Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA2051

Pages:98

Published On:August 2025

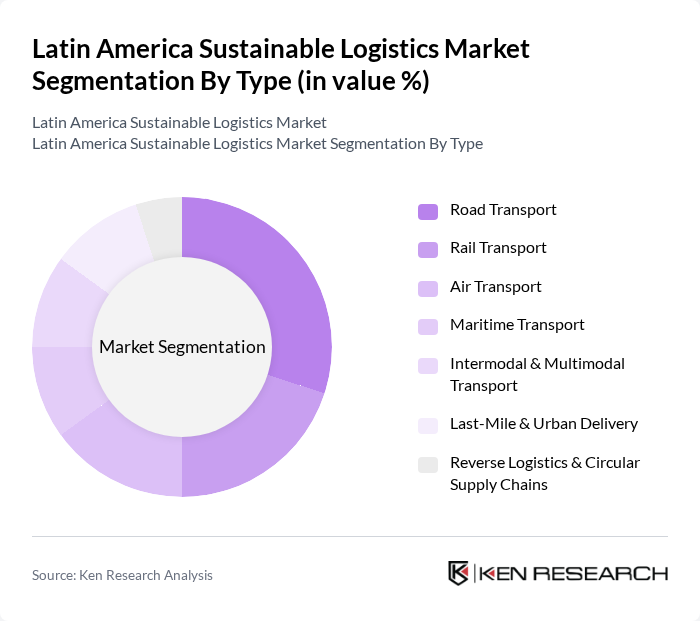

By Type:The market is segmented into various transportation methods, including road, rail, air, maritime, intermodal, last-mile delivery, and reverse logistics. Road transport remains the dominant mode due to its flexibility and extensive network coverage, while multimodal and intermodal solutions are gaining momentum as companies seek to optimize costs and reduce environmental impact. Last-mile and urban delivery are rapidly expanding, driven by e-commerce growth and the need for efficient urban logistics. Reverse logistics and circular supply chains are increasingly prioritized as companies focus on sustainability and resource efficiency .

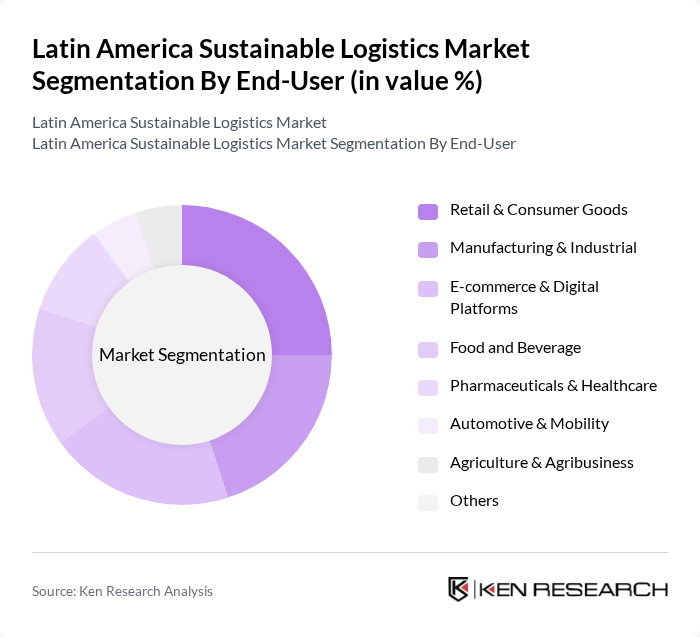

By End-User:The end-user segmentation includes industries such as retail, manufacturing, e-commerce, food and beverage, pharmaceuticals, automotive, agriculture, and others. Retail and e-commerce are major demand drivers, particularly in urban areas, while manufacturing and food sectors require robust cold chain and cross-border logistics. Pharmaceuticals and healthcare increasingly demand temperature-controlled and traceable logistics solutions. Automotive and agriculture sectors are adopting green logistics to enhance supply chain sustainability and meet regulatory requirements .

The Latin America Sustainable Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, FedEx Logistics, UPS Supply Chain Solutions, Maersk Logistics, CEVA Logistics, DSV, Loggi Tecnologia Ltda., Grupo TPC, Rappi, B2W Digital (Americanas S.A.), Mercado Libre (Mercado Envios), Gefco Logistics, CargoX contribute to innovation, geographic expansion, and service delivery in this space.

The future of the sustainable logistics market in Latin America appears promising, driven by increasing regulatory support and consumer demand for eco-friendly solutions. By future, advancements in technology, such as AI and big data analytics, are expected to enhance operational efficiency and reduce emissions. Additionally, the integration of renewable energy sources into logistics operations will likely become more prevalent, further supporting sustainability goals and fostering a competitive edge for companies that embrace these innovations.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Transport Rail Transport Air Transport Maritime Transport Intermodal & Multimodal Transport Last-Mile & Urban Delivery Reverse Logistics & Circular Supply Chains |

| By End-User | Retail & Consumer Goods Manufacturing & Industrial E-commerce & Digital Platforms Food and Beverage Pharmaceuticals & Healthcare Automotive & Mobility Agriculture & Agribusiness Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Warehousing & Fulfillment Solutions Drop Shipping & Micro-Fulfillment Others |

| By Service Type | Freight Transportation Warehousing and Storage Inventory & Supply Chain Management Order Fulfillment & Last-Mile Delivery Value-Added Services (Packaging, Labeling, etc.) Others |

| By Investment Source | Private Investments Government Funding Public-Private Partnerships Foreign Direct Investment Multilateral Development Banks Others |

| By Policy Support | Tax Incentives Subsidies for Green Initiatives Grants for Sustainable Projects Regulatory Compliance Support Carbon Credits & Emission Trading Others |

| By Customer Segment | Large Enterprises Small and Medium Enterprises (SMEs) Government Agencies Non-Governmental Organizations (NGOs) Startups & Digital Natives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Sustainable Logistics | 60 | Logistics Managers, Sustainability Coordinators |

| Manufacturing Supply Chain Optimization | 50 | Operations Directors, Supply Chain Analysts |

| E-commerce Green Delivery Solutions | 40 | eCommerce Operations Managers, Fulfillment Directors |

| Transportation Emission Reduction Strategies | 40 | Fleet Managers, Environmental Compliance Officers |

| Waste Management in Logistics | 40 | Recycling Program Managers, Logistics Consultants |

The Latin America Sustainable Logistics Market is valued at approximately USD 106 billion, driven by factors such as increasing environmental awareness, government sustainability initiatives, and the growth of e-commerce, alongside advancements in digital logistics technologies.