Region:Asia

Author(s):Dev

Product Code:KRAC4066

Pages:91

Published On:October 2025

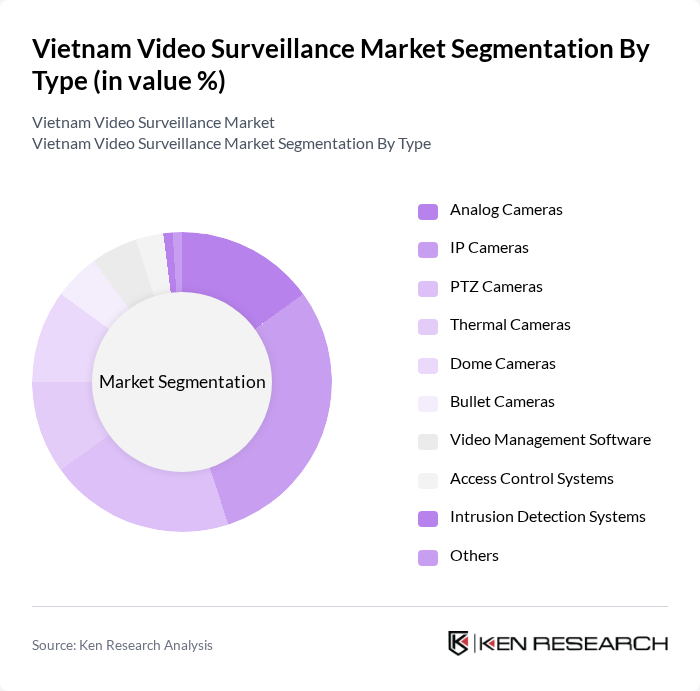

By Type:The market can be segmented into various types of video surveillance equipment, including Analog Cameras, IP Cameras, PTZ Cameras, Thermal Cameras, Dome Cameras, Bullet Cameras, Video Management Software, Access Control Systems, Intrusion Detection Systems, and Others. Each type serves distinct purposes and caters to different consumer needs. The market is witnessing a shift from traditional analog systems to IP-based and AI-integrated solutions, with IP cameras and advanced analytics gaining substantial traction among commercial and government users .

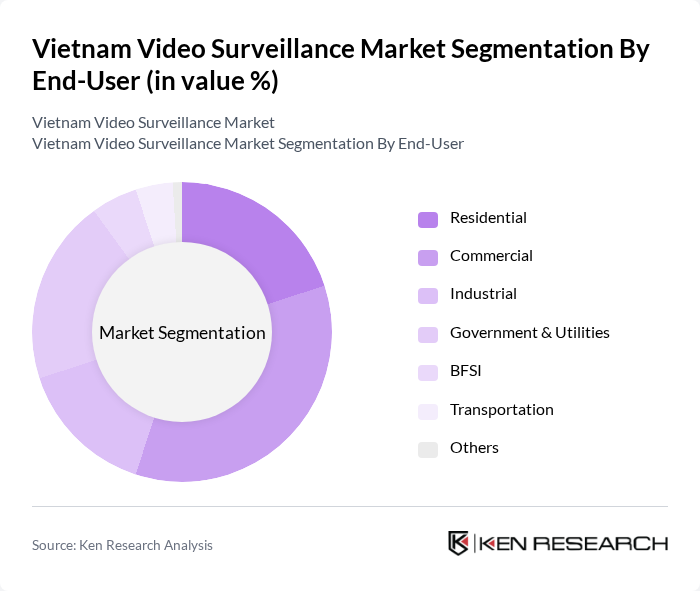

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Government & Utilities, BFSI, Transportation, and Others. Each segment has unique requirements and applications for video surveillance systems, influencing purchasing decisions and market dynamics. The commercial and government sectors are leading adopters, driven by regulatory compliance, urban safety initiatives, and the need for real-time monitoring in high-traffic environments .

The Vietnam Video Surveillance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hikvision Digital Technology Co., Ltd., Dahua Technology Co., Ltd., Axis Communications AB, Bosch Security Systems, Hanwha Vision Co., Ltd., Panasonic Corporation, FLIR Systems, Inc., Honeywell International Inc., Avigilon Corporation (Motorola Solutions), CP Plus International, Uniview Technologies Co., Ltd., ZKTeco Co., Ltd., Vivotek Inc., Geutebrück GmbH, Milestone Systems A/S, FPT Telecom (Vietnam), Bkav Corporation (Vietnam), Nam Long Telecom (Vietnam) contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam video surveillance market is poised for significant transformation as urbanization and security concerns continue to escalate. In future, advancements in technology, particularly in AI and IoT integration, will enhance surveillance capabilities, making systems more efficient and user-friendly. Additionally, the government's commitment to smart city initiatives will further drive the adoption of sophisticated surveillance solutions. As businesses and municipalities prioritize safety, the market is expected to witness increased investments in innovative surveillance technologies, fostering a more secure environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Analog Cameras IP Cameras PTZ Cameras Thermal Cameras Dome Cameras Bullet Cameras Video Management Software Access Control Systems Intrusion Detection Systems Others |

| By End-User | Residential Commercial Industrial Government & Utilities BFSI Transportation Others |

| By Application | Public Safety Traffic Monitoring Retail Security Infrastructure Protection Home Security Corporate Security Others |

| By Distribution Channel | Direct Sales Online Retail Distributors System Integrators |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam Others |

| By Price Range | Low-End Mid-Range High-End |

| By Technology | Wired Surveillance Systems Wireless Surveillance Systems Cloud-Based Surveillance Systems Hybrid Systems |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Surveillance | 90 | Loss Prevention Managers, Store Owners |

| Public Safety Initiatives | 80 | Public Safety Officials, Urban Planners |

| Transportation Security Systems | 70 | Transport Managers, Safety Compliance Officers |

| Banking and Financial Institutions | 90 | Risk Management Officers, IT Security Heads |

| Industrial and Manufacturing Surveillance | 70 | Facility Managers, Safety Officers |

The Vietnam Video Surveillance Market is valued at approximately USD 1.2 billion, driven by urbanization, security concerns, and technological advancements. This growth reflects a significant demand for surveillance systems across various sectors, including commercial and government applications.