Region:North America

Author(s):Dev

Product Code:KRAA2233

Pages:95

Published On:August 2025

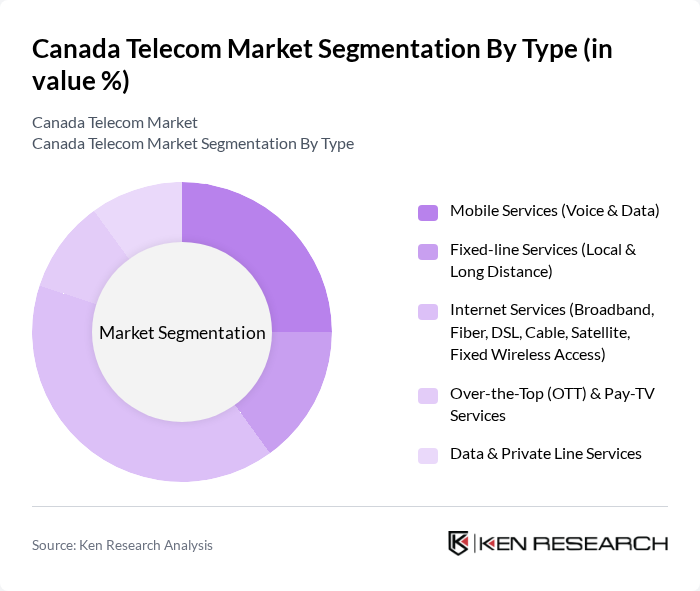

By Type:

The telecom market in Canada is segmented into various types, including Mobile Services (Voice & Data), Fixed-line Services (Local & Long Distance), Internet Services (Broadband, Fiber, DSL, Cable, Satellite, Fixed Wireless Access), Over-the-Top (OTT) & Pay-TV Services, and Data & Private Line Services. Among these, Internet Services dominate the market due to the increasing reliance on high-speed internet for both personal and professional use. The shift towards digital platforms, streaming services, and cloud-based applications has significantly boosted demand for broadband and fiber optic solutions, making them essential for modern connectivity. Mobile data services also hold a substantial share, driven by smartphone penetration and high-speed connectivity needs .

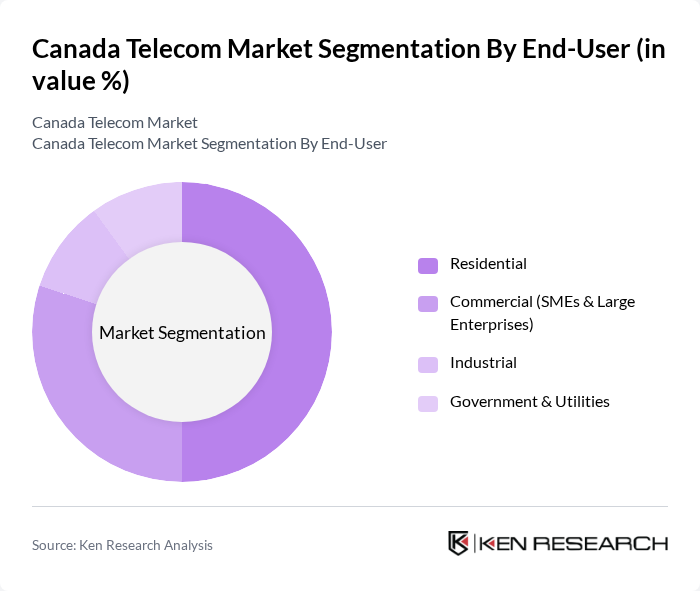

By End-User:

The end-user segmentation of the telecom market includes Residential, Commercial (SMEs & Large Enterprises), Industrial, and Government & Utilities. The Residential segment leads the market, driven by the growing number of households requiring internet and mobile services. The increasing trend of smart homes, remote work, and demand for high-speed internet for entertainment and productivity have significantly contributed to the growth of this segment, making it a focal point for telecom providers. Commercial and industrial segments are also expanding due to digital transformation initiatives and increased connectivity needs .

The Canada Telecom Market is characterized by a dynamic mix of regional and international players. Leading participants such as Rogers Communications Inc., BCE Inc. (Bell Canada), Telus Corporation, Shaw Communications Inc., Quebecor Inc. (Videotron), SaskTel (Saskatchewan Telecommunications Holding Corporation), Freedom Mobile Inc., Eastlink (Bragg Communications Inc.), Tbaytel, Xplornet Communications Inc., Videotron Ltd., Northwestel Inc., Cogeco Communications Inc., VMedia Inc., Distributel Communications Limited contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Canadian telecom market appears promising, driven by technological advancements and increasing consumer demand for connectivity. As 5G networks continue to roll out, they are expected to enhance mobile broadband capabilities, supporting new applications in various sectors. Additionally, the focus on customer experience and bundled services will likely reshape service offerings, fostering customer loyalty. Companies that adapt to these trends and invest in innovative solutions will be well-positioned to thrive in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Services (Voice & Data) Fixed-line Services (Local & Long Distance) Internet Services (Broadband, Fiber, DSL, Cable, Satellite, Fixed Wireless Access) Over-the-Top (OTT) & Pay-TV Services Data & Private Line Services |

| By End-User | Residential Commercial (SMEs & Large Enterprises) Industrial Government & Utilities |

| By Service Model | Subscription-based Pay-as-you-go Bundled Packages |

| By Distribution Channel | Direct Sales Retail Outlets Online Platforms |

| By Customer Segment | Individual Consumers Small and Medium Enterprises (SMEs) Large Enterprises |

| By Pricing Strategy | Premium Pricing Competitive Pricing Discount Pricing |

| By Technology | G LTE G Fiber Optic Satellite Fixed Wireless Access (FWA) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Service Users | 120 | Consumers aged 18-65, diverse demographics |

| Broadband Subscribers | 100 | Households with internet access, varying income levels |

| Small Business Telecom Solutions | 60 | Owners and managers of small to medium enterprises |

| Telecom Industry Experts | 40 | Analysts, consultants, and academics in telecommunications |

| Regulatory Stakeholders | 40 | Policy makers and representatives from regulatory bodies |

The Canada Telecom Market is valued at approximately USD 59 billion, driven by the increasing demand for mobile and internet services, advancements in technology like 5G, and the rise of remote work and digital services.