Region:Global

Author(s):Rebecca

Product Code:KRAD5059

Pages:84

Published On:December 2025

By Type:

The segment of Diagnostic Imaging Systems is currently dominating the market due to the increasing demand for early and accurate diagnosis of eye diseases and the central role of imaging in routine and specialized ophthalmic practice. Technologies such as Optical Coherence Tomography (OCT), fundus cameras, and corneal topography systems are widely adopted in clinical settings, enabling healthcare providers to detect conditions like diabetic retinopathy, glaucoma, and age-related macular degeneration at earlier stages and to monitor disease progression over time. The growing awareness of eye health, expanding screening programs, and the integration of AI-assisted image analysis further drive the adoption of these advanced imaging systems, making them a critical component of modern ophthalmic care.

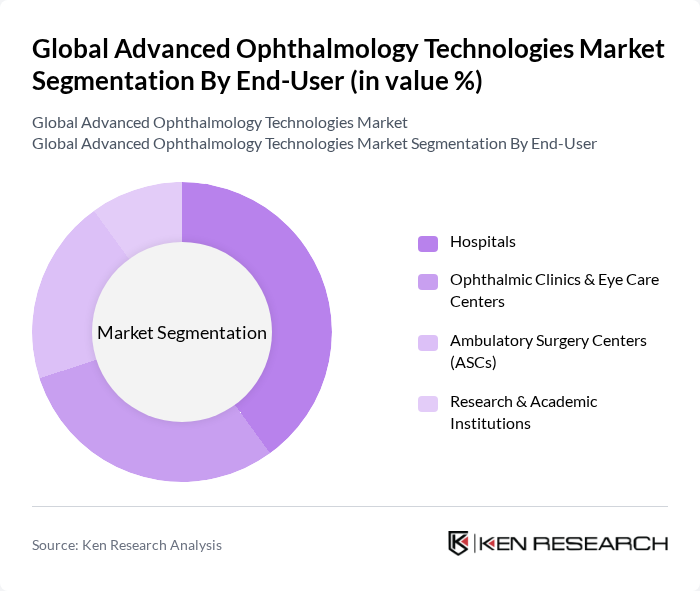

By End-User:

Hospitals are the leading end-user segment in the market, primarily due to their capacity to invest in advanced diagnostic imaging platforms, premium surgical systems, and comprehensive perioperative care pathways. The integration of advanced ophthalmology technologies in hospitals enhances surgical outcomes, enables high-volume cataract and refractive procedures, and improves patient safety through standardized protocols and advanced visualization tools, making them a preferred choice for complex and combined eye surgeries. Additionally, hospitals often serve as training centers and reference sites for new technologies, collaborating in clinical trials and post-market studies, which further drives their adoption and utilization in clinical practice and accelerates diffusion of innovation to smaller clinics and ambulatory centers.

The Global Advanced Ophthalmology Technologies Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson & Johnson Vision Care, Inc., Alcon Inc., Bausch + Lomb Corporation, Novartis AG (Ophthalmology Division), Carl Zeiss Meditec AG, Abbott Medical Optics (now part of Johnson & Johnson Vision), Hoya Corporation, CooperVision, Inc., EssilorLuxottica SA, Regeneron Pharmaceuticals, Inc., Santen Pharmaceutical Co., Ltd., Genentech, Inc. (a member of the Roche Group), Allergan (an AbbVie company), Topcon Corporation, Nidek Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of advanced ophthalmology technologies is poised for significant transformation, driven by ongoing innovations and demographic shifts. The integration of artificial intelligence and telemedicine is expected to enhance diagnostic capabilities and patient engagement, while the demand for minimally invasive procedures will continue to rise. As healthcare systems adapt to these trends, the focus will shift towards personalized medicine, ensuring tailored treatment plans that cater to individual patient needs, ultimately improving outcomes and satisfaction in eye care.

| Segment | Sub-Segments |

|---|---|

| By Type | Diagnostic Imaging Systems (OCT, fundus cameras, corneal topography) Surgical Systems (phacoemulsification, femtosecond laser platforms) Therapeutic Devices & Implants (IOLs, glaucoma drainage devices) Vision Correction & Refractive Devices (LASIK/SMILE systems, contact lenses) Digital & AI-Enabled Solutions (tele-ophthalmology, decision-support software) |

| By End-User | Hospitals Ophthalmic Clinics & Eye Care Centers Ambulatory Surgery Centers (ASCs) Research & Academic Institutions |

| By Application | Cataract Diagnosis & Surgery Glaucoma Screening & Management Retinal & Macular Disorders (AMD, diabetic retinopathy) Refractive Errors & Vision Correction Corneal & Ocular Surface Diseases |

| By Technology | Laser-Based Technologies (excimer, femtosecond, YAG) Optical Coherence Tomography & Advanced Imaging Ultrasound & Biometry Systems AI-Driven Diagnostic & Screening Platforms Others |

| By Distribution Channel | Direct Sales to Providers Distributors & Value-Added Resellers Group Purchasing Organizations (GPOs) & Tenders E-commerce & Online Procurement Platforms |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Policy Support | Government Vision Health Programs & Screening Initiatives Tax Incentives & Depreciation Benefits for Medical Equipment Public & Private Research Grants for Ophthalmic Innovation Reimbursement & Insurance Coverage Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ophthalmic Surgical Devices | 120 | Ophthalmologists, Surgeons, Medical Directors |

| Diagnostic Equipment for Eye Care | 90 | Optometrists, Clinic Managers, Equipment Buyers |

| Therapeutic Solutions in Ophthalmology | 80 | Pharmaceutical Representatives, Healthcare Providers |

| Telemedicine in Eye Care | 70 | Telehealth Coordinators, IT Managers in Healthcare |

| Regulatory Compliance in Ophthalmology | 60 | Regulatory Affairs Specialists, Quality Assurance Managers |

The Global Advanced Ophthalmology Technologies Market is valued at approximately USD 8.8 billion, reflecting significant growth driven by the rising prevalence of eye disorders and advancements in surgical and diagnostic technologies.