Region:Africa

Author(s):Rebecca

Product Code:KRAB1755

Pages:91

Published On:October 2025

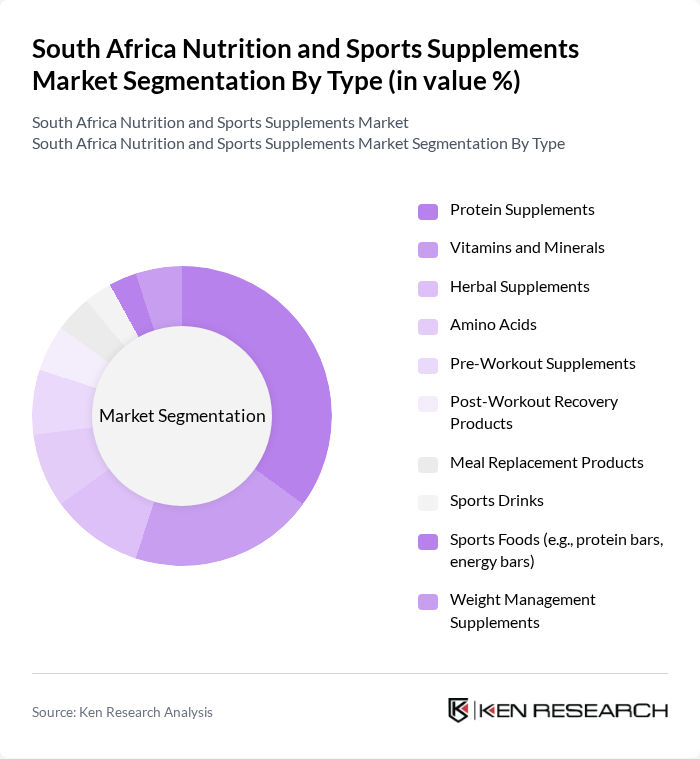

By Type:The market is segmented into various types of products, including protein supplements, vitamins and minerals, herbal supplements, amino acids, pre-workout supplements, post-workout recovery products, meal replacement products, sports drinks, sports foods, and weight management supplements. Among these, protein supplements are the most dominant due to their widespread use among athletes and fitness enthusiasts seeking to enhance muscle recovery and growth. The increasing trend of fitness and bodybuilding has led to a surge in demand for these products, making them a staple in the nutrition market .

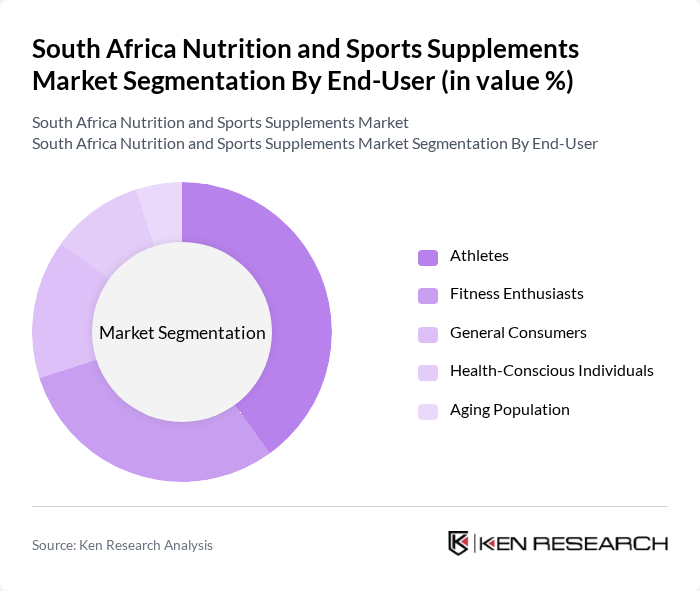

By End-User:The end-user segmentation includes athletes, fitness enthusiasts, general consumers, health-conscious individuals, and the aging population. Athletes and fitness enthusiasts represent the largest segment, driven by their need for performance enhancement and recovery. The growing awareness of health and wellness among the general population has also led to increased consumption of sports supplements, particularly among health-conscious individuals looking to maintain a balanced diet and active lifestyle .

The South Africa Nutrition and Sports Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., USN (Ultimate Sports Nutrition), Vital Health Foods, Evox Advanced Nutrition, Optimum Nutrition, Biogen, NPL (Nutritional Performance Labs), Nutritech, Futurelife, MusclePharm Corporation, BSN (Bio-Engineered Supplements and Nutrition), EHP Labs, Quest Nutrition, Nature's Best, Nutrabolt, ProSupps, MyProtein, GNC Holdings, Inc., Isagenix International, Cellucor contribute to innovation, geographic expansion, and service delivery in this space.

The South African nutrition and sports supplements market is poised for significant evolution, driven by consumer trends towards personalized nutrition and sustainable sourcing. As health awareness continues to rise, companies are likely to innovate with tailored products that meet individual dietary needs. Additionally, the focus on environmentally friendly practices will shape product development, appealing to a growing segment of eco-conscious consumers. These trends will create a dynamic market landscape, fostering opportunities for growth and expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Protein Supplements Vitamins and Minerals Herbal Supplements Amino Acids Pre-Workout Supplements Post-Workout Recovery Products Meal Replacement Products Sports Drinks Sports Foods (e.g., protein bars, energy bars) Weight Management Supplements |

| By End-User | Athletes Fitness Enthusiasts General Consumers Health-Conscious Individuals Aging Population |

| By Distribution Channel | Online Retail Supermarkets and Hypermarkets Specialty Stores Pharmacies Fitness Centers & Gyms |

| By Price Range | Premium Mid-Range Budget |

| By Packaging Type | Bottles Sachets Tubs Pouches |

| By Brand Loyalty | Brand Loyal Consumers Brand Switchers |

| By Product Form | Powders Capsules Bars Liquids Tablets |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Consumer Awareness | 100 | Health-conscious individuals, Fitness enthusiasts |

| Retail Market Insights | 60 | Store Managers, Sales Representatives |

| Professional Athlete Feedback | 40 | Professional athletes, Coaches |

| Nutritionist Perspectives | 40 | Registered Dietitians, Sports Nutritionists |

| Fitness Industry Trends | 50 | Gym Owners, Personal Trainers |

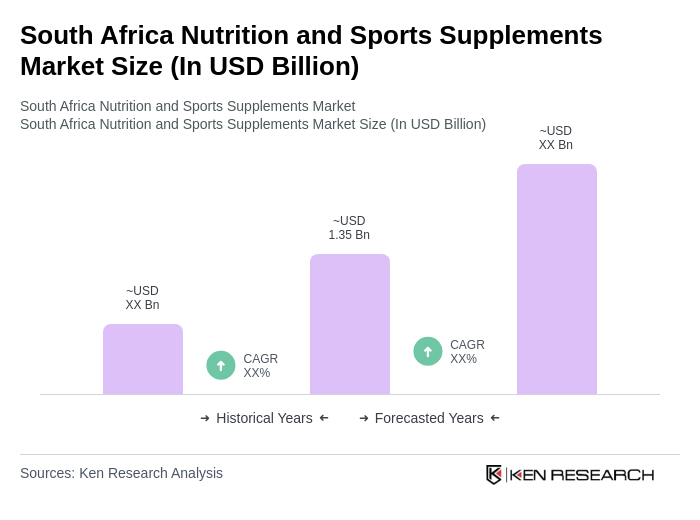

The South Africa Nutrition and Sports Supplements Market is valued at approximately USD 1.35 billion, with dietary supplements accounting for over USD 1.06 billion and sports nutrition contributing around USD 292 million, reflecting significant growth driven by health consciousness and fitness trends.