Region:Europe

Author(s):Rebecca

Product Code:KRAD0229

Pages:91

Published On:August 2025

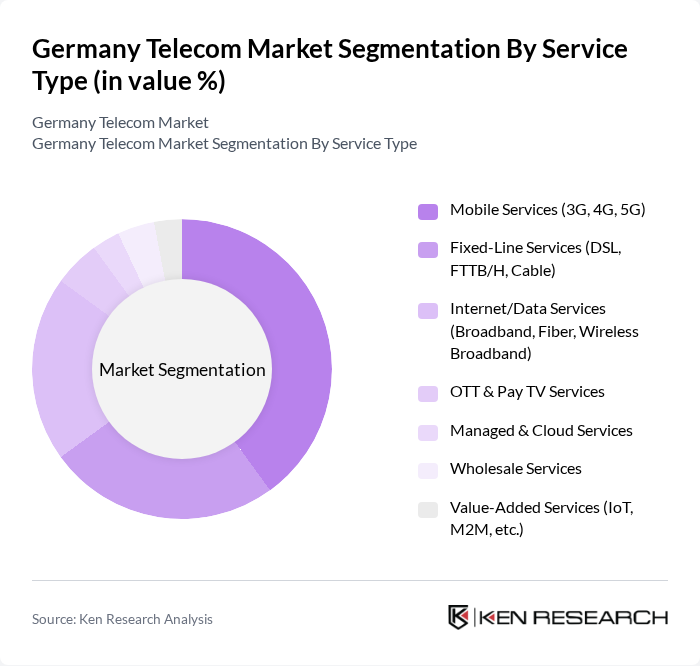

By Service Type:

The service type segmentation of the Germany Telecom Market includes Mobile Services (3G, 4G, 5G), Fixed-Line Services (DSL, FTTB/H, Cable), Internet/Data Services (Broadband, Fiber, Wireless Broadband), OTT & Pay TV Services, Managed & Cloud Services, Wholesale Services, and Value-Added Services (IoT, M2M, etc.). Mobile Services, particularly 5G, lead the market due to surging demand for high-speed mobile data and the proliferation of smart devices. The ongoing shift toward mobile-first solutions, remote work, and digitalization further accelerates mobile service adoption. Fixed-line and broadband services remain vital for enterprise and residential connectivity, while OTT and Pay TV services continue to grow with rising consumer appetite for streaming and on-demand content .

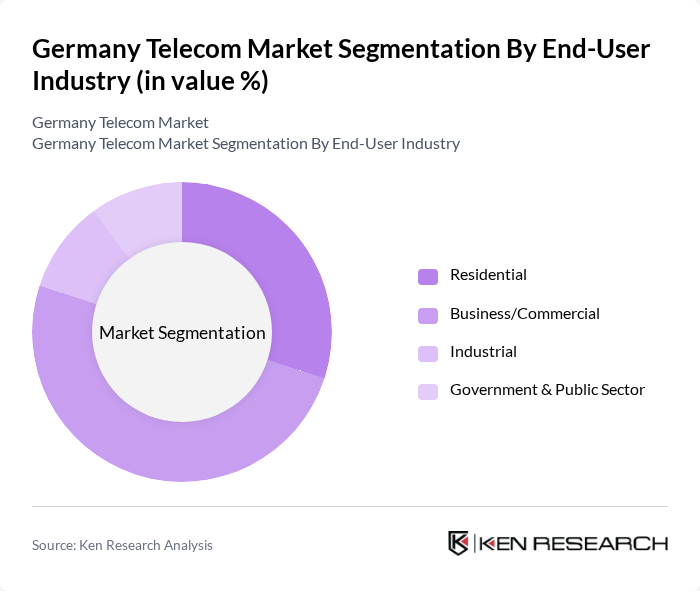

By End-User Industry:

The end-user industry segmentation includes Residential, Business/Commercial, Industrial, and Government & Public Sector. The Business/Commercial segment is the largest, driven by enterprises’ increasing reliance on high-speed connectivity, cloud services, and digital transformation initiatives. The rise in remote working and digital business models has led to significant investment in telecommunications by businesses, making this segment the primary driver of market growth. Residential demand remains strong, supported by the expansion of fiber and mobile networks, while industrial and public sector users continue to adopt advanced connectivity for automation and smart infrastructure .

The Germany Telecom Market is characterized by a dynamic mix of regional and international players. Leading participants such as Deutsche Telekom AG, Vodafone GmbH (Vodafone Germany), Telefónica Germany GmbH & Co. OHG (O2), 1&1 AG, United Internet AG, freenet AG, EWE TEL GmbH, M-net Telekommunikations GmbH, NetCologne Gesellschaft für Telekommunikation mbH, 1&1 Versatel GmbH, QSC AG, Deutsche Glasfaser Holding GmbH, Tele Columbus AG, Plusnet GmbH, E.ON SE contribute to innovation, geographic expansion, and service delivery in this space.

The future of the German telecom market appears promising, driven by technological advancements and increasing digitalization. The ongoing rollout of 5G networks will enhance connectivity and enable innovative applications across various sectors. Additionally, the government's commitment to improving digital infrastructure will likely foster growth in underserved areas. As companies adapt to evolving consumer preferences, a focus on customer experience and sustainable practices will become essential for maintaining competitive advantage in this dynamic market.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Mobile Services (3G, 4G, 5G) Fixed-Line Services (DSL, FTTB/H, Cable) Internet/Data Services (Broadband, Fiber, Wireless Broadband) OTT & Pay TV Services Managed & Cloud Services Wholesale Services Value-Added Services (IoT, M2M, etc.) |

| By End-User Industry | Residential Business/Commercial Industrial Government & Public Sector |

| By Application | Voice Communication Data Communication Video Communication & Streaming Messaging Services IoT/M2M Applications |

| By Sales Channel | Direct Sales Retail Outlets Online Sales Distributors/Partners |

| By Distribution Mode | Urban Distribution Rural Distribution Online Distribution |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing |

| By Customer Segment | Individual Consumers Small & Medium Enterprises (SMEs) Large Enterprises Public Institutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Service Users | 100 | Consumers aged 18-65, diverse demographic backgrounds |

| Broadband Subscribers | 80 | Household decision-makers, IT professionals |

| Enterprise Telecom Solutions | 60 | IT Managers, Procurement Officers in SMEs |

| Customer Service Feedback | 60 | Customer Service Representatives, Call Center Managers |

| Regulatory Impact Assessment | 40 | Policy Makers, Regulatory Affairs Specialists |

The Germany Telecom Market is valued at approximately USD 66 billion, reflecting revenues from mobile, fixed-line, broadband, and TV/OTT services. This market size is driven by strong consumer demand for high-speed internet and digital services.