Region:Global

Author(s):Geetanshi

Product Code:KRAA2315

Pages:85

Published On:August 2025

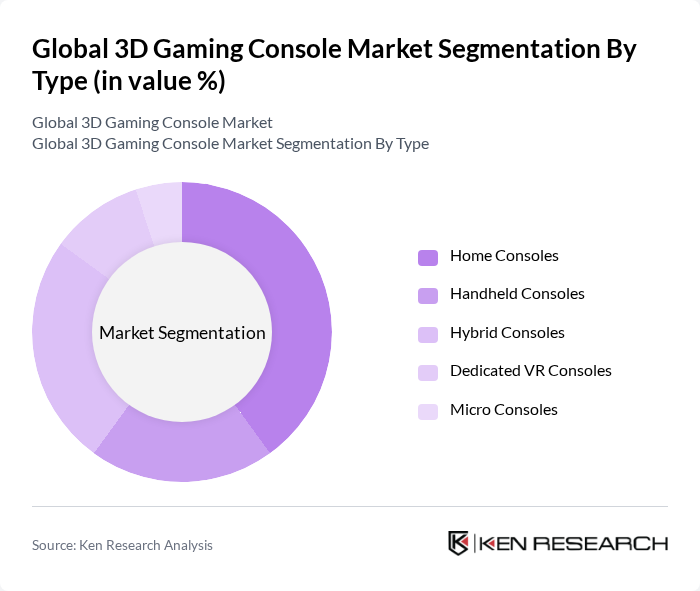

By Type:The 3D gaming console market is segmented into Home Consoles, Handheld Consoles, Hybrid Consoles, Dedicated VR Consoles, and Micro Consoles. Home Consoles are recognized for their high performance and extensive game libraries, appealing to dedicated gamers seeking advanced graphics and gameplay. Handheld Consoles attract users prioritizing portability and convenience. Hybrid Consoles, such as devices that function both as home and portable systems, cater to versatile gaming preferences. Dedicated VR Consoles offer fully immersive experiences through specialized hardware, while Micro Consoles provide cost-effective solutions for casual and entry-level gamers.

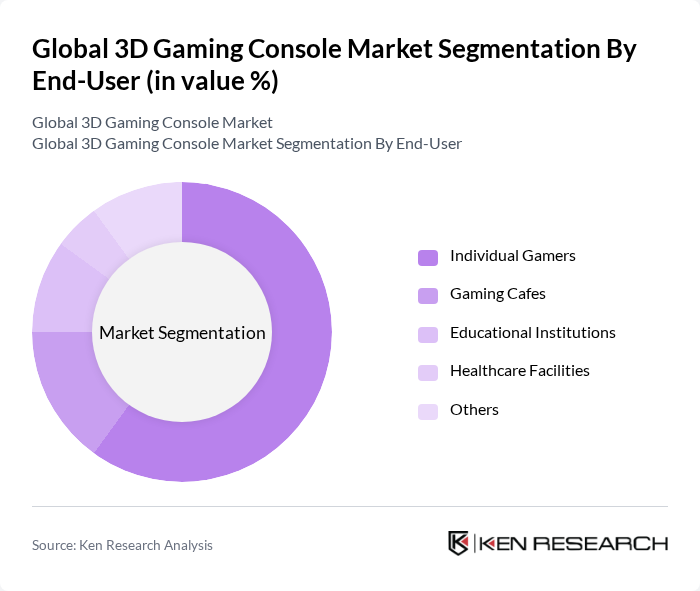

By End-User:The end-user segmentation of the 3D gaming console market includes Individual Gamers, Gaming Cafes, Educational Institutions, Healthcare Facilities, and Others. Individual Gamers represent the largest segment, driven by the expanding global gamer population and the increasing adoption of gaming as a mainstream entertainment medium. Gaming Cafes are particularly prominent in regions with high internet penetration, offering communal gaming experiences. Educational Institutions and Healthcare Facilities are emerging as new adopters, leveraging gaming for educational engagement and therapeutic interventions, respectively.

The Global 3D Gaming Console Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sony Interactive Entertainment, Microsoft Corporation, Nintendo Co., Ltd., Valve Corporation, Electronic Arts Inc., Activision Blizzard, Inc., Ubisoft Entertainment S.A., Sega Sammy Holdings Inc., Bandai Namco Entertainment Inc., Take-Two Interactive Software, Inc., Epic Games, Inc., Square Enix Holdings Co., Ltd., Capcom Co., Ltd., Riot Games, Inc., THQ Nordic AB, Tencent Holdings Ltd., Logitech International S.A., Razer Inc., Oculus (Meta Platforms, Inc.), AMD (Advanced Micro Devices, Inc.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the 3D gaming console market appears promising, driven by technological advancements and evolving consumer preferences. As the gaming landscape shifts towards more immersive experiences, the integration of virtual reality (VR) and augmented reality (AR) is expected to enhance gameplay. Additionally, the rise of subscription-based services will likely provide gamers with access to a broader range of 3D content, fostering engagement and driving console sales. The market is poised for growth as these trends continue to develop.

| Segment | Sub-Segments |

|---|---|

| By Type | Home Consoles Handheld Consoles Hybrid Consoles Dedicated VR Consoles Micro Consoles |

| By End-User | Individual Gamers Gaming Cafes Educational Institutions Healthcare Facilities Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales E-commerce Platforms Others |

| By Price Range | Budget Consoles Mid-Range Consoles Premium Consoles Others |

| By Game Genre | Action/Adventure Sports Role-Playing Games (RPG) Simulation Racing Others |

| By User Demographics | Age Group (Children, Teens, Adults) Gender (Male, Female, Non-binary) Skill Level (Casual, Competitive, Professional) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Console Ownership and Usage | 120 | Casual Gamers, Hardcore Gamers |

| Game Purchase Behavior | 90 | Game Retail Managers, Online Store Managers |

| Accessory Market Insights | 60 | Accessory Manufacturers, Retail Buyers |

| Consumer Preferences in Gaming | 100 | Gaming Community Leaders, Influencers |

| Impact of Streaming Services on Console Sales | 70 | Streaming Service Executives, Content Creators |

The Global 3D Gaming Console Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by advancements in graphics technology and increasing consumer demand for immersive gaming experiences.