Region:Middle East

Author(s):Shubham

Product Code:KRAC3678

Pages:90

Published On:January 2026

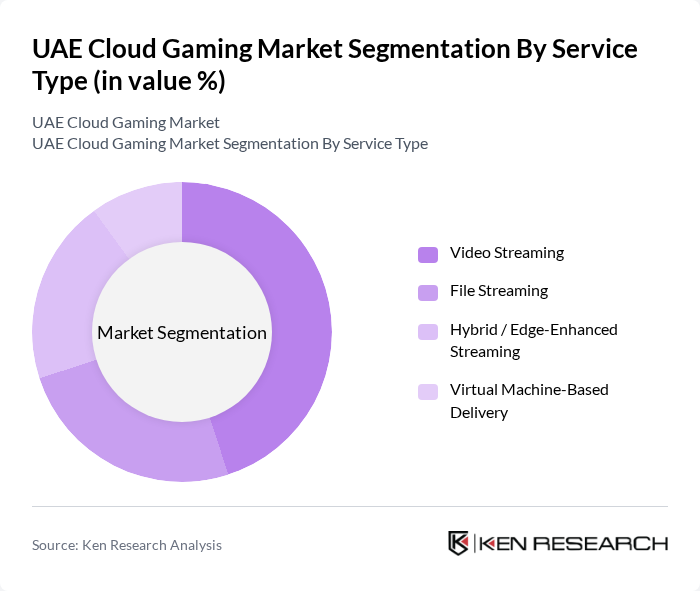

By Service Type:The service type segmentation includes various methods through which cloud gaming is delivered to users. The subsegments are Video Streaming, File Streaming, Hybrid / Edge-Enhanced Streaming, and Virtual Machine-Based Delivery. Video Streaming is currently the leading subsegment, as it allows users to play games directly from the cloud without the need for downloads, making it highly convenient for gamers, and aligns with global patterns where streaming-based access dominates cloud gaming consumption. The demand for seamless, low-latency gaming experiences, supported by edge computing and 5G deployments in the UAE, has driven the popularity of this service type.

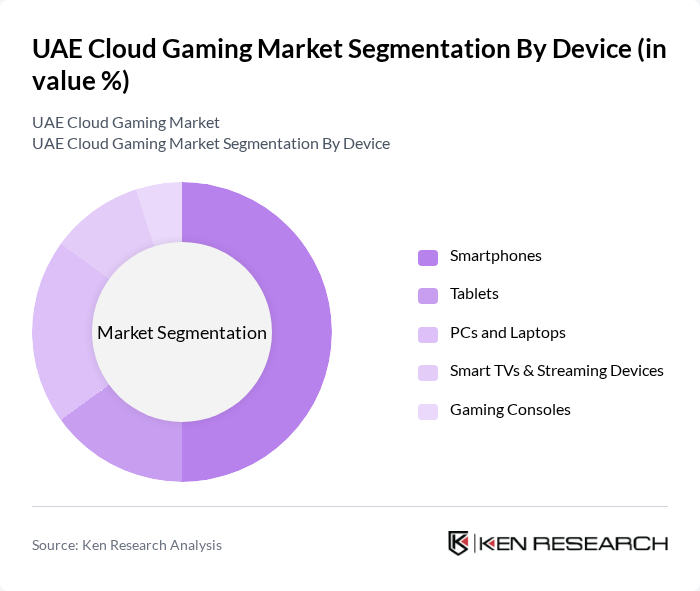

By Device:The device segmentation encompasses the various platforms through which cloud gaming is accessed. This includes Smartphones, Tablets, PCs and Laptops, Smart TVs & Streaming Devices, and Gaming Consoles. Smartphones are the dominant device for cloud gaming, driven by their widespread use, increasing processing power, and the convenience they offer for on-the-go gaming, in line with UAE gaming and subscription-based gaming market data where mobile and PC are the leading device categories. The increasing capabilities of mobile devices, affordable mobile data plans, and integration of cloud gaming with telco subscriptions have made them a preferred choice for gamers.

The UAE Cloud Gaming Market is characterized by a dynamic mix of regional and international players. Leading participants such as Microsoft Xbox Cloud Gaming (xCloud), NVIDIA GeForce NOW, Amazon Luna, Sony PlayStation Plus (Cloud Streaming), Boosteroid, Blacknut, Shadow PC, NetBoom, Paperspace / Cloud GPU Providers, Meta (Cloud Gaming Initiatives), Tencent Start / Tencent Cloud Gaming, Ubitus, PlayKey, Regional Telco Gaming Platforms (e.g., Etisalat, du), Local and Regional Gaming & Esports Platforms contribute to innovation, geographic expansion, and service delivery in this space.

The UAE cloud gaming market is poised for significant growth, driven by technological advancements and increasing consumer demand for interactive entertainment. As 5G networks expand, they will enhance connectivity and reduce latency, making cloud gaming more accessible. Additionally, partnerships with local developers are expected to enrich the game library, catering to regional preferences. The rise of esports events will further stimulate interest, creating a vibrant ecosystem that supports both casual and competitive gaming experiences in the UAE.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Video Streaming File Streaming Hybrid / Edge-Enhanced Streaming Virtual Machine-Based Delivery |

| By Device | Smartphones Tablets PCs and Laptops Smart TVs & Streaming Devices Gaming Consoles |

| By Gamer Type | Casual Gamers Avid / Hardcore Gamers Lifestyle / Social Gamers |

| By Business Model | Subscription (SVoD) Pay-Per-Play / Transactional Freemium with In-Game Monetization Bundled Telco & OTT Offers |

| By Application | Consumer Entertainment Esports & Game Streaming Educational & Serious Gaming Enterprise & Location-Based Entertainment |

| By Revenue Stream | Subscription Revenues In-Game Purchases & Microtransactions Advertising & Sponsorship Licensing & B2B Services |

| By Emirate | Abu Dhabi Dubai Sharjah Other Emirates |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Casual Gamers | 120 | Individuals aged 18-35, frequent mobile gamers |

| Hardcore Gamers | 90 | Individuals aged 18-45, console and PC gamers |

| Game Developers | 60 | Professionals working in game design and development |

| Cloud Service Providers | 40 | Executives and product managers in cloud gaming services |

| Gaming Influencers | 50 | Content creators and streamers with a focus on gaming |

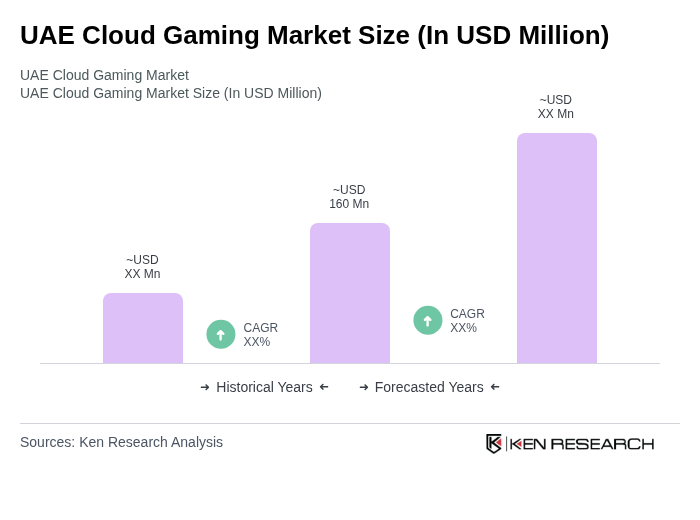

The UAE Cloud Gaming Market is valued at approximately USD 160 million, reflecting significant growth driven by high-speed internet penetration, mobile gaming popularity, and the rise of esports in the region.