Region:Middle East

Author(s):Shubham

Product Code:KRAA8629

Pages:85

Published On:November 2025

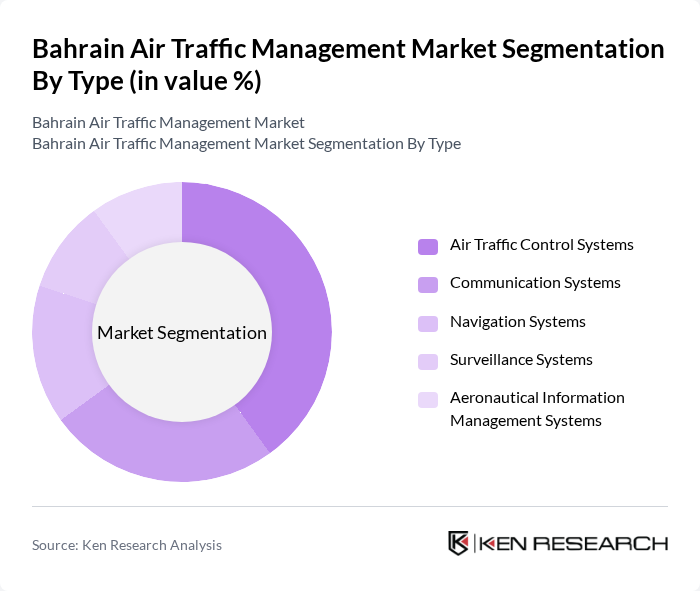

By Type:The market is segmented into Air Traffic Control Systems, Communication Systems, Navigation Systems, Surveillance Systems, and Aeronautical Information Management Systems. Air Traffic Control Systems remain the most dominant segment, reflecting their essential role in managing increasing flight movements and ensuring safety in Bahrain’s busy airspace. The growing complexity of airspace, coupled with the need for real-time data processing and automation, continues to drive demand for advanced air traffic control solutions.

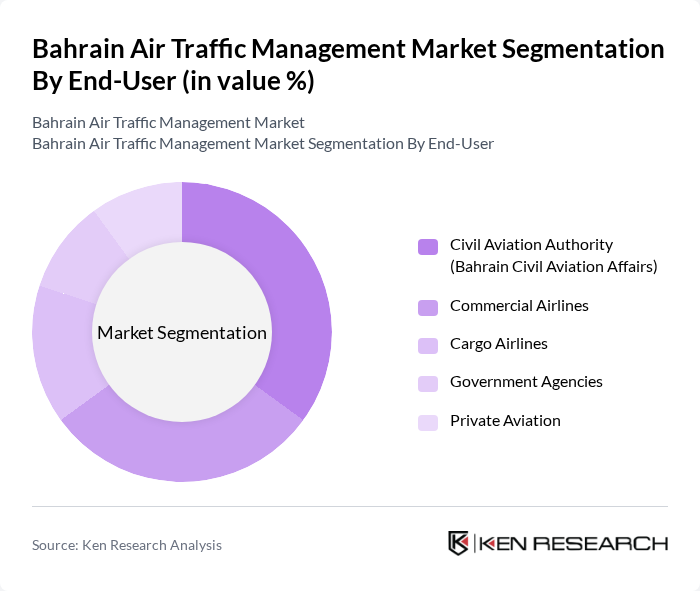

By End-User:The end-user segmentation includes the Civil Aviation Authority (Bahrain Civil Aviation Affairs), Commercial Airlines, Cargo Airlines, Government Agencies, and Private Aviation. The Civil Aviation Authority is the leading end-user, responsible for regulatory oversight, operational licensing, and airspace management in Bahrain. The rising number of commercial and cargo flights, supported by robust airport infrastructure and regulatory standards, drives demand for comprehensive air traffic management solutions across all segments.

The Bahrain Air Traffic Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Airport Company, Gulf Air, Thales Group, Indra Sistemas S.A., Honeywell International Inc., Leonardo S.p.A., Frequentis AG, Raytheon Technologies (RTX Corporation), Northrop Grumman Corporation, Saab AB, BAE Systems plc, SITA, L3Harris Technologies, Eve Air Mobility, Elbit Systems Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of Bahrain's air traffic management market appears promising, driven by ongoing investments in technology and infrastructure. As regional air travel continues to expand, the demand for efficient air traffic systems will grow. The integration of artificial intelligence and machine learning into air traffic management is expected to enhance operational efficiency and safety. Additionally, the focus on sustainable aviation practices will likely shape future developments, ensuring that Bahrain remains competitive in the global aviation sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Air Traffic Control Systems Communication Systems Navigation Systems Surveillance Systems Aeronautical Information Management Systems |

| By End-User | Civil Aviation Authority (Bahrain Civil Aviation Affairs) Commercial Airlines Cargo Airlines Government Agencies Private Aviation |

| By Service Type | Air Traffic Control Services Air Traffic Flow Management Services Maintenance and Support Services Consulting Services Training Services |

| By Technology | Automation Technologies Data Analytics Cloud-Based Solutions Cybersecurity Solutions Remote/Digital Tower Solutions |

| By Application | Airport Operations Airspace Management Flight Planning Incident Management Drone/UAV Traffic Management |

| By Investment Source | Public Sector Investments Private Sector Investments International Funding Joint Ventures Public-Private Partnerships |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support International Collaboration ICAO/Global Aviation Compliance |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Air Traffic Control Operations | 100 | Air Traffic Controllers, Operations Managers |

| Airline Operational Efficiency | 60 | Airline Executives, Flight Operations Managers |

| Airport Infrastructure Development | 50 | Airport Authorities, Infrastructure Planners |

| Regulatory Compliance in Aviation | 40 | Aviation Regulators, Compliance Officers |

| Technological Innovations in Air Traffic Management | 70 | IT Managers, Aviation Technology Experts |

The Bahrain Air Traffic Management Market is valued at approximately USD 520 million, reflecting significant growth driven by increasing air traffic volume and advancements in air traffic control technology.