Region:Europe

Author(s):Dev

Product Code:KRAB0884

Pages:88

Published On:October 2025

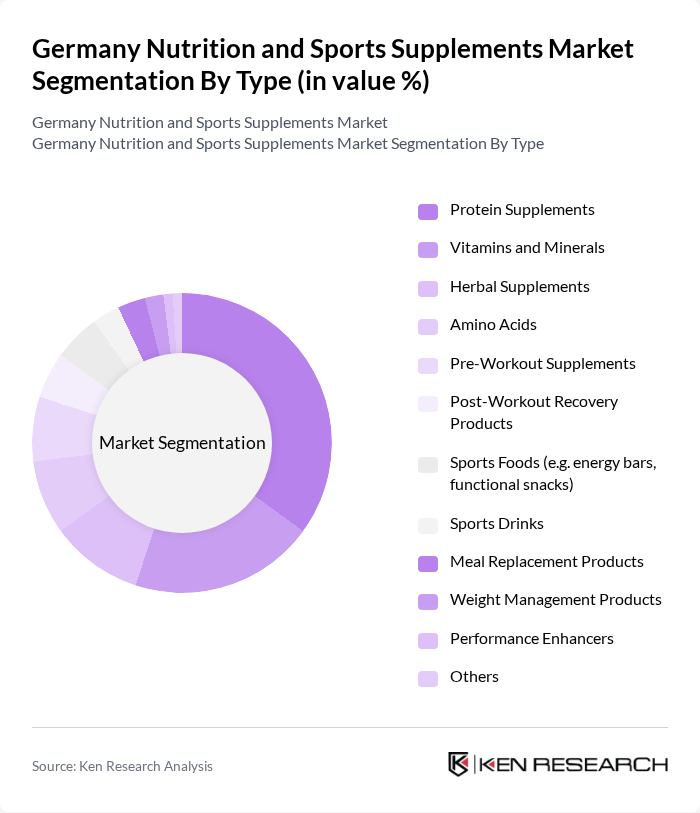

By Type:The market is segmented into various types of nutritional and sports supplements, including Protein Supplements, Vitamins and Minerals, Herbal Supplements, Amino Acids, Pre-Workout Supplements, Post-Workout Recovery Products, Sports Foods (e.g., energy bars, functional snacks), Sports Drinks, Meal Replacement Products, Weight Management Products, Performance Enhancers, and Others. Among these, Protein Supplements are the most dominant due to their widespread use among athletes and fitness enthusiasts seeking muscle gain and recovery. The vitamins segment also holds a significant share, reflecting the growing demand for immunity and wellness products .

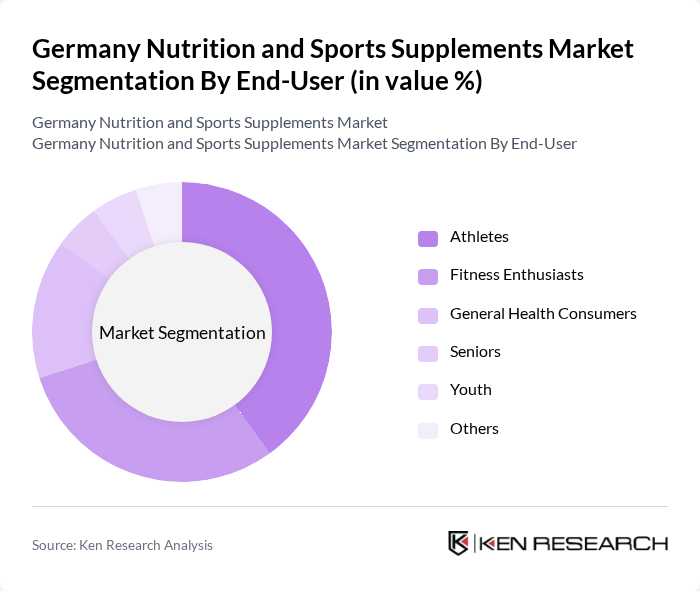

By End-User:The end-user segmentation includes Athletes, Fitness Enthusiasts, General Health Consumers, Seniors, Youth, and Others. Athletes represent the largest segment, driven by their need for performance enhancement and recovery solutions. Fitness enthusiasts also contribute significantly to the market, as they increasingly incorporate supplements into their routines to achieve specific health and fitness goals. The general health consumer segment is expanding due to greater public focus on preventive health and wellness .

The Germany Nutrition and Sports Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Queisser Pharma GmbH & Co. KG, Dr. B. Scheffler Nachfolger GmbH & Co. KG, ZeinPharma Germany GmbH, Denk Pharma GmbH & Co. KG, Pascoe Naturmedizin, Orthomol pharmazeutische Vertriebs GmbH, Nutraceuticals Group Europe, Pamex Pharmaceuticals GmbH, Ayanda GmbH, Sabinsa Europe GmbH, MyProtein (The Hut Group), Glanbia plc (Optimum Nutrition, BSN, etc.), Nestlé Health Science, Abbott Laboratories, and Quest Nutrition contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Germany nutrition and sports supplements market appears promising, driven by evolving consumer preferences and innovative product offerings. As health consciousness continues to rise, brands are likely to focus on transparency and quality, enhancing consumer trust. Additionally, the integration of technology in personalized nutrition solutions is expected to gain traction, allowing for tailored supplement regimens. The market will also benefit from increased collaboration with fitness influencers, further promoting product awareness and driving sales in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Protein Supplements Vitamins and Minerals Herbal Supplements Amino Acids Pre-Workout Supplements Post-Workout Recovery Products Sports Foods (e.g. energy bars, functional snacks) Sports Drinks Meal Replacement Products Weight Management Products Performance Enhancers Others |

| By End-User | Athletes Fitness Enthusiasts General Health Consumers Seniors Youth Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Sports Stores Pharmacies Direct Sales Channels Fitness Centers Convenience Stores Others |

| By Price Range | Low Price Mid Price Premium Price |

| By Formulation | Powder Capsules/Tablets Liquid Bars Others |

| By Target Demographic | Youth Adults Elderly |

| By Health Benefit | Weight Management Muscle Gain Immunity Boosting Energy Enhancement Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sports Supplement Outlets | 100 | Store Managers, Sales Representatives |

| Online Supplement Retailers | 80 | E-commerce Managers, Digital Marketing Specialists |

| Fitness Centers and Gyms | 60 | Gym Owners, Personal Trainers |

| Health and Wellness Influencers | 40 | Social Media Influencers, Nutrition Bloggers |

| Consumer Focus Groups | 50 | Athletes, Fitness Enthusiasts |

The Germany Nutrition and Sports Supplements Market is valued at approximately USD 5.3 billion, reflecting a significant growth trend driven by increasing health consciousness and fitness activities among the population.