Region:Global

Author(s):Shubham

Product Code:KRAA8821

Pages:80

Published On:November 2025

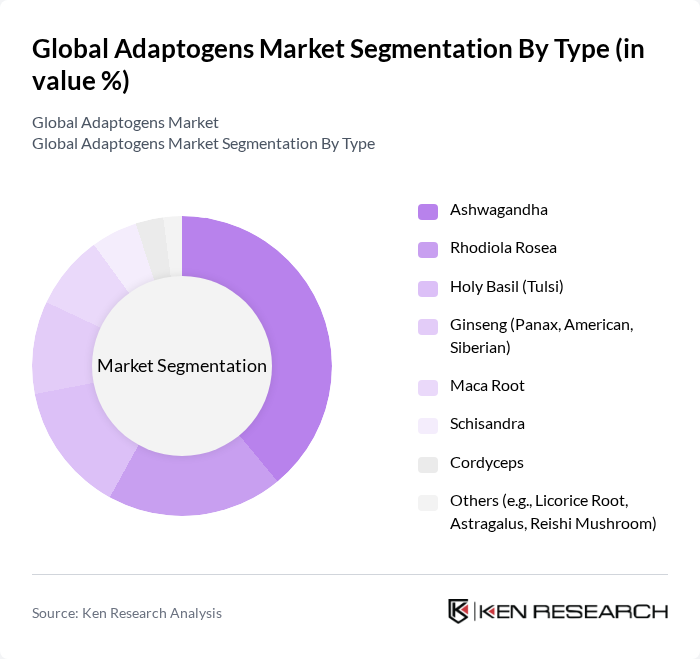

By Type:The market is segmented into various types of adaptogens, including Ashwagandha, Rhodiola Rosea, Holy Basil (Tulsi), Ginseng (Panax, American, Siberian), Maca Root, Schisandra, Cordyceps, and Others (e.g., Licorice Root, Astragalus, Reishi Mushroom). Among these, Ashwagandha has emerged as a leading sub-segment, accounting for the highest market share due to its extensive use in traditional medicine and growing popularity in health supplements. The increasing consumer preference for natural stress-relief solutions and the scientific validation of Ashwagandha's benefits have significantly boosted its demand .

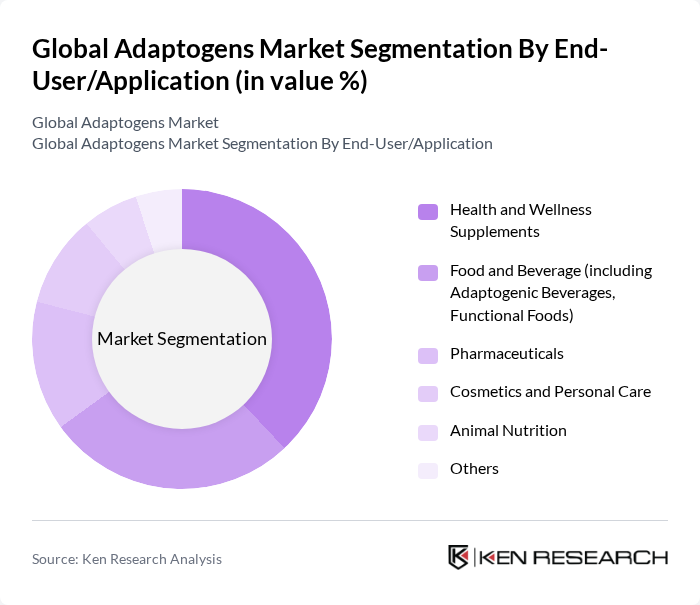

By End-User/Application:The adaptogens market is also segmented by end-user applications, which include Health and Wellness Supplements, Food and Beverage (including Adaptogenic Beverages, Functional Foods), Pharmaceuticals, Cosmetics and Personal Care, Animal Nutrition, and Others. The Health and Wellness Supplements segment is currently the most dominant, driven by a surge in consumer interest in preventive healthcare and natural remedies. This trend is further supported by the increasing incorporation of adaptogens into dietary supplements and functional beverages aimed at enhancing overall well-being .

The Global Adaptogens Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gaia Herbs, Herbalife Nutrition Ltd., Four Sigmatic, Sun Potion, Adaptogen Science, Om Mushroom Superfood, NutraBlast, The Republic of Tea, Rasa, Pukka Herbs, Traditional Medicinals, HealthForce SuperFoods, Nature's Way, New Chapter, Organic India, NOW Foods, Himalaya Wellness Company, Natreon Inc., NutraScience Labs, Aloha Medicinals Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the adaptogens market appears promising, driven by increasing consumer interest in holistic health solutions and natural products. As more individuals prioritize mental well-being and stress management, the demand for adaptogenic products is expected to rise. Additionally, innovations in product formulations and the integration of adaptogens into mainstream food and beverage categories will likely enhance market penetration, creating new avenues for growth and consumer engagement in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Ashwagandha Rhodiola Rosea Holy Basil (Tulsi) Ginseng (Panax, American, Siberian) Maca Root Schisandra Cordyceps Others (e.g., Licorice Root, Astragalus, Reishi Mushroom) |

| By End-User/Application | Health and Wellness Supplements Food and Beverage (including Adaptogenic Beverages, Functional Foods) Pharmaceuticals Cosmetics and Personal Care Animal Nutrition Others |

| By Formulation | Powders Capsules/Tablets Liquid Extracts/Tinctures Teas and Beverages Gummies Others |

| By Distribution Channel | Online Retail/E-commerce Supermarkets/Hypermarkets Health Food Stores/Specialty Chains Pharmacies/Drug Stores B2B (Bulk/Ingredient Sales) Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Consumer Demographics | Age Group (18-24, 25-34, 35-44, 45+) Gender (Male, Female, Non-binary) Lifestyle (Active, Sedentary, Athletes, Wellness Seekers) Health Focus (Stress, Immunity, Energy, Beauty, Hormonal Balance) Others |

| By Product Positioning | Premium Products Mid-Range Products Budget Products Clean Label/Organic Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Adaptogens | 150 | Store Managers, Product Buyers |

| Consumer Preferences for Herbal Supplements | 120 | Health-Conscious Consumers, Fitness Enthusiasts |

| Market Trends in Natural Health Products | 100 | Market Analysts, Industry Experts |

| Usage Patterns of Adaptogens in Food & Beverages | 80 | Product Developers, Food Scientists |

| Insights from Health Practitioners | 60 | Nutritionists, Herbalists |

The Global Adaptogens Market is valued at approximately USD 11 billion, reflecting a significant growth trend driven by increasing consumer awareness of health and wellness, demand for natural products, and the expansion of e-commerce channels.