Region:Global

Author(s):Dev

Product Code:KRAC3402

Pages:86

Published On:October 2025

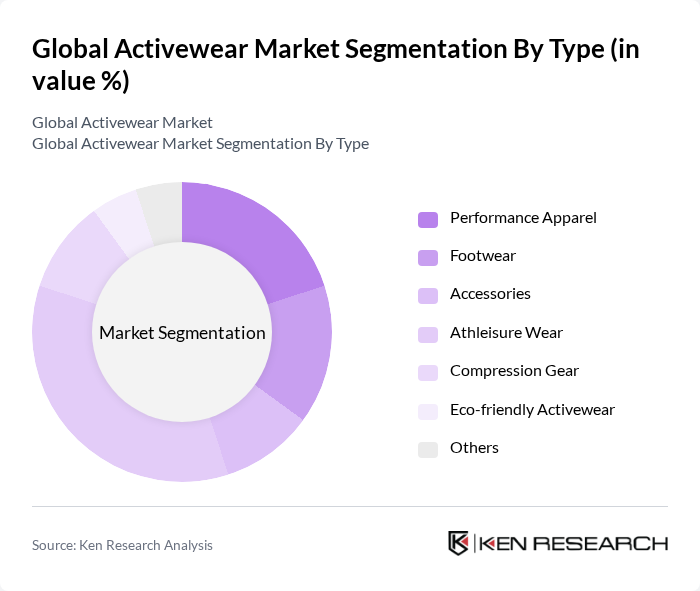

By Type:The activewear market is segmented into various types, including Performance Apparel, Footwear, Accessories, Athleisure Wear, Compression Gear, Eco-friendly Activewear, and Others. Among these, Athleisure Wear has emerged as the dominant segment, driven by changing consumer lifestyles that favor comfort and style. The trend of wearing activewear in casual settings has significantly boosted the demand for this category, making it a preferred choice for many consumers. The segment’s growth is further supported by the increasing adoption of athleisure among younger demographics and the influence of social media and celebrity endorsements .

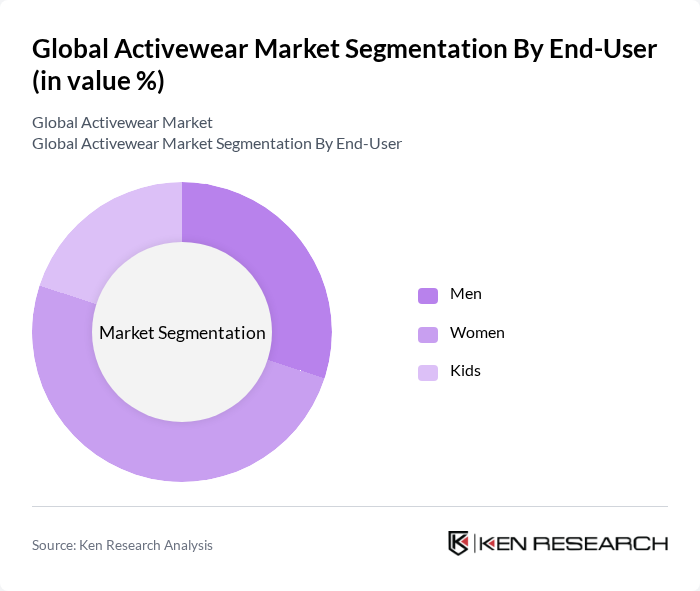

By End-User:The activewear market is also segmented by end-user, which includes Men, Women, and Kids. The Women’s segment is currently the leading category, driven by a growing focus on fitness and wellness among women. Brands are increasingly targeting female consumers with innovative designs and marketing strategies that resonate with their lifestyle choices, further enhancing the segment's growth. The segment’s dominance is reinforced by the higher participation of women in sports and fitness activities and the proliferation of women-centric activewear brands .

The Global Activewear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike, Inc., Adidas AG, Under Armour, Inc., Lululemon Athletica Inc., Puma SE, New Balance Athletics, Inc., ASICS Corporation, Columbia Sportswear Company, Reebok International Ltd., Gymshark Ltd., Fabletics, LLC, Champion (Hanesbrands Inc.), Athleta (Gap Inc.), Outdoor Voices, Inc., Sweaty Betty Ltd., Decathlon S.A., VF Corporation (The North Face, Vans), Li-Ning Company Limited, Anta Sports Products Limited, Mizuno Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the activewear market appears promising, driven by ongoing trends in health consciousness and technological advancements. As consumers increasingly seek sustainable and innovative products, brands that prioritize eco-friendly practices and smart technology integration are likely to thrive. Additionally, the rise of e-commerce will continue to reshape the retail landscape, providing opportunities for brands to reach a broader audience and enhance customer engagement through personalized shopping experiences.

| Segment | Sub-Segments |

|---|---|

| By Type | Performance Apparel Footwear Accessories Athleisure Wear Compression Gear Eco-friendly Activewear Others |

| By End-User | Men Women Kids |

| By Distribution Channel | Online Retail Specialty Stores Department Stores Discount Stores In-store Retail Others |

| By Price Range | Premium Mid-range Budget |

| By Material | Synthetic Fabrics (e.g., Polyester, Nylon, Spandex) Natural Fabrics (e.g., Cotton, Bamboo) Blended Fabrics |

| By Occasion/Usage | Gym & Fitness Training Outdoor Sports & Activities Yoga & Pilates Running Casual Wear Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Activewear | 150 | Fitness Enthusiasts, Casual Wear Consumers |

| Retail Insights on Activewear Sales | 100 | Store Managers, Retail Buyers |

| Brand Perception and Loyalty | 80 | Brand Advocates, Social Media Influencers |

| Market Trends in Activewear Innovation | 60 | Product Development Managers, Trend Analysts |

| Impact of Sustainability on Purchasing Decisions | 90 | Eco-conscious Consumers, Sustainability Advocates |

The Global Activewear Market is valued at approximately USD 414 billion, reflecting significant growth driven by health consciousness, athleisure trends, and increased fitness activities among consumers. This valuation is based on a comprehensive five-year historical analysis.