Region:Global

Author(s):Dev

Product Code:KRAD0549

Pages:98

Published On:August 2025

By Type:The market is segmented into various types, including Air Traffic Services (ATS), Communication, Navigation & Surveillance (CNS), Automation & Decision Support, Unmanned Traffic Management (UTM), Airport Operations & Runway Management, and Cybersecurity & Network Management. Among these, Air Traffic Services (ATS) is the leading segment due to the increasing demand for air traffic control and management services, driven by the growing number of flights and the need for enhanced safety measures. Broader industry analyses consistently categorize ATM around ATS and CNS as core pillars, with accelerating adoption of automation/decision support (e.g., AMAN/DMAN, A?CDM) and growing UTM integration to accommodate drones and advanced air mobility, while cybersecurity gains strategic importance as ATM systems digitize.

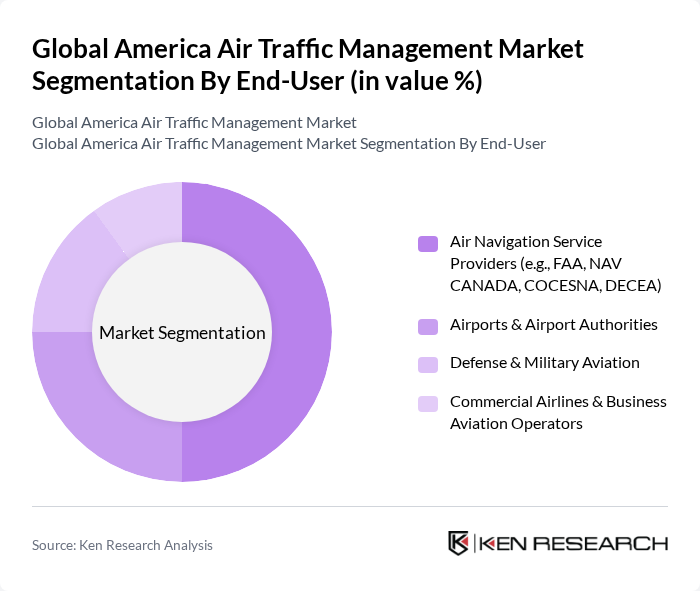

By End-User:The end-user segmentation includes Air Navigation Service Providers, Airports & Airport Authorities, Defense & Military Aviation, and Commercial Airlines & Business Aviation Operators. The Air Navigation Service Providers segment is the most significant due to their central role in operating national airspace systems, procuring and integrating ATS/CNS/automation platforms, and driving modernization programs with regulatory oversight, which aligns with observed purchasing patterns and public-sector investment flows in ATM.

The Global America Air Traffic Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thales Group, RTX Corporation (Raytheon), Lockheed Martin Corporation, Northrop Grumman Corporation, Indra Sistemas, S.A., Frequentis AG, Leonardo S.p.A., L3Harris Technologies, Inc., BAE Systems plc, Saab AB, SITA (SITA for Aircraft / SITA ATC solutions), ADB SAFEGATE, Honeywell International Inc., Collins Aerospace (an RTX business), Leidos Holdings, Inc. contribute to innovation, geographic expansion, and service delivery in this space. Industry sources consistently list these firms among principal ATM/CNS providers and integrators across systems such as surveillance radars, automation platforms, voice comms, and tower/airport solutions in the Americas.

The future of air traffic management in the U.S. is poised for transformative changes driven by technological advancements and increased air traffic. The integration of artificial intelligence and automation is expected to enhance operational efficiency, while the focus on sustainability will shape new regulatory frameworks. As airports modernize, the demand for smart technologies will rise, creating a more interconnected and efficient airspace. This evolution will require ongoing collaboration between government agencies and private sector technology providers to ensure safety and efficiency in air travel.

| Segment | Sub-Segments |

|---|---|

| By Type | Air Traffic Services (ATS): ATC, ATFM, AIM Communication, Navigation & Surveillance (CNS) Automation & Decision Support (TWR/APP/ACC automation, A-CDM, DMAN/AMAN) Unmanned Traffic Management (UTM) & Counter-UAS Integration Airport Operations & Runway Management (A-SMGCS, surface movement) Cybersecurity & Network Management |

| By End-User | Air Navigation Service Providers (e.g., FAA, NAV CANADA, COCESNA, DECEA) Airports & Airport Authorities Defense & Military Aviation Commercial Airlines & Business Aviation Operators |

| By Component | Hardware (radar, ADS-B ground stations, VCS, recorders) Software (ATM automation suites, FDP/SDP, ATFM/A-CDM) Services (integration, training, maintenance, managed services) |

| By Application | Air Traffic Control (TWR/APP/ACC) Air Traffic Flow & Capacity Management (ATFM) Airspace & Route Management (PBN, Free Route Airspace) Aeronautical Information Management (AIM/AIXM/eAIP) |

| By Sales Channel | Direct to Government/ANSP Contracts System Integrators & Prime Contractors Strategic Partnerships & Framework Agreements |

| By Distribution Mode | On-Premise Deployment Cloud/SaaS & Hybrid Deployment |

| By Policy Support | FAA NextGen, NAV CANADA NAV CAN and ADS-B mandates ICAO GANP/ASBU Implementation & CNS/ATM Modernization Environmental & Noise Abatement (CORSIA, sustainability programs) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Air Traffic Control Operations | 100 | Air Traffic Controllers, Operations Supervisors |

| Airline Management Perspectives | 80 | Airline Executives, Flight Operations Managers |

| Technology Providers in ATM | 70 | Product Managers, Technical Directors |

| Regulatory and Compliance Insights | 60 | Regulatory Affairs Specialists, Compliance Officers |

| Airport Infrastructure Development | 90 | Airport Managers, Infrastructure Planners |

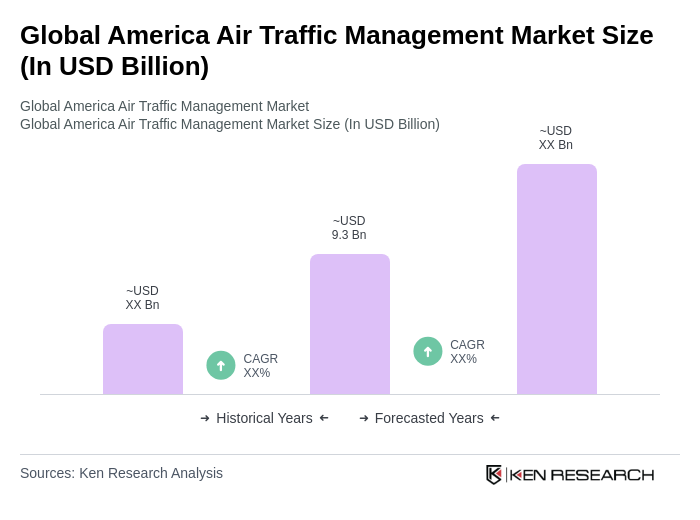

The Global America Air Traffic Management Market is valued at approximately USD 9.3 billion, reflecting a five-year historical analysis. This valuation is driven by increasing air traffic volume and modernization of ATM infrastructure.