Region:Global

Author(s):Dev

Product Code:KRAA2530

Pages:86

Published On:August 2025

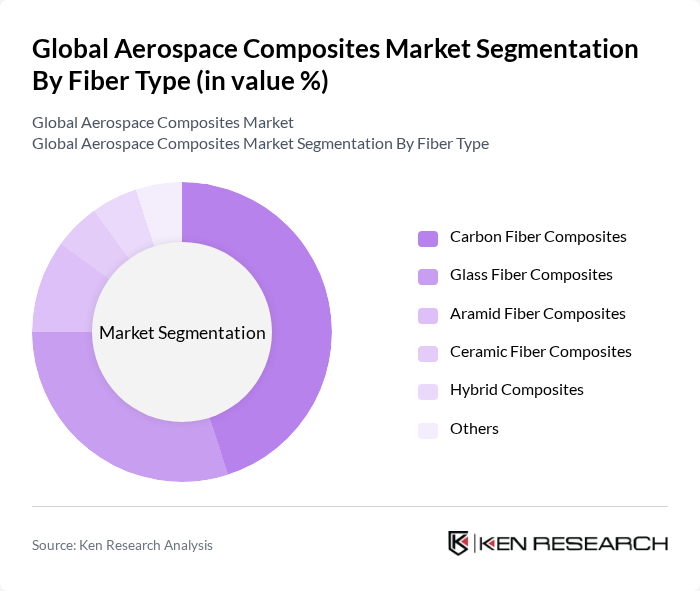

By Fiber Type:The fiber type segmentation encompasses key composite materials essential for aerospace applications. The primary subsegments are Carbon Fiber Composites, Glass Fiber Composites, Aramid Fiber Composites, Ceramic Fiber Composites, Hybrid Composites, and Others. Carbon Fiber Composites lead the market due to their exceptional strength-to-weight ratio, fatigue resistance, and suitability for critical structural components such as fuselage sections and wings. Glass Fiber Composites are widely used for less critical applications, offering cost-effective solutions. The demand for these materials is driven by the industry’s focus on reducing aircraft weight, improving fuel efficiency, and meeting stringent emission standards .

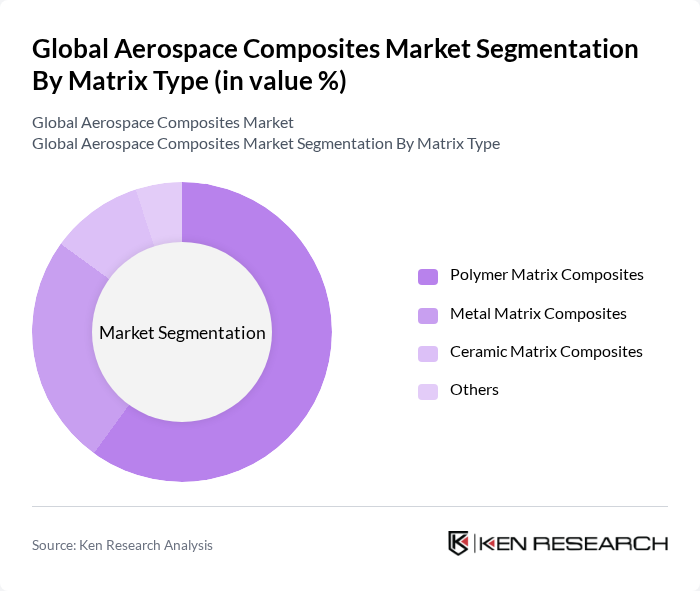

By Matrix Type:The matrix type segmentation includes materials that bind the fibers in composite structures. The subsegments are Polymer Matrix Composites, Metal Matrix Composites, Ceramic Matrix Composites, and Others. Polymer Matrix Composites dominate due to their versatility, lightweight nature, and ease of processing, making them suitable for a broad range of aerospace applications. Metal Matrix Composites are gaining traction for their superior thermal and mechanical properties, especially in high-performance aerospace components. The industry’s ongoing focus on lightweighting and performance enhancement continues to drive the growth of these composite types .

The Global Aerospace Composites Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hexcel Corporation, Toray Industries, Inc., Solvay S.A., Teijin Limited, SGL Carbon SE, Mitsubishi Chemical Corporation, Owens Corning, Gurit Holding AG, Spirit AeroSystems Holdings, Inc., GKN Aerospace (GKN Ltd.), Safran S.A., 3M Company, DuPont de Nemours, Inc., BASF SE, Bally Ribbon Mills contribute to innovation, geographic expansion, and service delivery in this space.

The future of the aerospace composites market is poised for significant transformation, driven by technological advancements and regulatory pressures. As manufacturers increasingly adopt digitalization in production processes, efficiency and customization will improve, catering to specific client needs. Furthermore, the shift towards sustainable materials will likely accelerate, with a growing emphasis on eco-friendly composites. This evolution will not only enhance operational efficiency but also align with global sustainability goals, ensuring the aerospace sector remains competitive and environmentally responsible.

| Segment | Sub-Segments |

|---|---|

| By Fiber Type | Carbon Fiber Composites Glass Fiber Composites Aramid Fiber Composites Ceramic Fiber Composites Hybrid Composites Others |

| By Matrix Type | Polymer Matrix Composites Metal Matrix Composites Ceramic Matrix Composites Others |

| By Manufacturing Process | Automated Tape Laying (ATL) & Automated Fiber Placement (AFP) Resin Transfer Molding (RTM) Lay-Up Process Filament Winding Others |

| By Aircraft Type | Commercial Aircraft Business & General Aviation Civil Helicopter Military Aircraft Spacecraft Unmanned Aerial Vehicles (UAVs) Others |

| By Application | Interior Components Exterior/Structural Components Engine Components Aerodynamic Components Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Aircraft Manufacturing | 120 | Production Managers, Materials Engineers |

| Military Aerospace Applications | 60 | Defense Procurement Officers, Aerospace Analysts |

| General Aviation Sector | 50 | Aircraft Designers, Composite Material Specialists |

| Aerospace Research Institutions | 40 | Research Scientists, Academic Professors |

| Suppliers of Composite Materials | 45 | Sales Directors, Product Development Managers |

The Global Aerospace Composites Market is valued at approximately USD 37 billion, driven by the increasing demand for lightweight, high-strength materials in aircraft manufacturing, which enhances fuel efficiency and supports sustainability goals.