Region:Europe

Author(s):Rebecca

Product Code:KRAB1736

Pages:96

Published On:October 2025

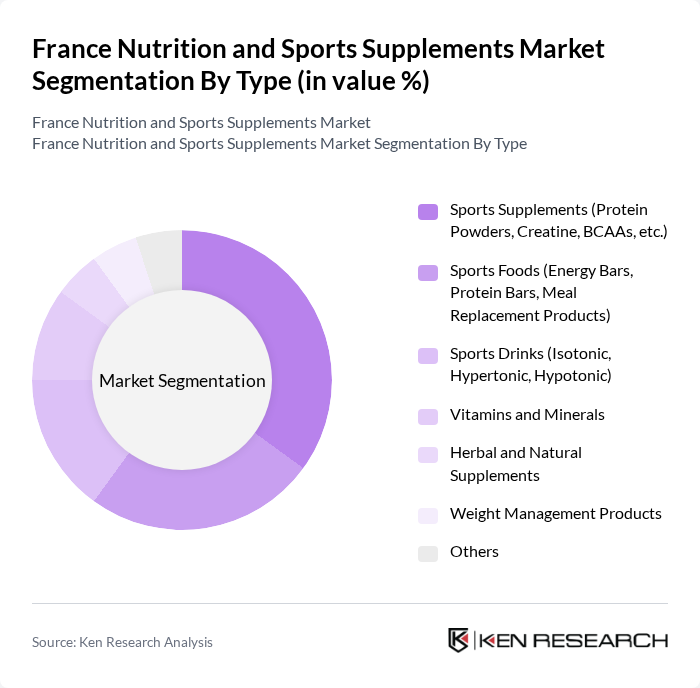

By Type:The market is segmented into various types, including sports supplements, sports foods, sports drinks, vitamins and minerals, herbal and natural supplements, weight management products, and others. Among these, sports supplements—particularly protein powders and BCAAs—dominate the market due to their widespread use among athletes and fitness enthusiasts. The increasing trend of personalized nutrition and demand for clean-label, plant-based products is also driving growth in this segment .

By End-User:The end-user segmentation includes athletes, fitness enthusiasts, general consumers, bodybuilders, and seniors. Athletes and fitness enthusiasts are the primary consumers of sports supplements, driven by their need for performance enhancement and recovery. The growing trend of fitness among the general population and increased awareness of healthy aging among seniors are also contributing to the increasing demand for these products .

The France Nutrition and Sports Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Danone S.A., Nestlé S.A., Glanbia Performance Nutrition (Optimum Nutrition, BSN), Myprotein (The Hut Group), Herbalife Nutrition Ltd., PepsiCo Inc. (including brands like Gatorade), USN (Ultimate Sports Nutrition), Science in Sport plc, Nutrabolt (Cellucor, XTEND), Abbott Laboratories, Isostar (Nutrition & Santé), Atlantic Multipower Germany GmbH & Co. OHG (Multipower), Foodspring (Goodlife Company GmbH), Prozis, Decathlon S.A. (Own sports nutrition brands) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the France nutrition and sports supplements market appears promising, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, brands are expected to innovate with clean label products and personalized nutrition solutions. Additionally, the integration of digital platforms for marketing and sales will likely enhance consumer engagement, fostering a more informed customer base. This dynamic environment presents opportunities for growth and expansion, particularly in niche segments catering to specific dietary needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Sports Supplements (Protein Powders, Creatine, BCAAs, etc.) Sports Foods (Energy Bars, Protein Bars, Meal Replacement Products) Sports Drinks (Isotonic, Hypertonic, Hypotonic) Vitamins and Minerals Herbal and Natural Supplements Weight Management Products Others |

| By End-User | Athletes Fitness Enthusiasts General Consumers Bodybuilders Seniors |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Pharmacies Fitness Centers/Gyms |

| By Price Range | Budget Mid-Range Premium |

| By Formulation | Powders Capsules/Tablets Liquids Bars |

| By Packaging Type | Single-Serve Packs Bulk Packaging Retail Packs |

| By Brand Loyalty | Established Brands New Entrants Private Labels |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Sports Supplements | 120 | Active Individuals, Fitness Enthusiasts |

| Retail Insights on Supplement Sales | 80 | Store Managers, Sales Representatives |

| Health Professional Perspectives | 60 | Nutritionists, Dietitians, Personal Trainers |

| Market Trends in E-commerce for Supplements | 100 | E-commerce Managers, Digital Marketing Specialists |

| Regulatory Impact on Supplement Formulations | 50 | Regulatory Affairs Specialists, Compliance Officers |

The France Nutrition and Sports Supplements Market is valued at approximately USD 2.5 billion, reflecting a consistent growth trend driven by increasing health consciousness and the rising popularity of sports nutrition products among consumers.