Region:Europe

Author(s):Shubham

Product Code:KRAA0992

Pages:87

Published On:August 2025

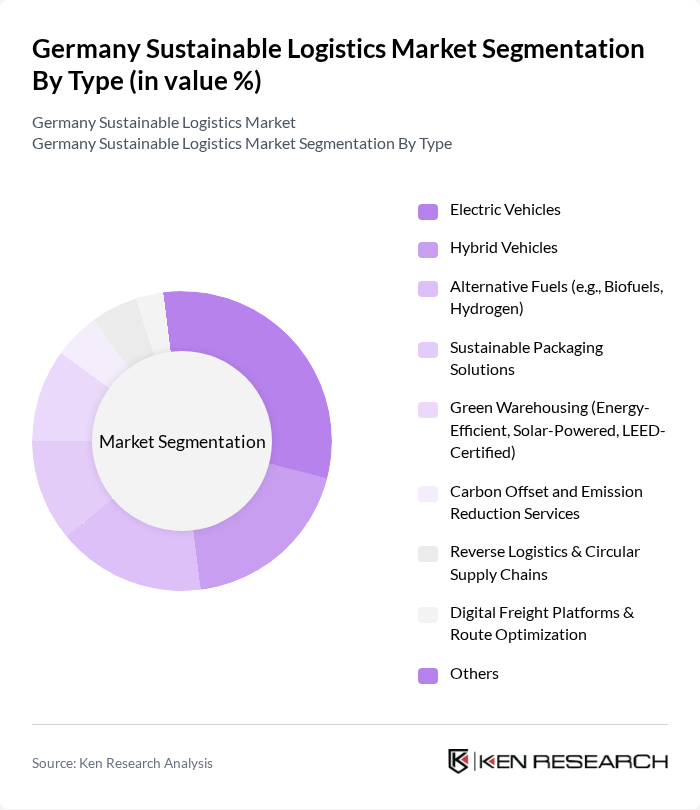

By Type:The market is segmented into Electric Vehicles, Hybrid Vehicles, Alternative Fuels, Sustainable Packaging Solutions, Green Warehousing, Carbon Offset Services, Reverse Logistics, Digital Freight Platforms, and Others. Electric Vehicles lead the market, driven by government incentives, regulatory support, and growing consumer preference for low-emission transport. Hybrid Vehicles maintain a significant share as a transitional technology, while Sustainable Packaging Solutions are increasingly adopted to reduce waste and enhance environmental performance. Green Warehousing, including energy-efficient and solar-powered facilities, is also a key area of investment as companies seek to decarbonize their supply chains .

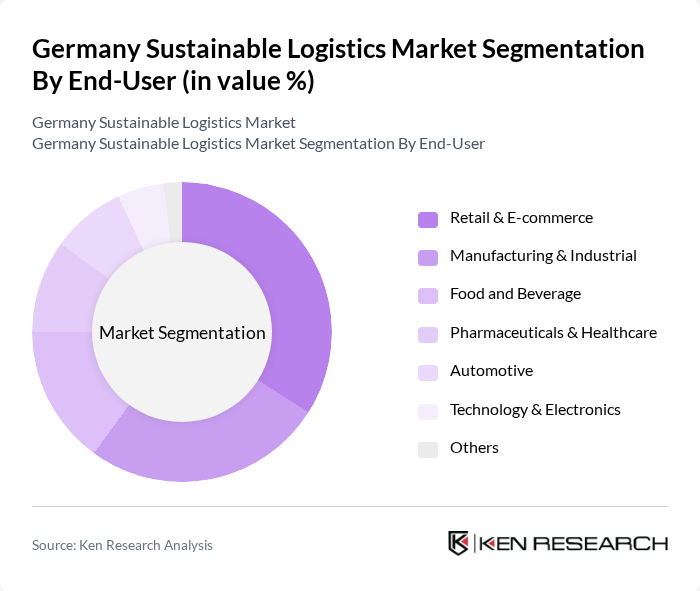

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing & Industrial, Food and Beverage, Pharmaceuticals & Healthcare, Automotive, Technology & Electronics, and Others. Retail & E-commerce remains the dominant segment, fueled by the continued expansion of online shopping and demand for sustainable last-mile delivery. Manufacturing & Industrial users are prioritizing supply chain optimization and emission reduction. Food and Beverage companies are increasingly adopting sustainable logistics to align with consumer expectations and regulatory requirements for environmental stewardship .

The Germany Sustainable Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DB Schenker, DHL Supply Chain, Kuehne + Nagel, DPDHL Group, Rhenus Logistics, Hellmann Worldwide Logistics, DSV, Geodis, DB Cargo, UPS, FedEx, Hermes Germany, Transporeon, Fiege Logistics, and Dachser contribute to innovation, geographic expansion, and service delivery in this space.

The future of the sustainable logistics market in Germany appears promising, driven by increasing consumer demand for eco-friendly solutions and supportive government policies. As companies invest in innovative technologies and sustainable practices, the logistics sector is expected to evolve significantly. The focus on carbon neutrality and compliance with stringent regulations will further accelerate the transition towards greener logistics. Additionally, the rise of e-commerce and last-mile delivery services will create new opportunities for sustainable logistics solutions, enhancing market dynamics.

| Segment | Sub-Segments |

|---|---|

| By Type | Electric Vehicles Hybrid Vehicles Alternative Fuels (e.g., Biofuels, Hydrogen) Sustainable Packaging Solutions Green Warehousing (Energy-Efficient, Solar-Powered, LEED-Certified) Carbon Offset and Emission Reduction Services Reverse Logistics & Circular Supply Chains Digital Freight Platforms & Route Optimization Others |

| By End-User | Retail & E-commerce Manufacturing & Industrial Food and Beverage Pharmaceuticals & Healthcare Automotive Technology & Electronics Others |

| By Distribution Mode | Road Transport (EV/Hybrid Fleets) Rail Transport (Electrified Rail, Green Corridors) Air Transport (Sustainable Aviation Fuel, Carbon-Neutral Operations) Sea Transport (LNG/Biofuel Vessels, Green Ports) Intermodal & Multimodal Transport Urban/Last-Mile Delivery Others |

| By Application | Freight Transportation Warehousing and Storage Last-Mile Delivery Reverse Logistics & Returns Management Supply Chain Management & Optimization Value Added Services (e.g., Packaging, Kitting, Assembly) Others |

| By Investment Source | Private Investments Public Funding Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) EU Green Deal & Climate Funds Others |

| By Policy Support | Subsidies for Electric & Alternative Fuel Vehicles Tax Incentives for Green Logistics Grants for Sustainable Infrastructure Regulatory Support for Emission Reductions Mandates for Carbon Reporting & Transparency Others |

| By Technology | IoT and Telematics in Logistics Blockchain for Supply Chain Transparency Automation and Robotics Data Analytics & AI for Route Optimization Renewable Energy Integration (Solar, Wind in Warehousing) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Sustainable Logistics | 60 | Logistics Managers, Sustainability Coordinators |

| Manufacturing Green Supply Chains | 50 | Operations Directors, Environmental Compliance Officers |

| Automotive Industry Recycling Programs | 40 | Procurement Managers, Supply Chain Analysts |

| Food and Beverage Sustainable Distribution | 45 | Logistics Executives, Quality Assurance Managers |

| E-commerce Sustainable Returns Management | 50 | eCommerce Operations Managers, Customer Experience Leaders |

The Germany Sustainable Logistics Market is valued at approximately USD 120 billion, reflecting the segment of green logistics within the broader logistics sector. This valuation is based on a five-year historical analysis and indicates robust growth driven by environmental regulations and consumer demand for sustainability.