Region:Global

Author(s):Shubham

Product Code:KRAD5487

Pages:84

Published On:December 2025

Market.png)

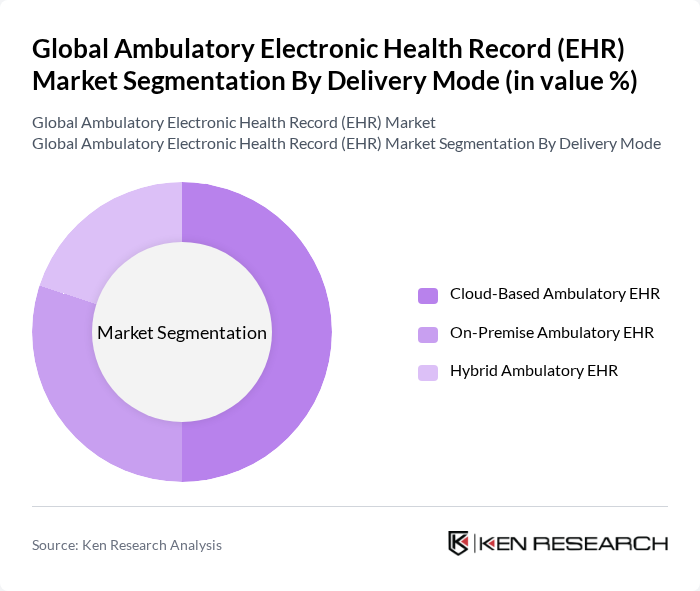

By Delivery Mode:The delivery mode of EHR systems is crucial in determining how healthcare providers access and utilize these technologies. The market is segmented into Cloud-Based, On-Premise, and Hybrid models. Cloud-Based Ambulatory EHR systems are gaining traction due to their scalability, subscription-based pricing, easier upgrades, and remote access, and industry analyses indicate that cloud-based and web-based deployments now account for a substantial share of new ambulatory EHR implementations. On-Premise solutions, while traditionally popular, are facing challenges due to high upfront and maintenance costs, hardware requirements, and the need for in-house IT support. Hybrid models offer a balanced approach, combining the data control of on-premise systems with the flexibility and scalability of cloud services, and are increasingly adopted by larger networks and health systems seeking phased migration strategies.

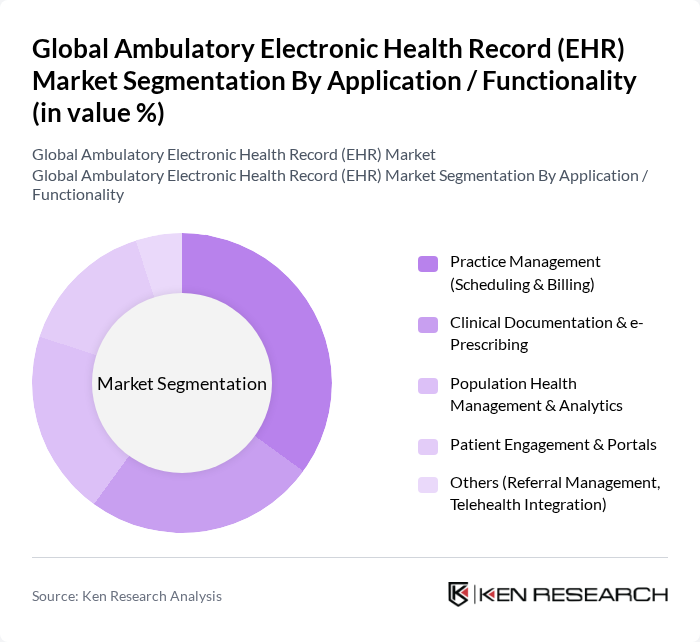

By Application / Functionality:The application and functionality of EHR systems are vital for enhancing operational efficiency in healthcare settings. This segment includes Practice Management, Clinical Documentation, Population Health Management, Patient Engagement, and other functionalities, which aligns with common segmentations covering practice management, patient management, e?prescribing, referral management, population health management, decision support, and health analytics. Practice Management solutions are particularly dominant as they streamline scheduling, registration, and billing processes, which are critical for the financial health and throughput of ambulatory practices. Clinical Documentation and e-Prescribing functionalities are also essential for improving patient care, reducing medication errors, supporting clinical decision-making, and ensuring compliance with regulatory and payer documentation requirements.

The Global Ambulatory Electronic Health Record (EHR) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Epic Systems Corporation, Oracle Cerner Corporation, Veradigm Inc. (formerly Allscripts Healthcare Solutions), MEDITECH (Medical Information Technology, Inc.), NextGen Healthcare, Inc., athenahealth, Inc., eClinicalWorks LLC, Greenway Health, LLC, Modernizing Medicine, Inc. (ModMed), AdvancedMD, Inc., GE HealthCare Technologies Inc., McKesson Corporation, Siemens Healthineers AG, Koninklijke Philips N.V., Oracle Health (Oracle Corporation – Health Business) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ambulatory EHR market appears promising, driven by ongoing technological advancements and increasing regulatory support. As healthcare providers increasingly adopt value-based care models, the demand for integrated EHR solutions that enhance patient outcomes will rise. Additionally, the growing emphasis on data analytics will likely lead to more sophisticated EHR systems capable of providing actionable insights, ultimately improving care delivery and operational efficiency across the healthcare landscape.

| Segment | Sub-Segments |

|---|---|

| By Delivery Mode | Cloud-Based Ambulatory EHR On-Premise Ambulatory EHR Hybrid Ambulatory EHR |

| By Application / Functionality | Practice Management (Scheduling & Billing) Clinical Documentation & e-Prescribing Population Health Management & Analytics Patient Engagement & Portals Others (Referral Management, Telehealth Integration) |

| By Practice Size | Small Practices (1–5 Physicians) Medium-Sized Practices (6–49 Physicians) Large Practices / Group Practices (50+ Physicians) |

| By End-User | Hospital-Owned Ambulatory Centers Independent Ambulatory Centers & Clinics Ambulatory Surgical Centers Physician Groups & Other Outpatient Settings |

| By Specialty | Primary Care Specialty Clinics (e.g., Cardiology, Orthopedics) Urgent Care & Walk-In Clinics Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Policy & Regulatory Environment | Government Incentives & Subsidy Programs Compliance Mandates (e.g., HIPAA, GDPR) Grants and Digital Health Funding Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital EHR Implementation | 120 | IT Directors, Chief Information Officers |

| Outpatient Clinic EHR Usage | 100 | Practice Managers, Healthcare Providers |

| Long-term Care Facility EHR Adoption | 80 | Facility Administrators, Nursing Home Directors |

| Telehealth EHR Integration | 70 | Telehealth Coordinators, IT Support Staff |

| Specialty Care EHR Solutions | 90 | Specialty Physicians, IT Consultants |

The Global Ambulatory Electronic Health Record (EHR) Market is valued at approximately USD 9 billion, reflecting a significant growth trend driven by the increasing adoption of digital health solutions and the demand for efficient healthcare management systems.