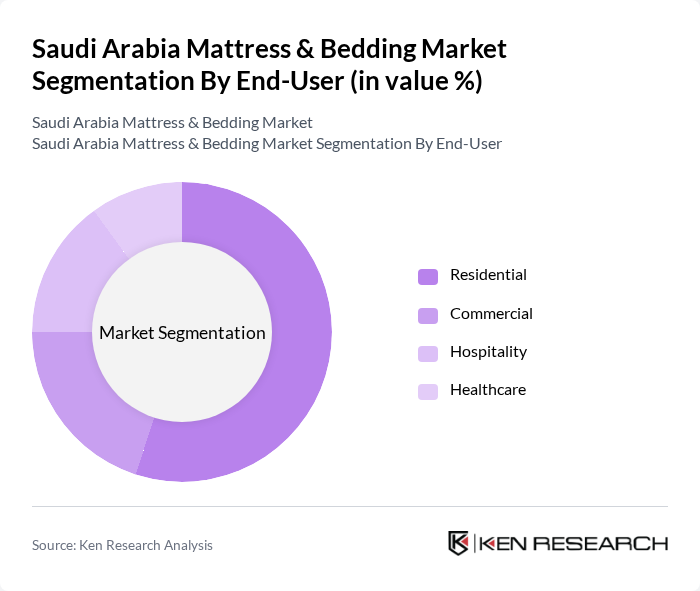

By End-User:The market can also be segmented based on end-users, including Residential, Commercial, Hospitality, and Healthcare. The Residential segment holds the largest share, driven by the increasing number of households and the growing trend of home improvement. The Hospitality segment is also significant, as hotels and resorts invest in high-quality bedding to enhance guest experiences. The Healthcare segment is witnessing growth due to the rising demand for specialized mattresses that cater to patients' needs.

The Saudi Arabia Mattress & Bedding Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Nahda International, Sleep High, IKEA Saudi Arabia, King Koil, Serta, Tempur-Pedic, Sealy, Restonic, Dreamland, Al-Muhaidib Group, Zinus, Comfort Solutions, Sleep Number, Duxiana, Rest Assured contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia mattress and bedding market is poised for significant transformation, driven by technological advancements and changing consumer preferences. The increasing integration of smart technology in mattresses, such as sleep tracking features, is expected to attract tech-savvy consumers. Additionally, the shift towards online shopping is likely to reshape distribution channels, making it easier for consumers to access a wider range of products. As sustainability becomes a priority, manufacturers will need to innovate with eco-friendly materials to meet evolving consumer demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Innerspring Memory Foam Latex Hybrid Adjustable Waterbed Others |

| By End-User | Residential Commercial Hospitality Healthcare |

| By Sales Channel | Online Retail Offline Retail Direct Sales |

| By Price Range | Budget Mid-Range Premium |

| By Material | Foam Fabric Metal |

| By Distribution Mode | Direct Distribution Indirect Distribution |

| By Brand Positioning | Luxury Mid-Range Value |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Mattress Purchases | 150 | Homeowners, Renters, Newlyweds |

| Retail Bedding Sales | 100 | Store Managers, Sales Representatives |

| Hospitality Sector Bedding Needs | 80 | Hotel Managers, Procurement Officers |

| Online Bedding Purchases | 120 | eCommerce Managers, Digital Marketing Specialists |

| Trends in Sustainable Bedding | 70 | Sustainability Advocates, Product Designers |

The Saudi Arabia Mattress & Bedding Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing consumer awareness of sleep health, rising disposable incomes, and a growing population.