Region:Global

Author(s):Shubham

Product Code:KRAD5411

Pages:94

Published On:December 2025

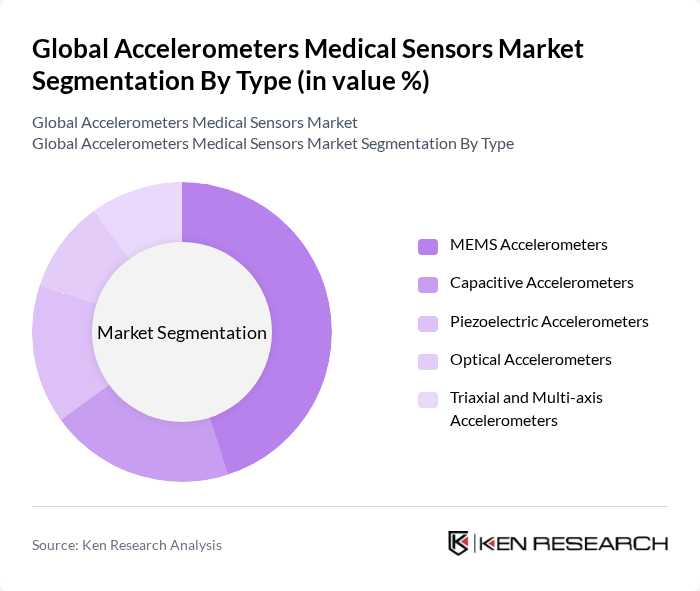

By Type:The market is segmented into various types of accelerometers, including MEMS accelerometers, capacitive accelerometers, piezoelectric accelerometers, optical accelerometers, and triaxial and multi-axis accelerometers. MEMS accelerometers are widely used in medical applications due to their compact size, low power consumption, and ability to be integrated into wearable and mobile health devices, aligning with the broader industry shift toward miniaturized, battery-efficient sensor solutions. Their suitability for continuous motion tracking, activity monitoring, and fall detection in consumer wearables and clinical-grade devices supports the strong penetration of MEMS technology in this market segment.

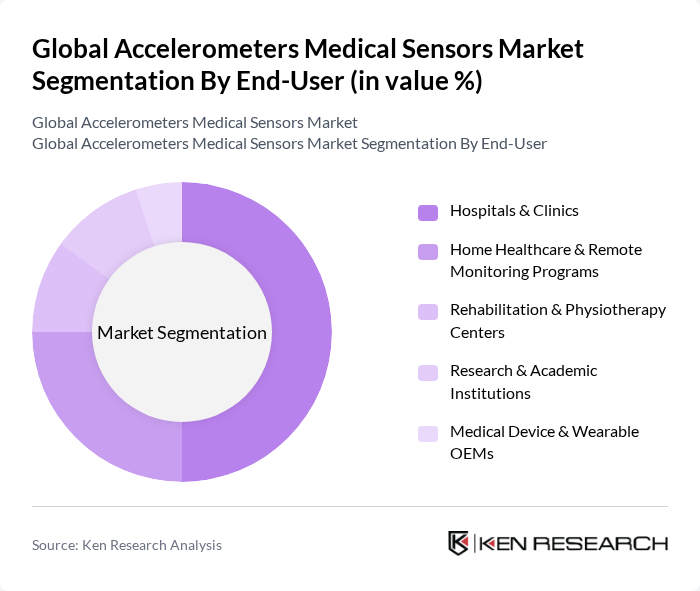

By End-User:The end-user segmentation includes hospitals and clinics, home healthcare and remote monitoring programs, rehabilitation and physiotherapy centers, research and academic institutions, and medical device and wearable OEMs. Hospitals and clinics are the leading end-users, supported by evidence that this segment accounts for the largest share of accelerometer medical sensor usage due to the need for in-hospital clinical monitoring, post-acute care monitoring, and integration of sensor-based systems into routine diagnostics and patient management workflows. The growing adoption of telemedicine, remote patient monitoring, and home healthcare programs using wearable accelerometer-based devices further drives demand from home care and ambulatory settings, complementing the dominant role of hospitals and clinics.

The Global Accelerometers Medical Sensors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Analog Devices, Inc., STMicroelectronics N.V., Robert Bosch GmbH (Bosch Sensortec), TDK Corporation (InvenSense), NXP Semiconductors N.V., Texas Instruments Incorporated, Honeywell International Inc., Microchip Technology Inc., Maxim Integrated (Analog Devices, Inc.), Murata Manufacturing Co., Ltd., Kionix, Inc. (ROHM Group), MEMSIC, Inc., Silicon Microstructures, Inc. (Elmos Semiconductor SE), ams-OSRAM AG, Omron Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the accelerometers medical sensors market appears promising, driven by technological advancements and increasing healthcare demands. The integration of AI and machine learning into sensor applications is expected to enhance data analysis capabilities, leading to improved patient outcomes. Additionally, the expansion of telemedicine and remote patient monitoring will further propel the adoption of accelerometers, as healthcare providers seek efficient ways to manage patient care outside traditional settings. This evolving landscape presents significant opportunities for innovation and growth.

| Segment | Sub-Segments |

|---|---|

| By Type | MEMS Accelerometers Capacitive Accelerometers Piezoelectric Accelerometers Optical Accelerometers Triaxial and Multi-axis Accelerometers |

| By End-User | Hospitals & Clinics Home Healthcare & Remote Monitoring Programs Rehabilitation & Physiotherapy Centers Research & Academic Institutions Medical Device & Wearable OEMs |

| By Application | Chronic Illness & Risk Monitoring (e.g., CVD, CHF, metabolic disorders) Patient Mobility, Gait & Fall Detection Implantables, Prosthetics & Orthopedic Monitoring Fitness, Wellness & Activity Tracking Surgical, Diagnostic & Therapeutic Devices |

| By Sensor Integration | Standalone Board-level Sensors Integrated Sensors in Wearables (wristbands, patches, garments) Embedded Sensors in Medical Devices & Equipment Multi-sensor Modules (accelerometer + gyroscope + others) |

| By Connectivity | Wired (Ethernet, USB, Serial) Connectivity Short-range Wireless (Bluetooth, BLE) Wi-Fi and Cloud-connected Systems Cellular / LPWAN (4G/5G, NB-IoT, LoRa) Enabled Systems Offline / Data-logger Based |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Policy Support | Government Grants for Digital Health & Medical Technology Tax Incentives for R&D in Medical Devices & Sensors Subsidies and Reimbursement for Remote Patient Monitoring Standards & Regulatory Frameworks for Connected Medical Devices |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Wearable Health Monitoring Devices | 150 | Healthcare Practitioners, Device Manufacturers |

| Rehabilitation Accelerometers | 120 | Physical Therapists, Rehabilitation Specialists |

| Clinical Research Applications | 90 | Clinical Researchers, Medical Device Regulators |

| Home Healthcare Solutions | 60 | Home Care Providers, Patient Advocates |

| Telemedicine Integration | 80 | Telehealth Coordinators, IT Specialists in Healthcare |

The Global Accelerometers Medical Sensors Market is valued at approximately USD 4.1 billion, driven by the increasing demand for advanced healthcare monitoring solutions and the rise in chronic diseases and geriatric populations.