Region:Europe

Author(s):Shubham

Product Code:KRAC0869

Pages:81

Published On:August 2025

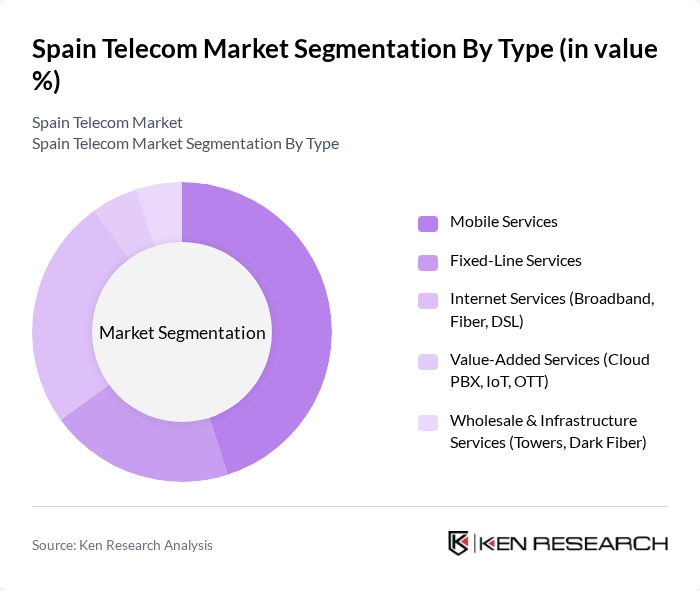

By Type:The telecom market in Spain is segmented into mobile services, fixed-line services, internet services (broadband, fiber, DSL), value-added services (cloud PBX, IoT, OTT), and wholesale & infrastructure services (towers, dark fiber). Mobile services remain the most dominant segment, driven by high smartphone penetration and surging demand for mobile data. The ongoing shift toward digital communication, proliferation of mobile applications, and enhanced 5G coverage have reinforced the leading position of mobile services in Spain’s telecom market.

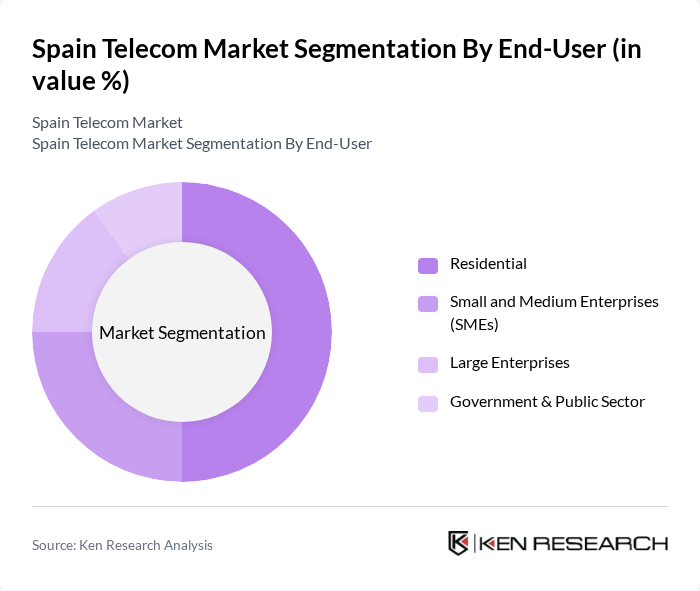

By End-User:The end-user segmentation of the telecom market in Spain includes residential, small and medium enterprises (SMEs), large enterprises, and government & public sector. The residential segment holds the largest share, supported by the increasing demand for internet and mobile services among households. Trends such as remote work, online education, and digital entertainment have further accelerated the need for reliable telecommunications in residential areas.

The Spain Telecom Market is characterized by a dynamic mix of regional and international players. Leading participants such as Telefónica S.A., Vodafone España, S.A.U., Orange Espagne S.A.U., MásOrange (joint venture: MásMóvil Ibercom S.A. & Orange Espagne S.A.U.), Digi Spain Telecom S.L.U., Cellnex Telecom S.A., Euskaltel S.A. (part of MásOrange), R Cable y Telecomunicaciones Galicia S.A. (part of MásOrange), Telecable de Asturias S.A.U. (part of MásOrange), Yoigo (brand of MásOrange), Avatel Telecom S.A., Virgin Telco (brand of Euskaltel/MásOrange), O2 España (brand of Telefónica S.A.), Finetwork (Wewi Mobile S.L.), Adamo Telecom Iberia S.A.U. contribute to innovation, geographic expansion, and service delivery in this space.

The Spain telecom market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The increasing adoption of 5G technology and the expansion of high-speed internet access will enhance connectivity and enable innovative services. Additionally, the focus on sustainability initiatives and customer experience will shape competitive strategies. As digital services continue to grow, telecom operators must adapt to meet changing demands, ensuring they remain relevant in a rapidly evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Services Fixed-Line Services Internet Services (Broadband, Fiber, DSL) Value-Added Services (Cloud PBX, IoT, OTT) Wholesale & Infrastructure Services (Towers, Dark Fiber) |

| By End-User | Residential Small and Medium Enterprises (SMEs) Large Enterprises Government & Public Sector |

| By Service Provider Type | Mobile Network Operators (MNOs) Internet Service Providers (ISPs) Virtual Network Operators (MVNOs) Infrastructure Providers (TowerCos, FiberCos) |

| By Pricing Model | Subscription-Based Pay-As-You-Go Bundled Packages |

| By Distribution Channel | Direct Sales Retail Outlets Online Platforms |

| By Customer Segment | Individual Consumers Small and Medium Enterprises Large Enterprises |

| By Geographic Region | Northern Spain Southern Spain Eastern Spain Western Spain |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Service Users | 120 | Consumers aged 18-65, diverse income levels |

| Broadband Subscribers | 90 | Households with internet access, varying service plans |

| Corporate Telecom Clients | 60 | IT Managers, Procurement Officers from SMEs and large enterprises |

| Regulatory Stakeholders | 40 | Government officials, policy advisors in telecommunications |

| Industry Experts | 40 | Consultants, analysts specializing in telecom market trends |

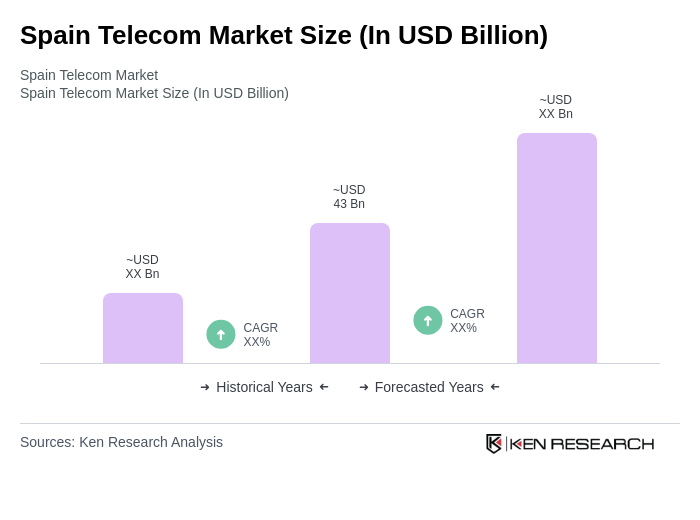

The Spain Telecom Market is valued at approximately USD 43 billion, driven by the rapid expansion of 5G infrastructure and the widespread adoption of high-speed fiber-optic broadband, which covers over 90% of Spanish households.