Region:Global

Author(s):Dev

Product Code:KRAA2562

Pages:80

Published On:August 2025

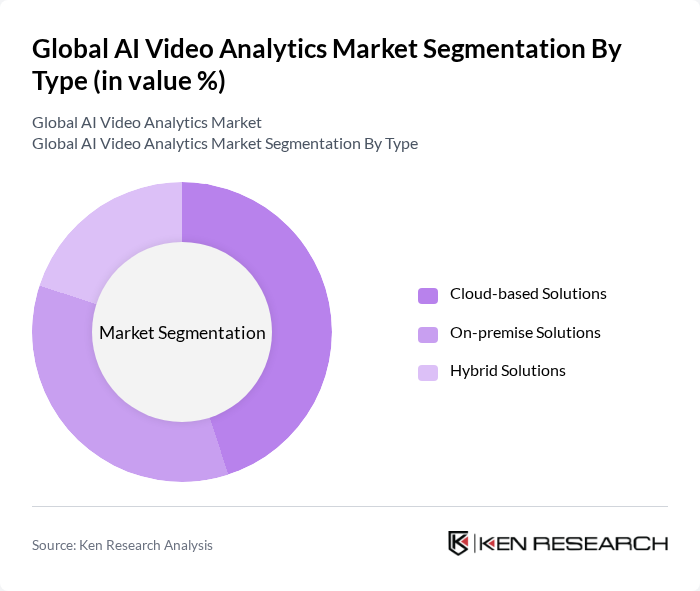

By Type:The market is segmented into three main types: Cloud-based Solutions, On-premise Solutions, and Hybrid Solutions. Each of these types caters to different customer needs and preferences, with cloud-based solutions gaining traction due to their scalability and cost-effectiveness. The adoption of cloud-based and hybrid models is increasing as organizations seek flexibility, centralized management, and lower upfront infrastructure costs .

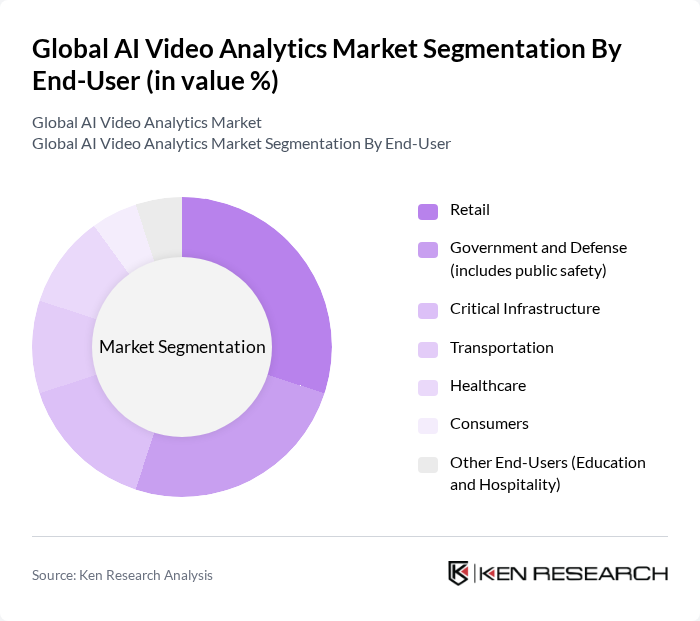

By End-User:The end-user segmentation includes Retail, Government and Defense (includes public safety), Critical Infrastructure, Transportation, Healthcare, Consumers, and Other End-Users (Education and Hospitality). Retail and Government sectors are leading the adoption of AI video analytics due to their focus on security and operational efficiency. Retailers leverage video analytics for loss prevention and customer behavior analysis, while government and defense sectors prioritize public safety and surveillance. Critical infrastructure and transportation are also expanding adoption to enhance monitoring and incident response .

The Global AI Video Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Cisco Systems, Inc., Honeywell International Inc., Axis Communications AB, Avigilon Corporation (a Motorola Solutions company), BriefCam Ltd., Genetec Inc., NEC Corporation, Panasonic Holdings Corporation, Qognify Inc., Verint Systems Inc., Hanwha Vision Co., Ltd., SightLogix, Inc., FLIR Systems, Inc. (now part of Teledyne Technologies), Irisity AB, Agent Video Intelligence Ltd. (Agent Vi), Derq Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of AI video analytics is poised for significant transformation, driven by technological advancements and increasing integration with IoT devices. As organizations prioritize real-time data processing, the demand for cloud-based solutions is expected to rise, facilitating scalable and flexible deployments. Additionally, the focus on predictive analytics will enhance decision-making capabilities across sectors, enabling businesses to anticipate trends and respond proactively to emerging challenges in security and operational efficiency.

| Segment | Sub-Segments |

|---|---|

| By Type | Cloud-based Solutions On-premise Solutions Hybrid Solutions |

| By End-User | Retail Government and Defense (includes public safety) Critical Infrastructure Transportation Healthcare Consumers Other End-Users (Education and Hospitality) |

| By Application | Security and Surveillance Traffic Management Customer Behavior Analysis Incident Detection Facial Recognition Intrusion Detection License Plate Recognition Crowd Management |

| By Component | Software Hardware Services |

| By Deployment Mode | On-premise Deployment Cloud Deployment |

| By Distribution Channel | Direct Sales Online Sales Distributors |

| By Geography | North America Europe Asia Australia and New Zealand Latin America Middle East and Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Analytics Implementation | 100 | Retail Managers, Data Analysts |

| Security Surveillance Systems | 80 | Security Directors, IT Managers |

| Traffic Management Solutions | 70 | City Planners, Transportation Engineers |

| Healthcare Video Monitoring | 50 | Healthcare Administrators, IT Managers |

| Manufacturing Process Optimization | 60 | Operations Managers, Quality Control Supervisors |

The Global AI Video Analytics Market is valued at approximately USD 3.9 billion, driven by the increasing demand for advanced surveillance systems and the integration of AI technologies in various sectors such as retail, transportation, and healthcare.