Region:Middle East

Author(s):Geetanshi

Product Code:KRAB1633

Pages:82

Published On:January 2026

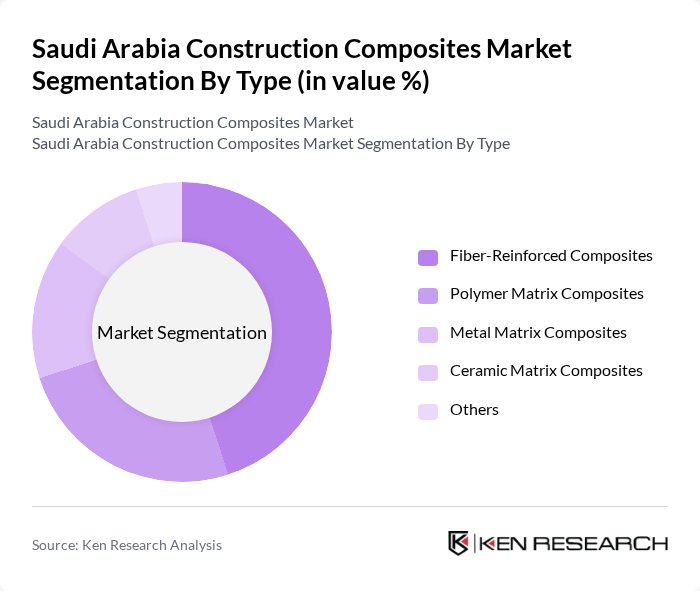

By Type:The market is segmented into various types of composites, including Fiber-Reinforced Composites, Polymer Matrix Composites, Metal Matrix Composites, Ceramic Matrix Composites, and Others. Among these, Fiber-Reinforced Composites are leading due to their high strength-to-weight ratio and versatility in applications. The increasing use of these composites in structural applications and their ability to withstand harsh environmental conditions make them a preferred choice in the construction industry.

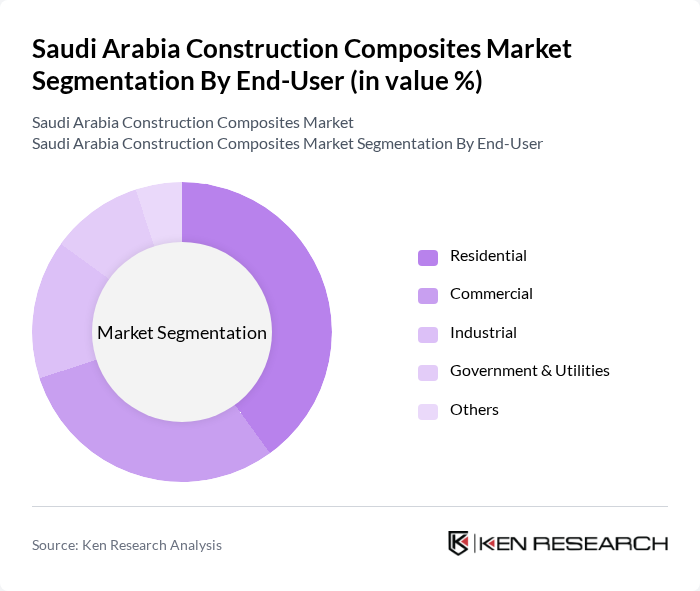

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Government & Utilities, and Others. The Residential segment is currently dominating the market, driven by the increasing demand for housing and urban development projects. The trend towards sustainable and energy-efficient buildings is also propelling the use of construction composites in residential applications, making it a key focus area for manufacturers.

The Saudi Arabia Construction Composites Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Composites Manufacturing Company, Advanced Composites Company, Saudi Arabian Glass Company, Al-Falak Composites, Saudi Plastic Factory, National Composites Group, Al-Jazira Factory for Composites, Gulf Composites, Saudi Advanced Industries Company, Al-Muhaidib Group, Saudi Building Materials Company, Al-Babtain Group, Al-Rajhi Group, Al-Khodari & Sons, Saudi Industrial Investment Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia construction composites market appears promising, driven by ongoing infrastructure projects and a strong governmental push towards sustainability. As the nation continues to diversify its economy, the integration of advanced materials in construction will likely gain momentum. Additionally, the increasing focus on smart city initiatives and renewable energy projects will further enhance the demand for innovative composite solutions, positioning the market for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Fiber-Reinforced Composites Polymer Matrix Composites Metal Matrix Composites Ceramic Matrix Composites Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Application | Structural Components Insulation Materials Decorative Elements Infrastructure Projects Others |

| By Material Source | Natural Fiber Composites Synthetic Fiber Composites Recycled Material Composites Others |

| By Manufacturing Process | Hand Lay-Up Spray-Up Compression Molding Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Central Region Eastern Region Western Region Southern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 100 | Project Managers, Site Engineers |

| Commercial Building Developments | 80 | Architects, Construction Supervisors |

| Infrastructure Projects (Bridges, Roads) | 70 | Civil Engineers, Procurement Managers |

| Composite Material Suppliers | 60 | Sales Managers, Product Development Engineers |

| Regulatory Bodies and Standards Organizations | 50 | Policy Makers, Compliance Officers |

The Saudi Arabia Construction Composites Market is valued at approximately USD 10.1 billion, driven by the demand for lightweight and durable materials in construction, as well as government initiatives focused on infrastructure development and urbanization.