UAE Internet of Things Market Overview

- The UAE Internet of Things market is valued at USD 5.1 billion, based on a five-year historical analysis. This growth is primarily driven by the rapid adoption of smart technologies across sectors such as healthcare, transportation, energy, and smart cities. Key drivers include the expansion of 5G infrastructure, government-backed digital transformation initiatives, and the increasing deployment of connected devices for real-time data and operational efficiency. The surge in B2B IoT applications, particularly in utilities, industrial automation, and healthcare, has significantly contributed to the market's expansion .

- Dubai and Abu Dhabi are the dominant cities in the UAE Internet of Things market, primarily due to their strategic initiatives aimed at becoming smart cities. The government's commitment to digital transformation, coupled with substantial investments in infrastructure, 5G networks, and smart city projects, has positioned these cities as leaders in IoT adoption and innovation. Recent deployments include AI-IoT traffic management systems, smart meters, and large-scale IoT-enabled infrastructure projects .

- The Dubai Internet of Things (IoT) Strategy, launched by the Smart Dubai Office under the Dubai Government in 2017, remains the principal regulatory and strategic framework for IoT in the UAE. This strategy mandates the development of IoT standards, data management protocols, and compliance requirements for all IoT deployments in Dubai. It requires stakeholders to register IoT devices, adhere to cybersecurity standards, and ensure data privacy as per the Dubai Data Law, 2015 (Law No. 26 of 2015 issued by the Government of Dubai). The framework supports public-private partnerships, innovation, and sector-specific IoT adoption .

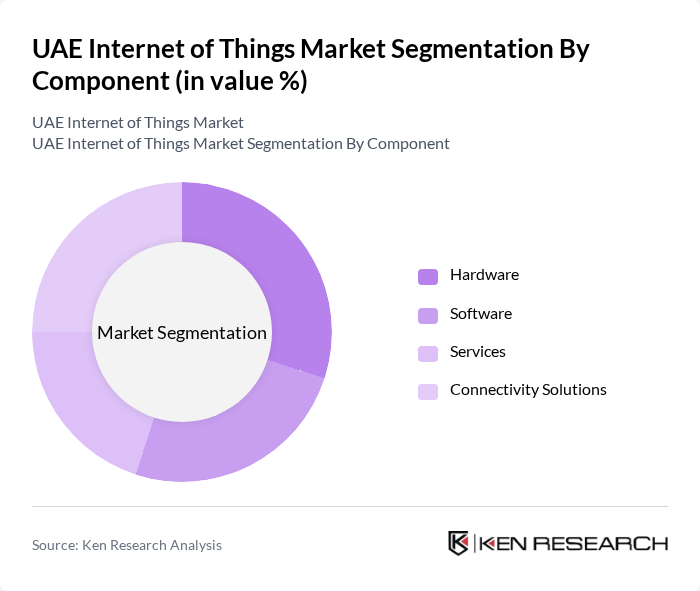

UAE Internet of Things Market Segmentation

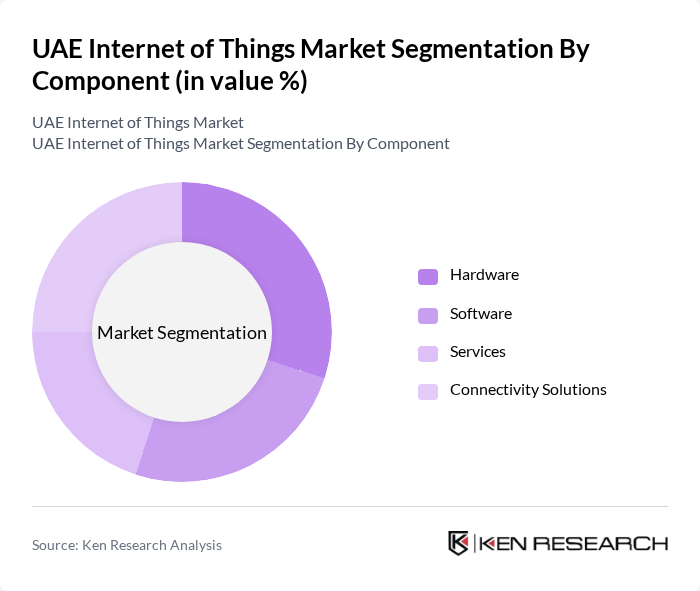

By Component:The components of the UAE Internet of Things market include Hardware, Software, Services, and Connectivity Solutions. Each of these components plays a crucial role in the overall functionality and efficiency of IoT systems. Hardware encompasses devices and sensors, while software includes applications and platforms that facilitate data management and analysis. Services cover installation, maintenance, consulting, and support, and connectivity solutions ensure seamless, secure communication between devices using technologies such as 5G, NB-IoT, and LPWAN .

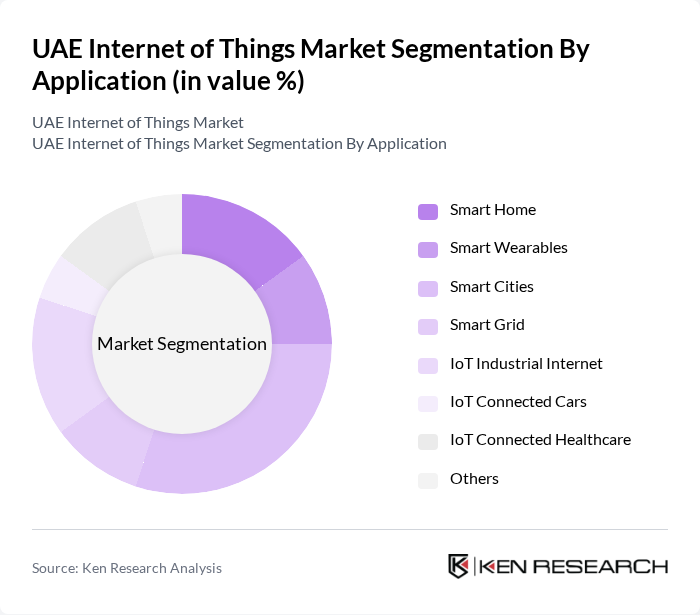

By Application:The applications of the UAE Internet of Things market include Smart Home, Smart Wearables, Smart Cities, Smart Grid, IoT Industrial Internet, IoT Connected Cars, IoT Connected Healthcare, and Others. These applications are designed to enhance efficiency, improve quality of life, and drive innovation across various sectors. Smart cities and connected healthcare are particularly prominent, reflecting the UAE's focus on urban development, energy management, and health technology. Industrial IoT, smart utilities, and transportation are also high-growth segments, driven by government investment and digital transformation goals .

UAE Internet of Things Market Competitive Landscape

The UAE Internet of Things market is characterized by a dynamic mix of regional and international players. Leading participants such as Etisalat by e&, du (Emirates Integrated Telecommunications Company), Dubai Electricity and Water Authority (DEWA), Injazat, Cisco Systems, IBM, Huawei, Microsoft, SAP, Oracle, Siemens, Honeywell, Schneider Electric, Bosch, General Electric, Nokia, and PTC contribute to innovation, geographic expansion, and service delivery in this space. These companies drive market growth through investments in smart infrastructure, IoT platforms, and sector-specific solutions for smart cities, industrial automation, energy, and healthcare .

UAE Internet of Things Market Industry Analysis

Growth Drivers

- Increasing Adoption of Smart City Initiatives:The UAE government has committed over AED 50 billion (USD 13.6 billion) to develop smart city projects, enhancing urban living through IoT technologies. Initiatives like Dubai's Smart City Strategy aim to integrate IoT solutions across various sectors, including transportation and energy. In future, the UAE plans to implement over 1,000 smart city projects, significantly increasing the demand for IoT devices and services, thereby driving market growth.

- Rising Demand for Automation in Industries:The UAE's industrial sector is projected to invest AED 20 billion (USD 5.4 billion) in automation technologies in future. This shift towards automation is driven by the need for efficiency and productivity, particularly in manufacturing and logistics. The integration of IoT solutions is expected to streamline operations, reduce costs, and enhance decision-making processes, thus propelling the growth of the IoT market in the region.

- Expansion of 5G Networks:The UAE is set to invest AED 10 billion (USD 2.7 billion) in expanding its 5G network infrastructure in future. This expansion will facilitate faster data transmission and connectivity for IoT devices, enabling real-time data processing and analytics. With over 90% of the population expected to have access to 5G in future, the enhanced connectivity will significantly boost the adoption of IoT applications across various sectors, including healthcare and transportation.

Market Challenges

- Data Security and Privacy Concerns:As the IoT ecosystem expands, data security remains a critical challenge. In future, it is estimated that cybercrime could cost the UAE economy AED 12 billion (USD 3.3 billion). The increasing number of connected devices raises vulnerabilities, making it essential for businesses to invest in robust security measures. Failure to address these concerns could hinder IoT adoption and growth in the region.

- High Implementation Costs:The initial investment required for IoT infrastructure can be substantial, with estimates suggesting that businesses may need to allocate AED 15 billion (USD 4.1 billion) for comprehensive IoT solutions in future. This high cost can deter small and medium enterprises from adopting IoT technologies, limiting market growth. Companies must find cost-effective solutions to overcome this barrier and fully leverage IoT benefits.

UAE Internet of Things Market Future Outlook

The future of the UAE IoT market appears promising, driven by technological advancements and increasing government support. In future, the integration of AI with IoT is expected to enhance operational efficiencies across sectors, while the focus on sustainability will lead to innovative IoT applications in energy management. Additionally, the expansion of IoT solutions into rural areas will create new market segments, fostering inclusive growth and technological adoption throughout the UAE.

Market Opportunities

- Growth in Healthcare IoT Applications:The healthcare sector in the UAE is projected to invest AED 5 billion (USD 1.36 billion) in IoT technologies in future. This investment will enhance patient monitoring, telemedicine, and data management, improving healthcare delivery and outcomes. The increasing demand for remote healthcare solutions presents a significant opportunity for IoT providers to innovate and expand their offerings.

- Development of Smart Transportation Solutions:The UAE government plans to invest AED 8 billion (USD 2.2 billion) in smart transportation initiatives in future. This investment will focus on integrating IoT technologies into public transport systems, traffic management, and logistics. The growing emphasis on efficient transportation solutions presents a lucrative opportunity for IoT companies to develop innovative applications that enhance mobility and reduce congestion.