Region:Global

Author(s):Shubham

Product Code:KRAA2674

Pages:99

Published On:August 2025

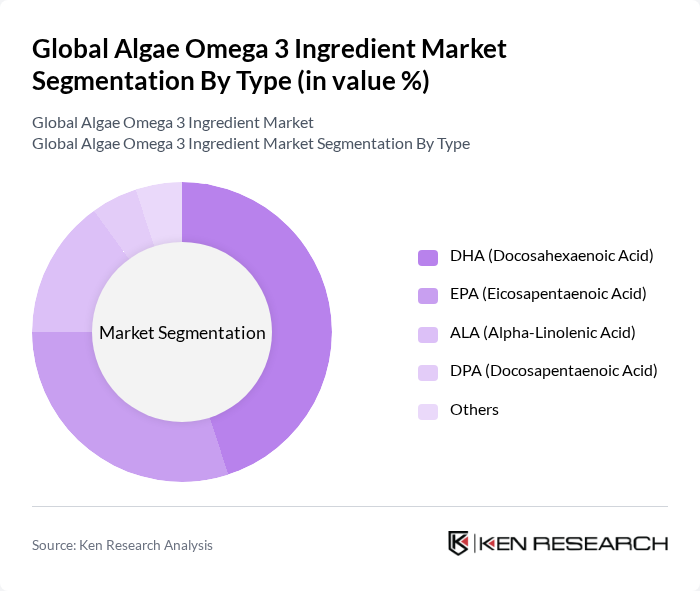

By Type:The market is segmented into various types of omega-3 fatty acids derived from algae, including DHA (Docosahexaenoic Acid), EPA (Eicosapentaenoic Acid), ALA (Alpha-Linolenic Acid), DPA (Docosapentaenoic Acid), and others. Among these,DHAis the most dominant due to its critical role in brain health, cognitive function, and infant development, driving demand in dietary supplements and infant formulas.EPAfollows, primarily valued for its anti-inflammatory properties and cardiovascular benefits in health products.ALAandDPAserve niche applications, while other omega-3s continue to gain traction in specialized nutrition segments .

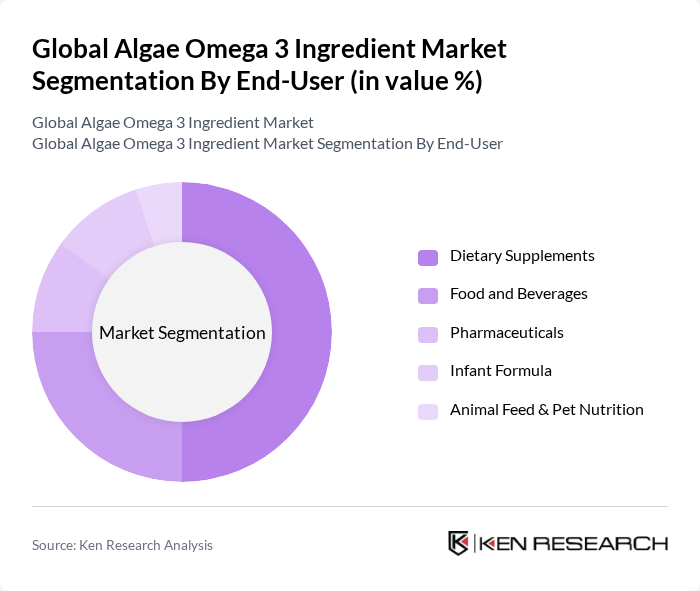

By End-User:The end-user segmentation includes dietary supplements, food and beverages, pharmaceuticals, infant formula, animal feed & pet nutrition, and others.Dietary supplementsremain the leading segment, driven by rising health consciousness, preventive healthcare trends, and the popularity of vegetarian and vegan nutrition. Thefood and beveragessegment is expanding as manufacturers fortify products with omega-3 to enhance nutritional value.Pharmaceuticalsandinfant formulasegments are growing due to clinical evidence supporting omega-3’s role in cardiovascular, cognitive, and early childhood health.Animal feed & pet nutritionis also gaining traction, especially in premium pet food markets .

The Global Algae Omega 3 Ingredient Market is characterized by a dynamic mix of regional and international players. Leading participants such as Koninklijke DSM N.V. (DSM-Firmenich), Corbion N.V., BASF SE, Archer Daniels Midland Company (ADM), Polaris Nutritional Lipids, Neptune Wellness Solutions Inc., Algatechnologies Ltd., Solutex GC, S.L., Cellana, Inc., AlgaeCytes Ltd., Fermentalg SA, Qualitas Health (iWi), Veramaris V.O.F., Mara Renewables Corporation, Cargill, Incorporated contribute to innovation, geographic expansion, and service delivery in this space.

The future of the algae omega-3 ingredient market appears promising, driven by increasing health consciousness and a shift towards sustainable sourcing. As consumers become more aware of the environmental impact of their dietary choices, the demand for plant-based omega-3 sources is expected to rise. Additionally, ongoing research into the health benefits of algae omega-3 will likely lead to innovative product developments, further expanding market opportunities and enhancing consumer acceptance.

| Segment | Sub-Segments |

|---|---|

| By Type | DHA (Docosahexaenoic Acid) EPA (Eicosapentaenoic Acid) ALA (Alpha-Linolenic Acid) DPA (Docosapentaenoic Acid) Others |

| By End-User | Dietary Supplements Food and Beverages Pharmaceuticals Infant Formula Animal Feed & Pet Nutrition Others |

| By Application | Nutraceuticals Functional Foods & Beverages Infant Nutrition Personal Care & Cosmetics Pharmaceuticals Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Health Food Stores Pharmacies Specialty Stores Others |

| By Source | Marine Algae Freshwater Algae Microalgae Others |

| By Form | Liquid Powder Capsules & Softgels Emulsions Others |

| By Price Range | Premium Mid-Range Budget |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dietary Supplement Manufacturers | 100 | Product Development Managers, Quality Assurance Specialists |

| Health Food Retailers | 80 | Store Managers, Purchasing Agents |

| Nutritionists and Dietitians | 60 | Registered Dietitians, Health Coaches |

| Algae Cultivation Experts | 50 | Research Scientists, Cultivation Managers |

| Regulatory Affairs Professionals | 40 | Compliance Officers, Regulatory Consultants |

The Global Algae Omega 3 Ingredient Market is valued at approximately USD 1.4 billion, reflecting a significant growth trend driven by increasing consumer awareness of the health benefits associated with omega-3 fatty acids from algae sources.