Global Outdoor Apparel Market Overview

- The Global Outdoor Apparel Market is valued at USD 18 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer interest in outdoor activities, coupled with a rising trend towards sustainable and functional clothing, product innovation in fabrics for breathability and moisture-wicking, and the expansion of adventure tourism. The market has seen a surge in demand for high-performance apparel that caters to various outdoor pursuits, including hiking, camping, skiing, running, and cycling.

- Key regions in this market include North America, Europe, and Asia Pacific, which dominate due to their strong retail infrastructure, high disposable incomes, and a culture that encourages outdoor activities. North America is particularly notable for its vast national parks and outdoor recreational areas, while Europe and Asia Pacific have seen a growing interest in outdoor sports and activities among their populations.

- The Ecodesign for Sustainable Products Regulation (ESPR), 2024 issued by the European Commission, addresses the environmental impact of textile production, which includes outdoor apparel. This regulation requires producers to assess and improve the environmental sustainability of textile products throughout their lifecycle, including design for durability, reparability, energy efficiency, and recycling, with mandatory digital product passports and bans on the destruction of unsold textiles exceeding specified thresholds. This initiative drives innovation and sustainability in the outdoor apparel sector.

Global Outdoor Apparel Market Segmentation

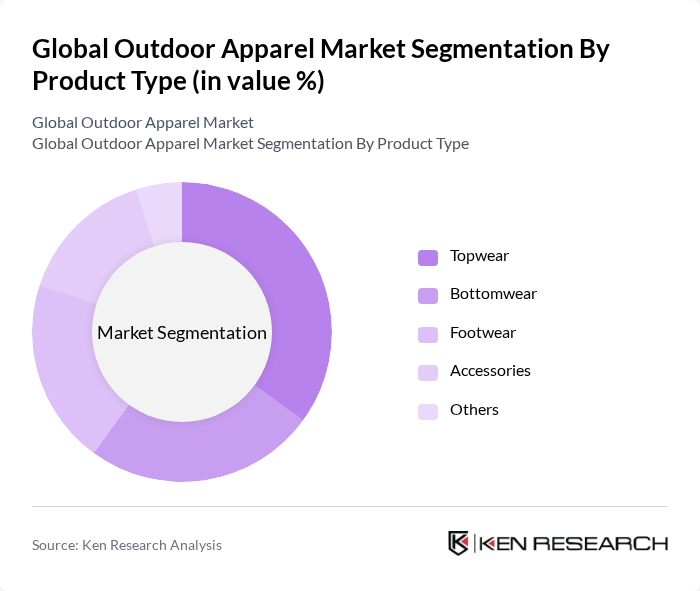

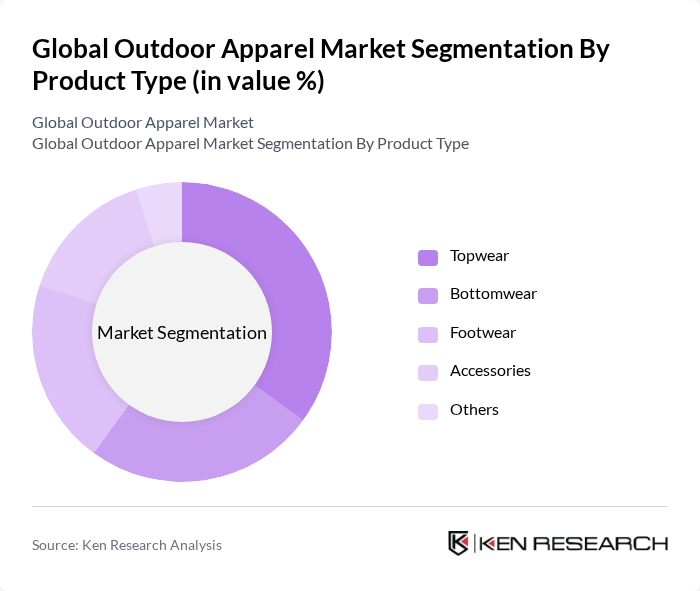

By Product Type:The product type segmentation includes Topwear, Bottomwear, Coveralls, and Others. Among these, Topwear is the leading sub-segment, driven by consumer preferences for versatile and functional clothing that can be used in various outdoor settings. The demand for lightweight, breathable, and moisture-wicking fabrics has made Topwear a popular choice for outdoor enthusiasts. Bottomwear, while also significant, tends to follow closely behind as consumers seek complementary pieces for their outdoor outfits.

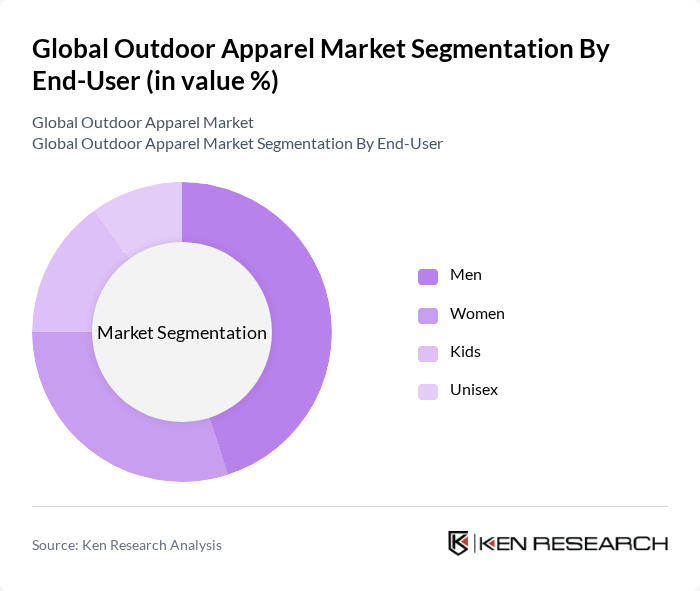

By End-User:The end-user segmentation includes Men, Women, Kids, and Unisex. The Men’s segment is the largest, driven by a growing interest in outdoor activities among male consumers. This segment benefits from a wide range of products designed specifically for men, including technical jackets and hiking pants. The Women’s segment is also significant, reflecting the increasing participation of women in outdoor sports and activities, while the Kids and Unisex segments cater to families and those seeking versatile options.

Global Outdoor Apparel Market Competitive Landscape

The Global Outdoor Apparel Market is characterized by a dynamic mix of regional and international players. Leading participants such as The North Face, Patagonia, Columbia Sportswear, Arc'teryx, REI Co-op, Marmot, Mountain Hardwear, Salomon, Black Diamond Equipment, Outdoor Research, Helly Hansen, Fjällräven, Prana, Montbell, Smartwool contribute to innovation, geographic expansion, and service delivery in this space.

Global Outdoor Apparel Market Industry Analysis

Growth Drivers

- Increasing Outdoor Activities:The global participation in outdoor activities has surged, with over 50% of adults in the None region engaging in hiking, camping, or other outdoor pursuits in future. This trend is supported by the World Outdoor Recreation Participation Report, which indicates that outdoor activity participation has increased by 15 million individuals since 2020. This growing interest drives demand for outdoor apparel, as consumers seek specialized clothing that enhances their experience and comfort during these activities.

- Rising Health Consciousness:Health awareness is at an all-time high, with 70% of the None population prioritizing fitness and outdoor activities as part of their lifestyle choices. According to the Health and Wellness Industry Report, spending on health-related products, including outdoor apparel, has increased by USD 12 billion in the last year. This shift towards healthier living is propelling the outdoor apparel market, as consumers invest in high-quality, functional clothing that supports their active lifestyles.

- Technological Advancements in Fabric:Innovations in fabric technology are revolutionizing outdoor apparel, with the introduction of moisture-wicking, UV-protective, and temperature-regulating materials. The global textile industry is projected to invest USD 5 billion in research and development in future, enhancing product performance and durability. These advancements not only improve user experience but also attract tech-savvy consumers who prioritize functionality and comfort in their outdoor gear, further driving market growth.

Market Challenges

- Intense Competition:The outdoor apparel market is characterized by fierce competition, with over 200 brands vying for market share in the None region. Major players like Patagonia and The North Face dominate, but emerging brands are rapidly gaining traction. This saturation leads to price wars and reduced profit margins, as companies strive to differentiate themselves through innovative designs and marketing strategies, making it challenging for new entrants to establish a foothold.

- Fluctuating Raw Material Prices:The outdoor apparel industry faces significant challenges due to volatile raw material prices, particularly for synthetic fibers and organic cotton. In future, the price of polyester is expected to rise by 10% due to supply chain disruptions and increased demand. This fluctuation can lead to higher production costs, forcing companies to either absorb the costs or pass them on to consumers, potentially impacting sales and profitability.

Global Outdoor Apparel Market Future Outlook

The future of the outdoor apparel market in the None region appears promising, driven by a growing consumer base that values sustainability and performance. As outdoor activities continue to gain popularity, brands are expected to innovate further, integrating smart technology into apparel. Additionally, the rise of e-commerce will facilitate broader access to diverse product offerings, enhancing consumer engagement and driving sales. Companies that adapt to these trends will likely thrive in this evolving landscape.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets in the None region present significant growth opportunities, with outdoor participation rates increasing by 20% annually. Companies can capitalize on this trend by tailoring products to local preferences and investing in targeted marketing strategies, potentially increasing their market share and revenue streams.

- Sustainable Product Development:The demand for sustainable outdoor apparel is on the rise, with 60% of consumers willing to pay more for eco-friendly products. By investing in sustainable materials and ethical production practices, brands can attract environmentally conscious consumers, enhancing brand loyalty and driving sales in a competitive market.