Region:Middle East

Author(s):Dev

Product Code:KRAD5248

Pages:91

Published On:December 2025

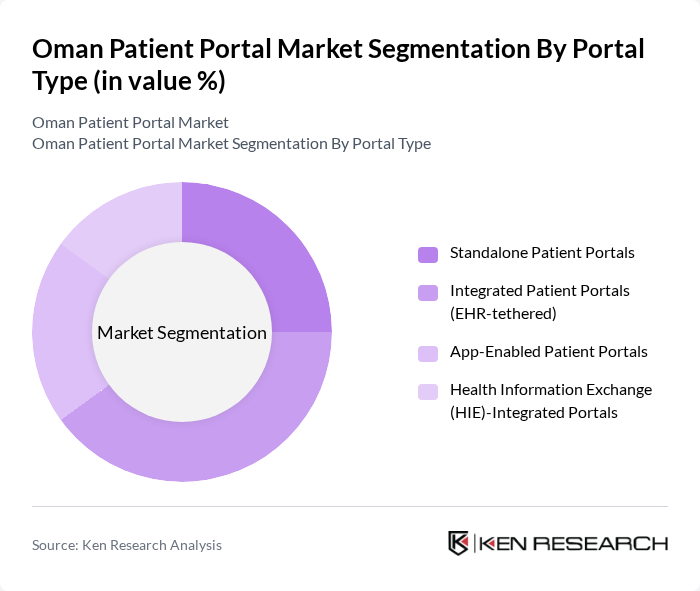

By Portal Type:The segmentation of the Oman Patient Portal Market by portal type includes various categories that cater to different healthcare needs. The subsegments are Standalone Patient Portals, Integrated Patient Portals (EHR-tethered), App-Enabled Patient Portals, and Health Information Exchange (HIE)-Integrated Portals. Each of these subsegments plays a crucial role in enhancing patient engagement and streamlining healthcare processes.

The Integrated Patient Portals (EHR-tethered) subsegment is dominating the market due to the increasing integration of electronic health records (EHR) with patient portals. This integration allows for seamless access to patient data, enhancing the overall patient experience and improving clinical outcomes. As healthcare providers focus on delivering personalized care, the demand for integrated solutions continues to rise, making this subsegment a key player in the market.

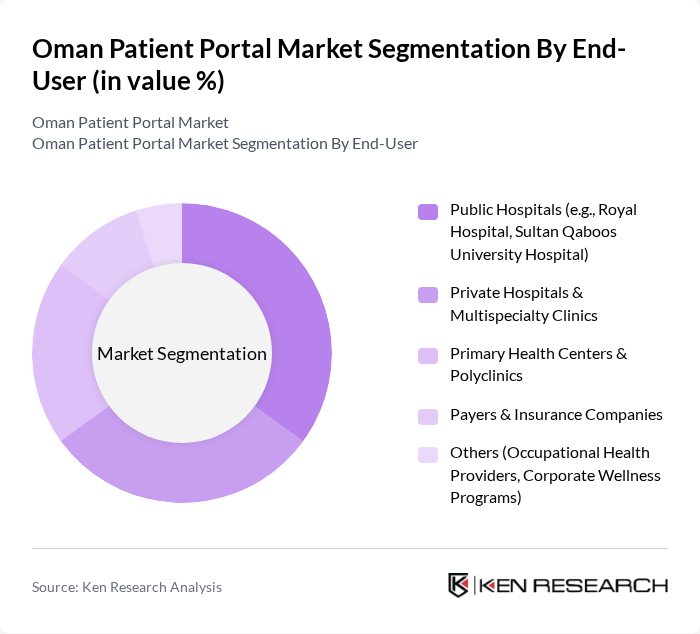

By End-User:The segmentation of the Oman Patient Portal Market by end-user includes Public Hospitals, Private Hospitals & Multispecialty Clinics, Primary Health Centers & Polyclinics, Payers & Insurance Companies, and Others. Each end-user category has unique requirements and contributes to the overall growth of the market.

Public Hospitals, such as the Royal Hospital and Sultan Qaboos University Hospital, are leading the market due to their large patient base and government support for digital health initiatives. These institutions are increasingly adopting patient portals to enhance service delivery, improve patient engagement, and streamline administrative processes, thereby driving the growth of this subsegment.

The Oman Patient Portal Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Ministry of Health – National eHealth / Patient Portal Initiatives, Royal Hospital, Muscat, Sultan Qaboos University Hospital (SQUH), Oman International Hospital, Badr Al Samaa Group of Hospitals & Poly Clinics, Muscat Private Hospital, Aster DM Healthcare – Oman Operations, NMC Healthcare – Oman Facilities, Starcare Hospital Muscat, KIMS Oman Hospital (KIMSHEALTH Oman), Al Raffah Hospital, Apollo Hospitals Muscat Clinics, Epic Systems Corporation (Regional Deployments in Oman), Cerner Corporation (Oracle Health) – Implementations in Oman, InterSystems Corporation – TrakCare / Patient Portal Deployments in Oman contribute to innovation, geographic expansion, and service delivery in this space.

The Oman Patient Portal Market is poised for significant growth as healthcare providers increasingly adopt digital solutions to enhance patient engagement and streamline operations. The integration of advanced technologies, such as AI and machine learning, will further improve the functionality of patient portals. Additionally, ongoing government support and investment in digital health infrastructure will facilitate broader access to these services, ultimately transforming the healthcare landscape in Oman and promoting a more patient-centric approach to care.

| Segment | Sub-Segments |

|---|---|

| By Portal Type | Standalone Patient Portals Integrated Patient Portals (EHR-tethered) App-Enabled Patient Portals Health Information Exchange (HIE)-Integrated Portals |

| By End-User | Public Hospitals (e.g., Royal Hospital, Sultan Qaboos University Hospital) Private Hospitals & Multispecialty Clinics Primary Health Centers & Polyclinics Payers & Insurance Companies Others (Occupational Health Providers, Corporate Wellness Programs) |

| By Deployment Mode | Cloud-Based Solutions On-Premise Solutions Hybrid Deployment SaaS Subscription Models |

| By Functional Module | Appointment Scheduling & Reminders Electronic Medical Records / Results Viewing e-Prescription & Medication Refill Management Secure Messaging & Teleconsultation Online Billing, Payments & Insurance Claims Patient Education & Remote Monitoring Integration |

| By Access Channel | Web-Based Portals Mobile Applications (iOS, Android) Kiosk-Based & In-Facility Access Others (Call-Center Assisted, SMS/USSD) |

| By Healthcare Setting | Tertiary Care & Teaching Hospitals Secondary Care Hospitals Primary Care & Community Health Centers Home Healthcare & Remote Care Programs |

| By Integration Level | Standalone Portals Integrated with EHR/EMR Systems Integrated with Practice Management / Revenue Cycle Systems Interoperable with National Health Information Systems |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Patient Portal Users | 140 | Patients, IT Managers, Healthcare Administrators |

| Clinic Patient Portal Users | 110 | Patients, Clinic Managers, Healthcare Providers |

| Telehealth Service Users | 90 | Patients, Telehealth Coordinators, IT Support Staff |

| Healthcare IT Professionals | 70 | IT Managers, System Analysts, Software Developers |

| Healthcare Policy Makers | 60 | Government Officials, Health Policy Analysts, Regulatory Experts |

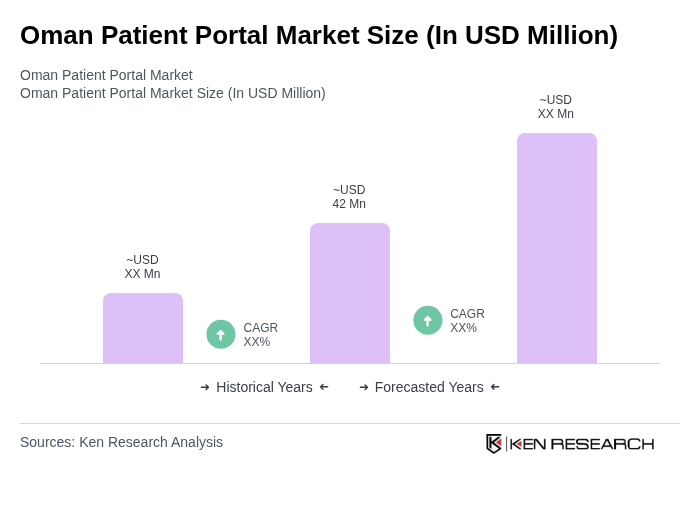

The Oman Patient Portal Market is valued at approximately USD 42 million, reflecting a significant growth trend driven by the increasing adoption of digital health solutions and the demand for enhanced patient engagement and efficient healthcare delivery systems.