Region:Europe

Author(s):Shubham

Product Code:KRAA0881

Pages:86

Published On:August 2025

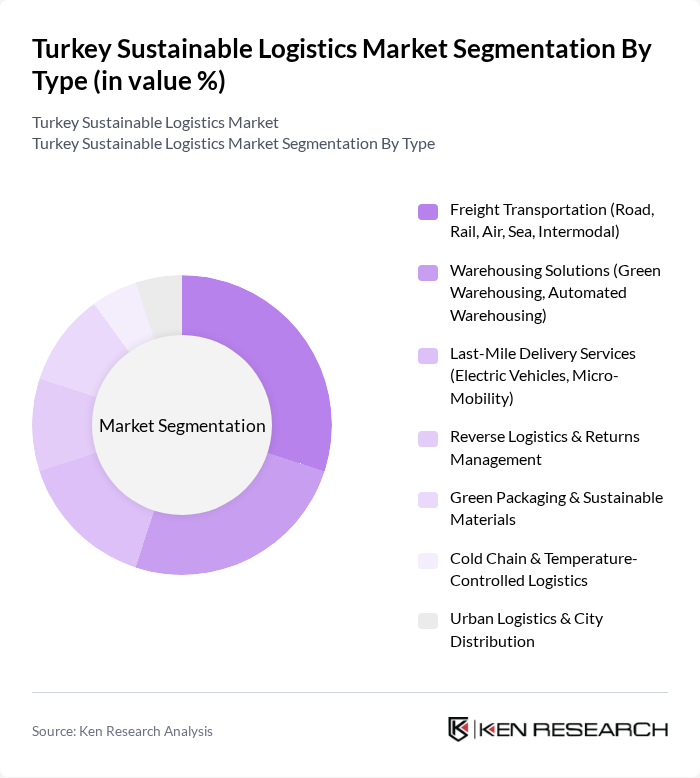

By Type:The market is segmented into Freight Transportation (road, rail, air, sea, intermodal), Warehousing Solutions (green warehousing, automated warehousing), Last-Mile Delivery Services (electric vehicles, micro-mobility), Reverse Logistics & Returns Management, Green Packaging & Sustainable Materials, Cold Chain & Temperature-Controlled Logistics, and Urban Logistics & City Distribution. Each of these segments plays a crucial role in enhancing the sustainability and efficiency of logistics operations, with a growing emphasis on digitalization, automation, and low-emission transport solutions .

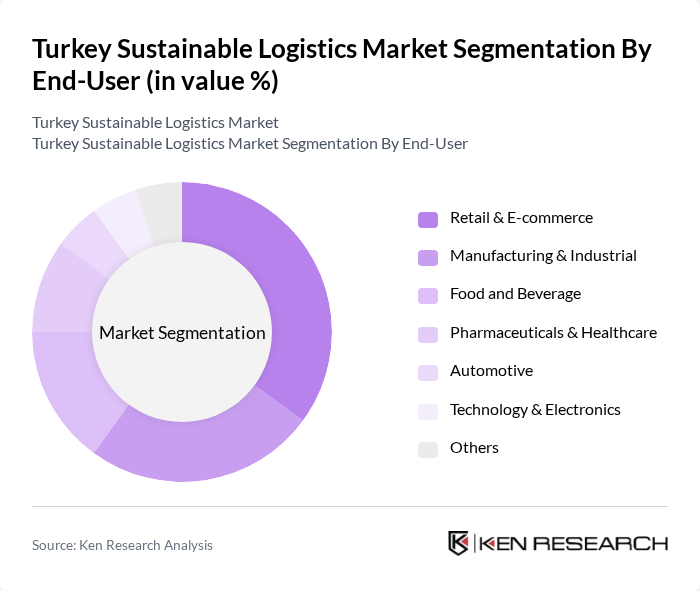

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing & Industrial, Food and Beverage, Pharmaceuticals & Healthcare, Automotive, Technology & Electronics, and Others. Each sector has unique logistics needs that drive the demand for sustainable solutions, with the retail and e-commerce sector leading due to the surge in online shopping and the need for efficient, low-emission last-mile delivery .

The Turkey Sustainable Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aras Kargo, MNG Kargo, Yurtiçi Kargo, PTT Kargo, DHL Express Turkey, UPS Turkey, Kuehne + Nagel Turkey, DB Schenker Arkas, CEVA Logistics Turkey, DFDS Turkey, Hepsijet, Getir, Trendyol Express, Ekol Logistics, and Borusan Lojistik contribute to innovation, geographic expansion, and service delivery in this space.

The future of the sustainable logistics market in Turkey appears promising, driven by increasing regulatory support and consumer demand for eco-friendly solutions. As the government intensifies its focus on emission reduction and green technology incentives, logistics companies are likely to invest more in sustainable practices. Additionally, advancements in technology, such as AI and IoT, will enhance operational efficiency and reduce costs, making sustainable logistics more attractive. Overall, the market is poised for significant growth as stakeholders adapt to evolving environmental standards and consumer expectations.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Transportation (Road, Rail, Air, Sea, Intermodal) Warehousing Solutions (Green Warehousing, Automated Warehousing) Last-Mile Delivery Services (Electric Vehicles, Micro-Mobility) Reverse Logistics & Returns Management Green Packaging & Sustainable Materials Cold Chain & Temperature-Controlled Logistics Urban Logistics & City Distribution |

| By End-User | Retail & E-commerce Manufacturing & Industrial Food and Beverage Pharmaceuticals & Healthcare Automotive Technology & Electronics Others |

| By Distribution Mode | Road Transport Rail Transport Air Transport Sea Transport Intermodal & Multimodal Transport Urban/Last-Mile Distribution |

| By Service Type | Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Freight Forwarding Supply Chain Management & Consulting Sustainable Packaging & Value-Added Services |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Grants and Subsidies International Development Funding |

| By Policy Support | Tax Incentives Subsidies for Green Technologies Regulatory Frameworks (National & EU Alignment) Emission Trading & Carbon Credits |

| By Customer Segment | Large Enterprises Small and Medium Enterprises (SMEs) Government Agencies Non-Governmental Organizations (NGOs) Startups & Tech Innovators |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Sustainable Practices | 100 | Logistics Managers, Sustainability Coordinators |

| Manufacturing Supply Chain Innovations | 80 | Operations Directors, Supply Chain Analysts |

| E-commerce Logistics Solutions | 90 | eCommerce Operations Managers, Fulfillment Specialists |

| Transportation Emission Reduction Strategies | 70 | Fleet Managers, Environmental Compliance Officers |

| Warehouse Efficiency and Sustainability | 50 | Warehouse Managers, Process Improvement Leads |

The Turkey Sustainable Logistics Market is valued at approximately USD 45 billion, reflecting a significant growth driven by environmental awareness, government investments in green infrastructure, and the expansion of e-commerce.